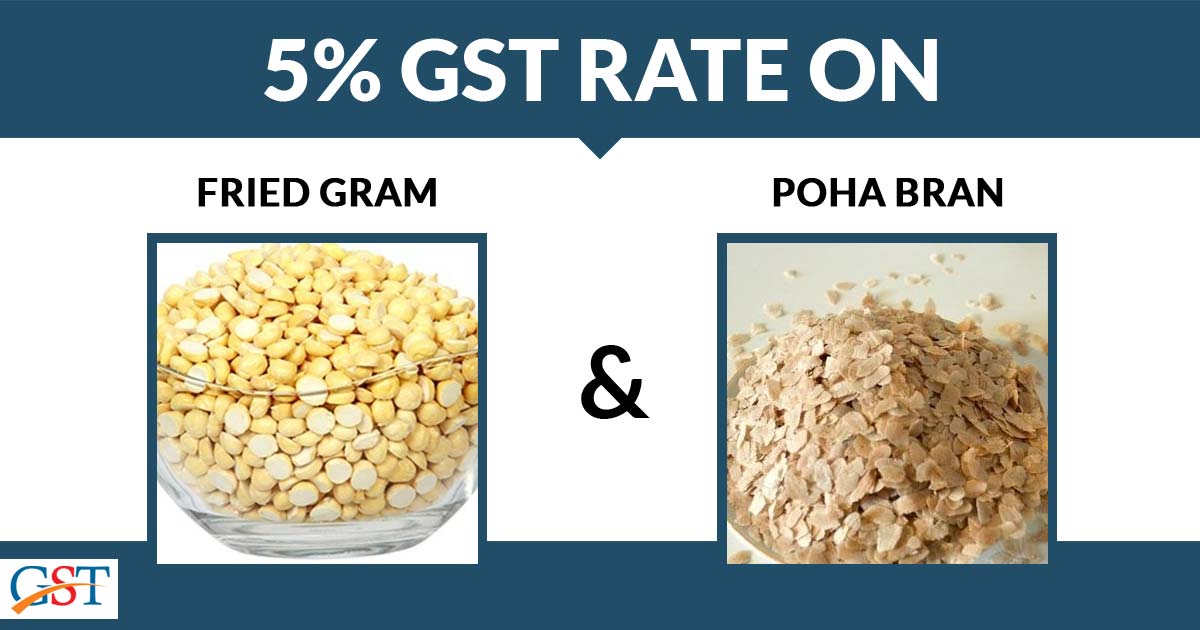

The Authority of Advance Ruling (AAR), Karnataka, ruled that 5% GST will be charged on the Poha Bran & Fried Gram, 2.5% State Goods and Services Tax & 2.5% Central Goods and Services Tax on each of the items. However, if the fried gram is not branded, then it will be exempted from both kinds of GST. M/s Bhagyalakshmi Trading Corporation, the applicant, being engaged in the supply business of puffed grains sought the rulings of the Karnataka AAR as the rate of interest was creating confusions among the community about the exemption of GST on fried Gram and the AAR ruled that 5% GST will be charged on the Fried Gram.

In another case, M/s Basaveshwara Corporation, the applicant, being engaged in Poha bran or rice bran sought the rulings of the Karnataka AAR as the rate of interest was creating confusions among the community about the rate of GST to be charged

The table of AAR consisting of two members, Dr. M.P. Ravi Prasad and Mashood Ur Rehman Farooqui, ruled that 5% GST (Goods and Services Tax) will be charged on the Poha Bran and Fried Gram, 2.5% State Goods and Services Tax (SGST) and 2.5% Central Goods and Services Tax (CGST). Download and view the official order no. 23/2020 by the Karnataka AAR