The Andhra Pradesh High Court held that GST ( Goods and Services Tax ) proceedings that do not have the Document Identification Number (DIN) are legally not valid.

The bench of Justice Kiranmayee Mandava and Justice Nyapathy Vijay of the Andhra Pradesh High Court discovered that the impugned proceedings do not hold DIN.

The court said that “In view of the Circular issued by the Central Board of Indirect Taxes and Government of Andhra Pradesh, the impugned proceedings dated 10.05.2024 issued by St the 1 respondent, without generating the DIN number would have no legs to stand in the eye of law and the said proceedings are liable to be set aside.”

The counsel of the applicant furnished that the impugned proceedings were issued without generating a DIN, breaching Circular No. 122/41/2019-GST, on November 5, 2019, issued by the Central Board of Indirect Taxes (CBIC), and Circular No. 2 of 2022, on August 1, 2022, from the Government of Andhra Pradesh. As per these circulars, any communication not carrying an electronically generated DIN is considered invalid and is regarded as never issued.

The Government Pleader representing the respondents showed written instructions from the Department, which established that any communication without a DIN is not valid.

Read Also: Easy Guide to DIN (Document Identification Number) Under GST with Benefits

The impugned proceedings do not hold DIN, the bench discovered. As per that the impugned proceedings were set aside. But the same allotted the department the freedom to move as per regulation, given the applicant cooperates in finishing the due assessment order before the first respondent- The Deputy Commissioner.

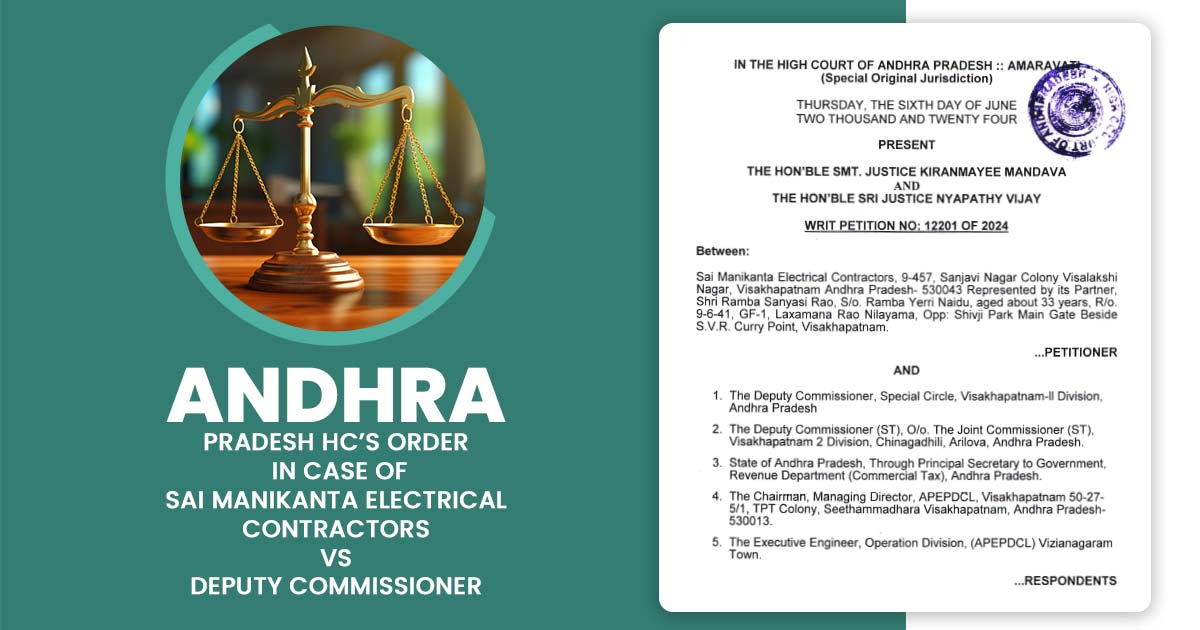

Therefore the writ petition is permitted. For the Petitioner, Pasupuleti Venkata Prasad appeared.

| Case Title | Sai Manikanta Electrical Contractors |

| Order No | Writ Petition No: 12201 of 2024 |

| Date | 06.06.2024 |

| For Petitioner | Pasupuleti Venkata Prasad |

| For Respondent | GP For Commercial Tax |

| Andhra Pradesh High Court | Read Order |