After the implementation of complex Goods and Services Tax (GST) Regime in India, now the Narendra Modi Government is working on bringing changes in respect of the direct tax.

Powerd By SAG INFOTECH

Notifications can be turned of anytime from browser settings

After the implementation of complex Goods and Services Tax (GST) Regime in India, now the Narendra Modi Government is working on bringing changes in respect of the direct tax.

Finally, Lok Sabha which passed the Finance bill completed the budget session which is an important exercise for this year 2017-18 in order to get the best out of economic agenda. As the finance bill is a depiction of the Money bill, it must pass through the Lok Sabha and after all, these, starting from April 1, 2017

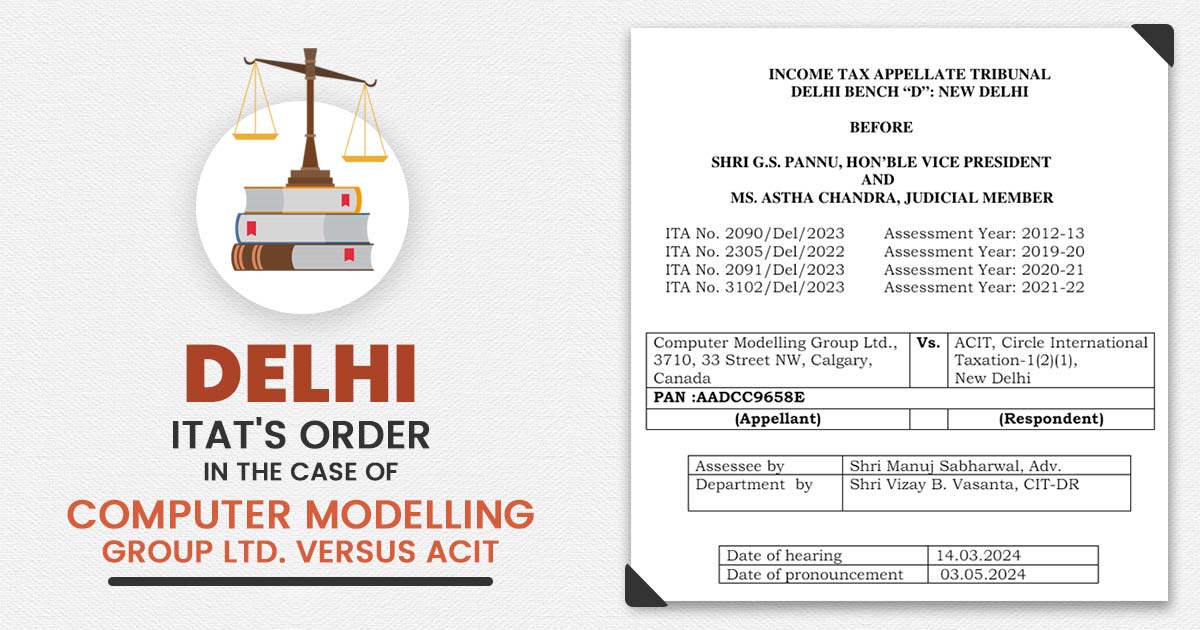

In a ruling that has captured the attention of tax professionals and businesses alike, the Income Tax Appellate Tribunal (ITAT) in Delhi furnished its verdict on the case between GSR Industries and the Deputy Director of Income Tax (DDIT). This case judged dated 26 December 2023, rotates about diverse problems related to income tax assessment […]

The Income Tax (IT) department will exempt the old tax demand of up to R1 lakh for any assessee under the Income Tax Act wealth Tax Act or Gift Tax Act, as per the notification. In the interim budget speech, Finance Minister Nirmala Sitharaman announced the withdrawal of petty tax demands of R10,000 a year […]

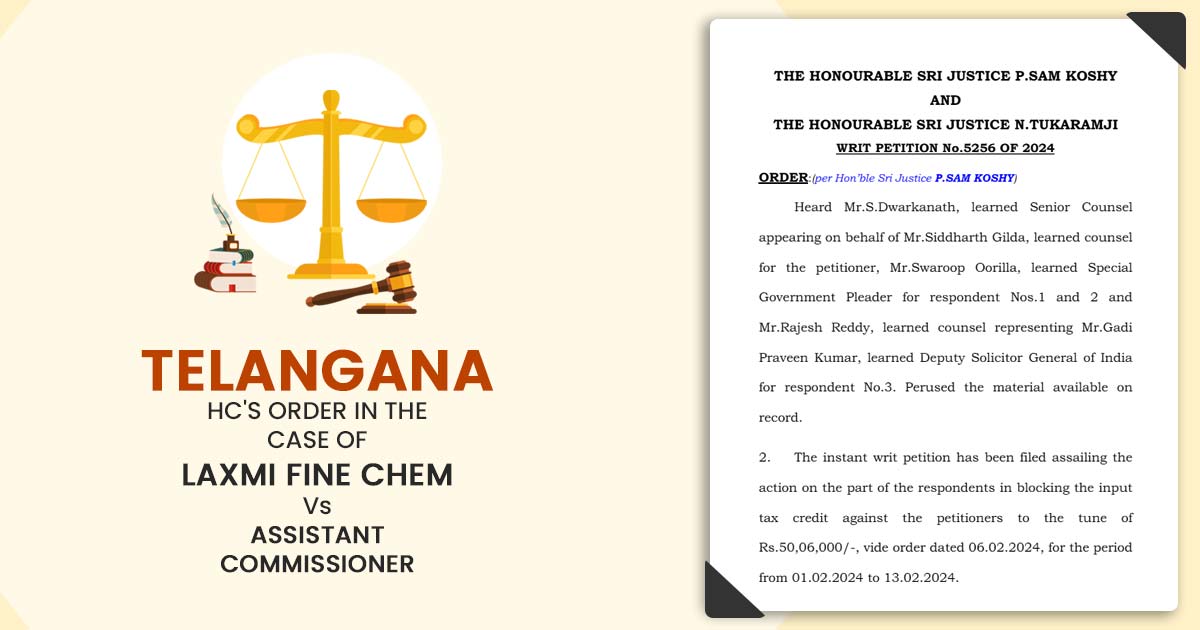

A circular via the GST department might be furnished to address the dispute of the spate of notices sent before the Indian arms of the foreign firms asking for the tax salaries filed to immigrants via the local unit. As per the circular input tax credit (ITC) must not be held back from 2017 to […]

Till after the 2024 general elections’ major announcements may be held. The forthcoming interim union budget shows the chance to address the lingering subjects and set the phase for the coming economic growth. This budget seems to prioritize fiscal discipline and prevent populist measures. In the domain of the personal income tax, there is optimism […]

The realm of cybercrime is rapidly expanding, posing a significant threat in today’s digital age. With nearly every individual equipped with a mobile phone or gadget, the vast array of possibilities also exposes them to malicious activities perpetrated by those who exploit technological advancements. You are eligible for an I-T refund of INR 15,490/-. The […]

Learn how can you improve your tax planning strategies with these important 5 essential habits. By using these habits, you can get a better understanding of all your income tax laws and regulations, optimize your tax deductions and credits, and reduce your tax burden. If you believe that tax planning solely revolves around settling taxes […]

The National Company Law Tribunal (NCLT) in Ahmedabad, India, recently made a decision. The bench comprised of Mrs Chitra Hankare (Judicial Member) and Dr Velamur G Venkata Chalapathy (Technical Member), stated that when a company is being liquidated, the income tax paid by the buyer in an auction should be considered as a recovery of […]