The norm w.e.f 15 February 2020, states that all the importers and exporters are obliged to duly mention their GST Identification Number or GSTIN in the goods shipping documents. This current norm is a part of the government’s endeavor to demolish tax evasion from the country.

Relevant to the scenario, the Central Board of Indirect Taxes and Customs (CBIC) has issued a circular bringing into notice that some importers and exporters (knowingly or unknowingly) have not mentioned their GST Identification Number

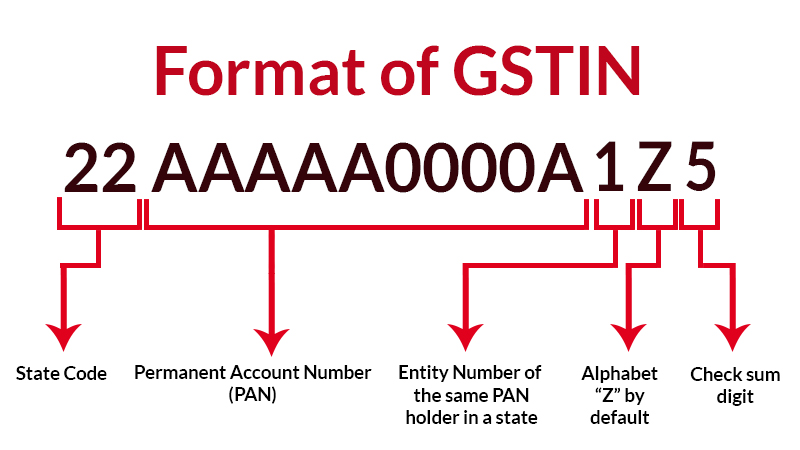

Introduction to GSTIN

GSTIN is a 15 digit identification number owned by every business operating in India and that is liable for paying income tax as per the constitutional norms. Talking about the importers, it is their duty to submit the import bill with the customs department while the exporters are required to present their shipping bill.

The aforesaid rule is about to commence on a mandatory basis from February 15.

The related circular stated that all the exporters and importers owning a registration under GST

According to a tax expert, the law of providing GSTIN on a mandatory basis by exporters and importers will help improvise the analysis of data, especially in the case of international transactions. Also, under the law, it will be easy for the tax officials to detect the frauds (who show a lower value on the border) and arrest/penalize them as soon as possible.

The law will restrict the loss of national revenue by matching the figures presented by exporters/importers with the GST figures, says a tax expert.

If you are an exporter, you are required to complete various formalities to export your products abroad. You have to generate and submit various documents like applications, licenses, various duties, and so on to the Customs Department to get your goods moving. Then, you are required to get clearance from the department.

The exporter can do so by submitting the ‘Shipping Bill’ to the officials. You will not be allowed to export the goods if you do not get the Bill submitted with the Customs Officer. You are required to submit the Shipping Bill before exporting the goods whether you export them through air, water or road transports.

The Central Board of Indirect Taxes and Customs(CBIC) has updated some New Requirements for submitting Shipping Bill which are as follows:

State of Origin: The exporter has to fill the name of the state from which the goods are originally originated.

District of Origin: The exporter is required to fill the name of the district from which the goods are originated.

Preferential Agreements: The exporter is required to file the details of preferential agreements regarding the export wherever they are necessary.

Standard Unit Quantity Code (SQC): The exporter is required to weigh and mark the goods according to the Standard Unit Quantity Code (SQC) from Custom Tariff Heading (CTH) as per the First Schedule of Customs Tariff Act, 1975. The SQC is a unit of measurement for the goods.

Documents under Indian Customs Electronic Gateway: It is mandatory to enter and upload the electronic integrated declaration and other respective details on Indian Customs Electronic Gateway (ICEGATE).

GSTIN: To make GST more transparent and centralized, the Central Board of Indirect Taxes and Customs(CBIC) have made it mandatory for the GST registered exporters and importers to declare GSTIN.