The Ahmedabad Bench of Income Tax Appellate Tribunal(ITAT) quashed the assessment for failure to issue the needed notice u/s 143(2) of the Income Tax Act,1961, and unjustified additions.

The taxpayer Jivarajbhai Ramabhai Chaudhary submitted the plea 63 days late due to a mistake by the Chartered Accountant. The delay was elaborated on and not countered by the counsel of the revenue. The delay was condoned and the plea was heard on its merits.

It was claimed by the taxpayer that the addition of Rs 14,98,000 to the income for the unexplained cash deposits at the time of the demonetization. An ex-parte order has been passed by the assessing officer (AO) under section 144 adding the deposits of Rs 12,31,000 and Rs. 2,67,000 from two bank accounts.

It was elaborated by the taxpayer that the deposits belonged from the cash sales of his agency business, “M/s. Babaramdev Sales.” The cash book has been reviewed by the Commissioner of Income Tax(Appeals) and accepted Rs. 7,27,307 as the opening cash balance, removing that part of the addition. CIT(A) confirmed the remaining Rs. 7,70,693 and additionally added Rs. 3,05,000 to income, enhancing the evaluated income.

Taxpayers sought issues, along with the invalidation of the return under section 142(1), the assessment u/s 144 does not have the notice u/s 143(2), and additions under Sections 69A and 251(2). On 25.07.2024 the revised grounds were filed emphasizing the invalidation of the return and assessment u/s 144 of the Act.

It was claimed by the taxpayer that the return cannot be invalid as of its delay quoting that the late returns were true but draw interest u/s 234A. The representative of the department asserted the return was invalid u/s 139(9) however cannot cite why. ITAT agreed with the appellant marking that the belated returns were true, and discovered the action of AO unsustainable.

Additionally, the appellate tribunal discovered that the AO incurred a mistake by not issuing the needed notice under section 143(2) before completing the assessment.

A single-member bench Annapurna Gupta(Accountant Member) discovered that the CIT(A) has accepted part of the cash book ineffectively rejecting the rest without proper justification. It carried that either the whole cash book must have been accepted or rejected and thus the addition to the income of the taxpayer was not justified. The plea was permitted.

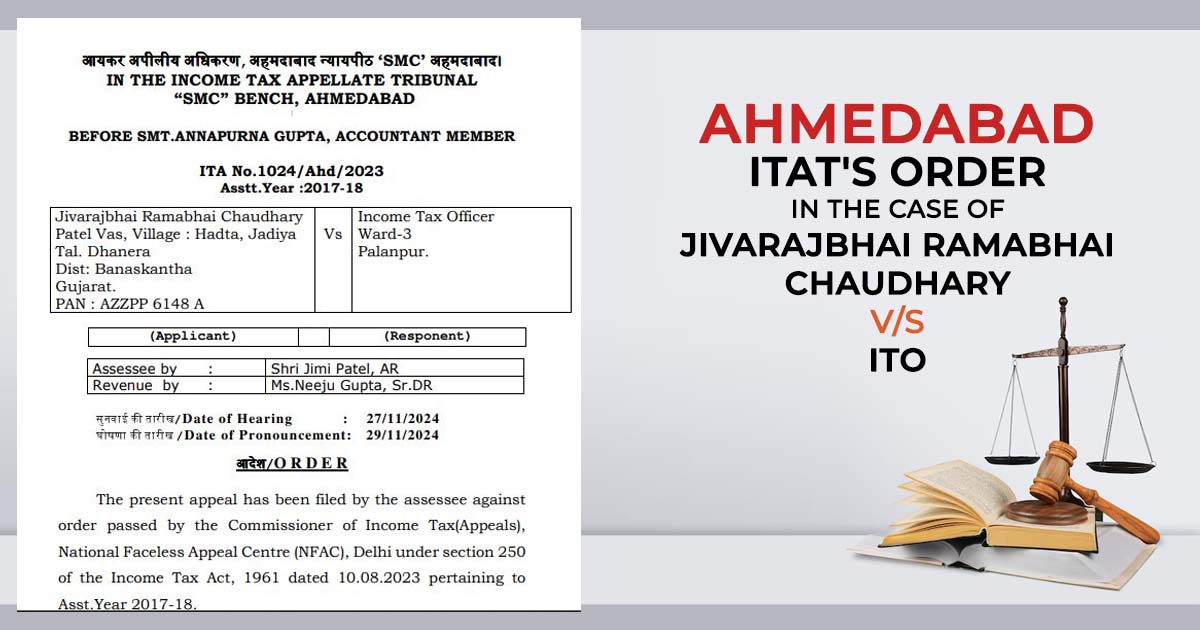

| Case Title | Jivarajbhai Ramabhai Chaudhary vs ITO |

| Order No | ITA No.1024/Ahd/2023 |

| Date | 29.11.2024 |

| Counsel For Appellant | Shri Jimi Patel, AR |

| Counsel For Respondent | Ms.Neeju Gupta, Sr.DR |

| Ahmedabad ITAT | Read Order |