The government finally crossed the 1 lakh crore mark of GST revenue from a long time in the month of December 2019 with INR 1,03,184 of gross GST revenue.

If we divide the GST revenue as per category than the CGST comes at INR 19,962 crore while the SGST accumulated at 26,792 crores. The IGST collections stood at 48,099 crore which also includes the INR 21,295 crore as imports.

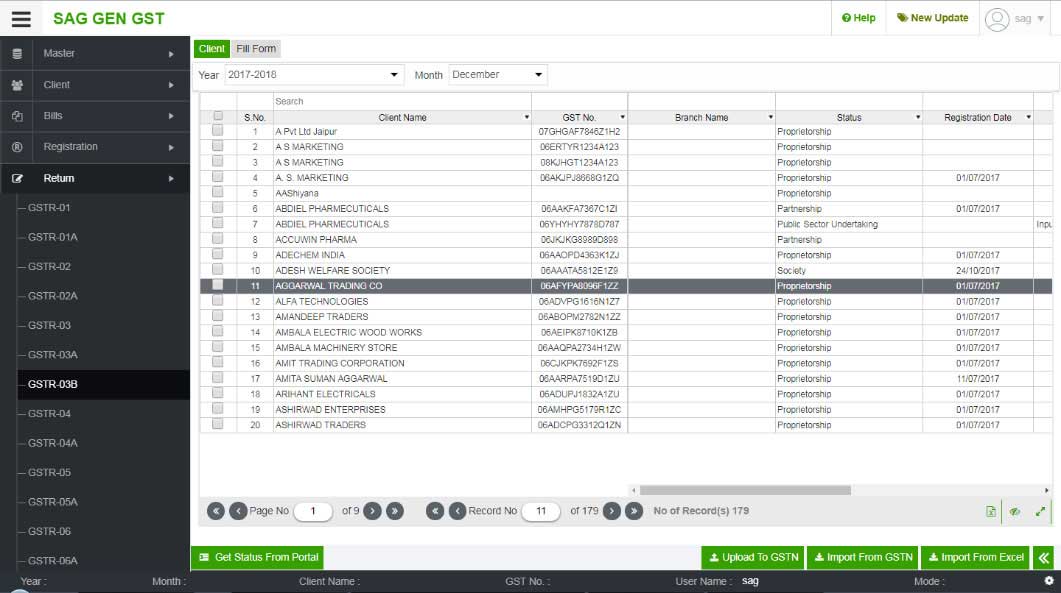

Also, the cess was collected with total amount coming at INR 8,331 crore which included INR 847 crore as imports revenue. If we check out the total number of GSTR 3B return filers

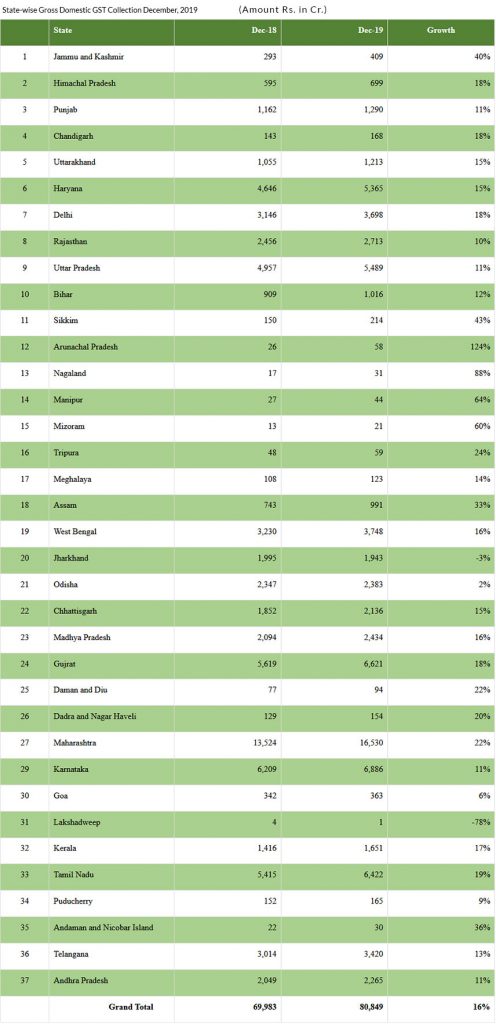

There was an upward of 16% GST revenue if compared to the last years of December 2018 collections. While the settlement stood at INR 21,814 crore to CGST and INR 15,366 crore to SGST.

Let us check out the complete details of the GST collection from the graph and table-wise of states individual collection: