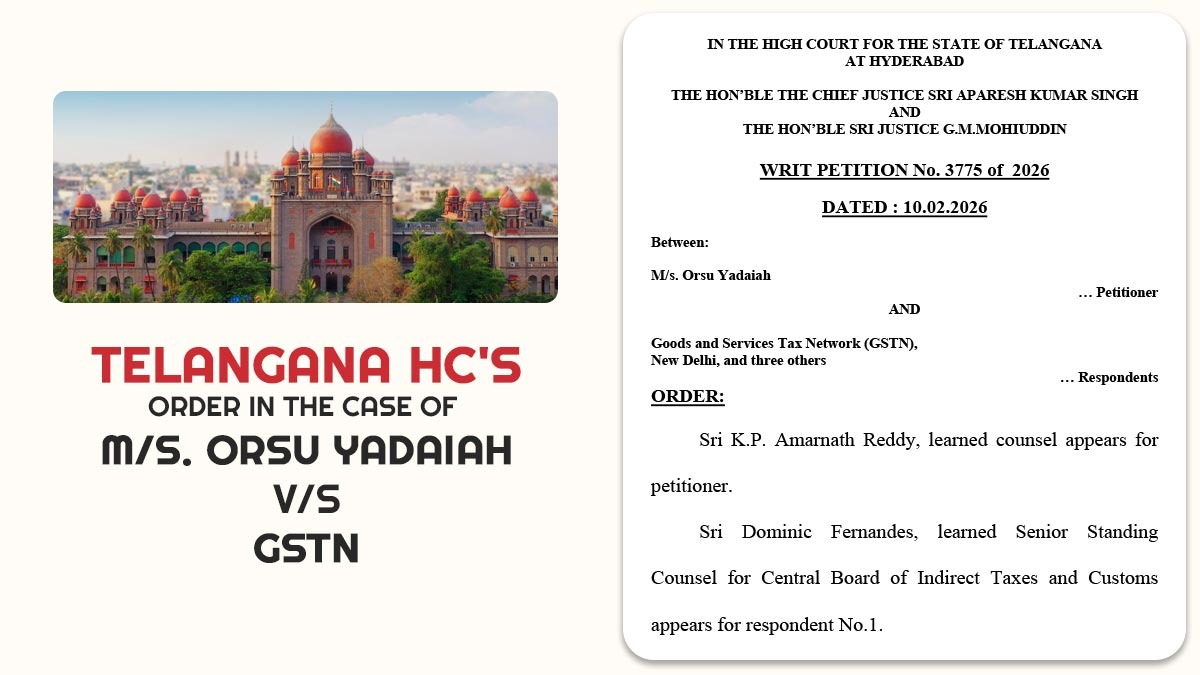

Before the Telangana High Court, the applicant contested the levy of penalty and interest, claiming that the outstanding tax dues had already been filed during the pendency of the adjudication proceedings after the issuance of the SCN.

Even after levying the payment of tax, penalty, and interest. Rather than submitting an appeal, the applicant involved in correspondence with Goods and Services Tax Network (GSTN) is asking permission to submit an appeal without making the crucial pre-deposit of 10%, claiming that no penalty was chargeable once tax had been paid.

In this process, the limitation period to submit the appeal has lapsed. The applicant approached the HC asking for relief from the requirement of pre-deposit and claimed that it had valid reasons to elaborate on the late filing of the appeal.

As per the revenue authorities, no regulatory authority exists to exempt the pre-deposit prerequisite. Pre-deposit is an obligatory condition for filing an appeal under the GST regime. The problem is that whether the penalty was correctly levied could merely be analysed via the appellate authority on merits after compliance with regulatory conditions.

Issue

Is the taxpayer under GST exempt from the obligatory pre-deposit requirement for filing a plea? Whether a taxpayer can be exempted from the obligatory pre-deposit prerequisite for submitting a plea under GST?

Held That-

The Court stated that no exemption is available under the GST law from making the regulatory pre-deposit while filing a plea. The pre-requisite of pre-deposit is crucial and cannot be exempted just because the applicant disputes the levying of a penalty or claims to have filed the tax dues at the time of adjudication.

Read Also: Supreme Court Upholds Use of ECL for Mandatory 10% Pre-Deposit in GST Appeals

The Court said that the correctness of the penalty of tax obligation is a case to be analysed by the appellate authority on merits, and the same dispute could not be a reason to overlook the regulatory precondition of pre-deposit.

The court acknowledged that the applicant had been corresponding with the authorities for the pre-deposit requirement and thereby missed the limitation period granted liberty before the applicant to submit a plea within 2 weeks, including the regulatory pre-deposit and an application for condonation of delay.

| Case Title | M/s. Orsu Yadaiah vs. GSTN |

| Case No. | Writ Petition No. 3775 of 2026 |

| Counsel for the Petitioner | Sri K.P. Amarnath Reddy |

| Sri K. Sai Akarsh and Sri Swaroop Oorilla | Sri K. Sai Akarsh, and Sri Swaroop Oorilla |

| Telangana High Court | Read Order |