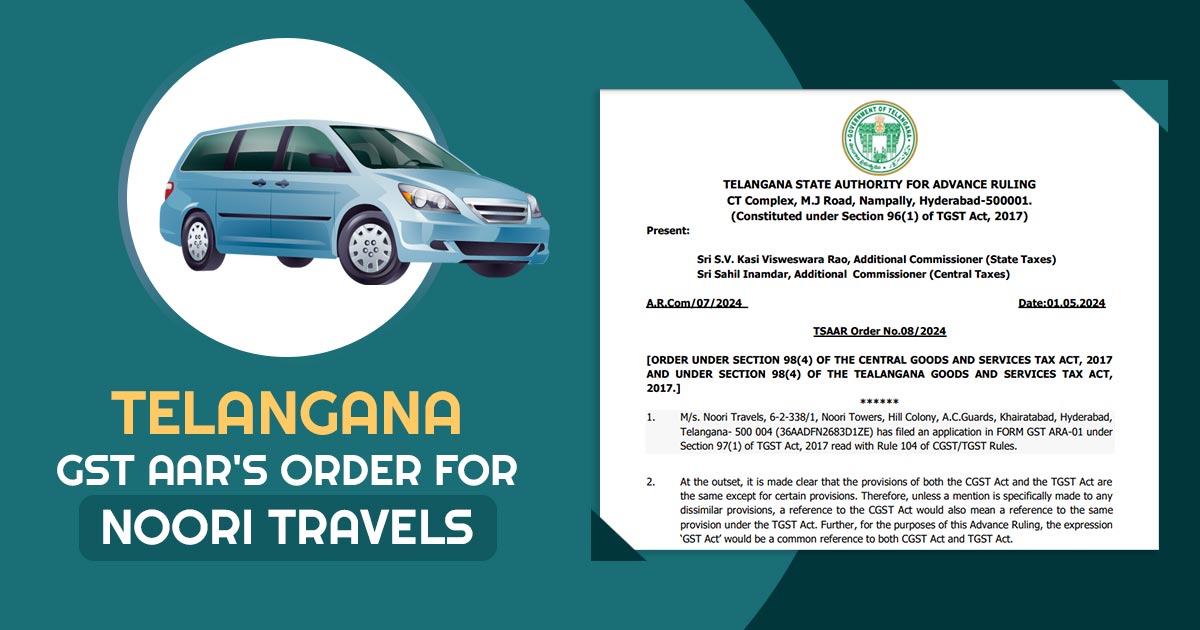

The petitioner via opting to pay the GST at a lower rate by not claiming the ITC on the goods and services used in his supplies has renounced his right to claim for the input tax credit, the Telangana Authority of Advance Ruling (AAR) mentioned. The bench of S.V. Kasi Visweswara Rao and Sahil Inamdar […]