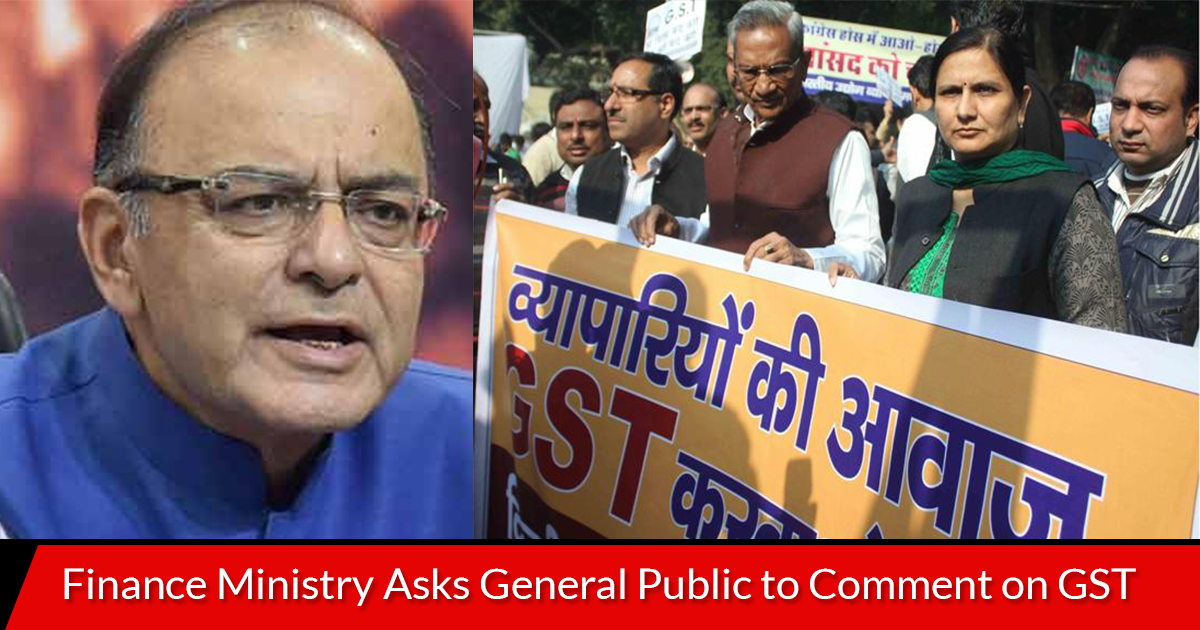

The finance ministry is taking the GST matter to the general public for the suggestion and advice row as the ministry have put a set of 8 rules in the public domain, which will be applied to the roll out of goods and service tax in India starting July 1. The government is also seeking comments from the industries in concern on the newly included 4 set of laws i.e. GST Composition, GST Valuation, GST Transition and GST ITC. The rules got passed with some approximation at the meeting of GST council on previously gone March 31.

Other 4 revised rules are from Central Board of Excise and Customs (CBEC) which include GST Invoice, GST Payment, GST Refund and GST Registration. All these respective rules got cleared and got a final approval at the GST council meet. But the legality is still on holds as the CBEC department has to place all the approved bills on the filing of GST returns in the public domain. PwC Partner and Leader – Indirect Tax Pratik Jain said that, “the rules provide much-needed clarity on several critical aspects such as mechanism of credit of tax paid on opening stock across the distribution chain, valuation of inter-state stock transfers and certain specific services, which currently enjoy lower service tax incidence such as airlines and insurance, This would now enable the industry in planning for the transition and process/technology related changes.”

Read Also: GST Online Payment Guide for Petty Tax Payers India

Rajat Mohan, Director (Indirect Taxation) Nangia & Co also highlighted this issue and said that, “With this, the government has made it clear that July 1, 2017, is the date for GST implementation, There is an indication that insurance companies, banking company, and telecom operator, would get some relief in case of self-supplies as they can issue the invoice on a quarterly basis.” CBEC also uploaded a 223 page FAQs on the department’s website on the information regarding CGST, SGST, IGST, UTGST and Compensation Cess laws along with other discussed rules granted approval by the GST council.

Recommended: What is Union Territory GST and Why It Is Implemented