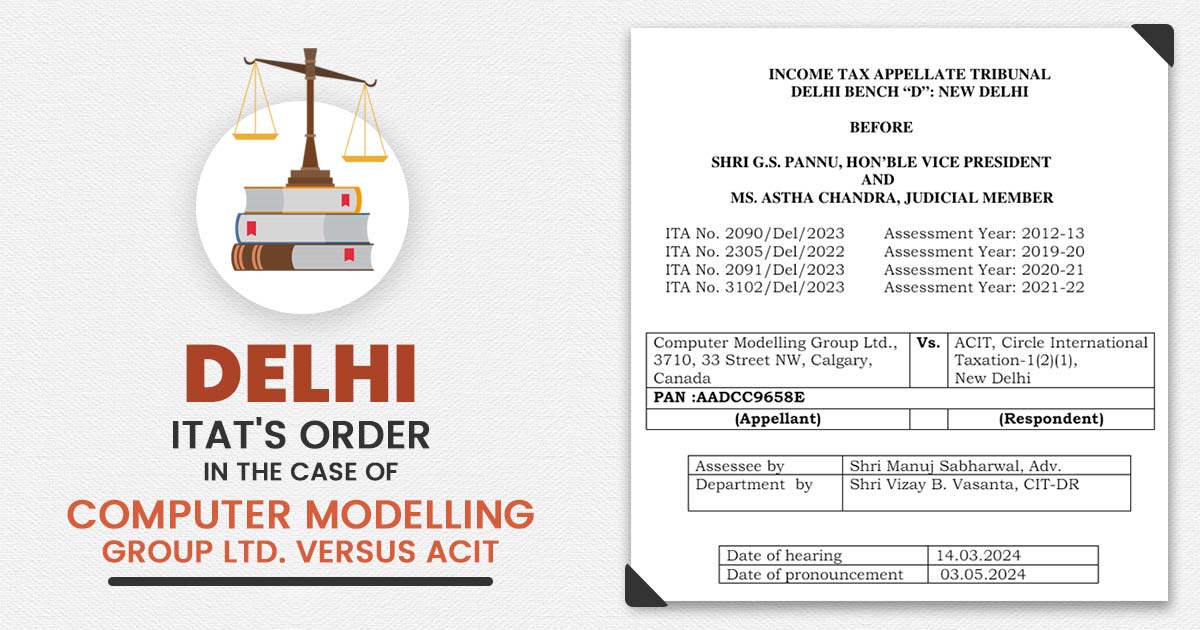

Towards commissions paid to the banks, the Delhi Bench of the Income Tax Appellate Tribunal (ITAT) ruled that the TDS provision would not be applicable. The two-member bench of Saktijit Dey (Judicial Member) and Dr B.R.R. Kumar (Accountant Member) sees that the commission furnished to the partners would not be covered under section 194H of […]