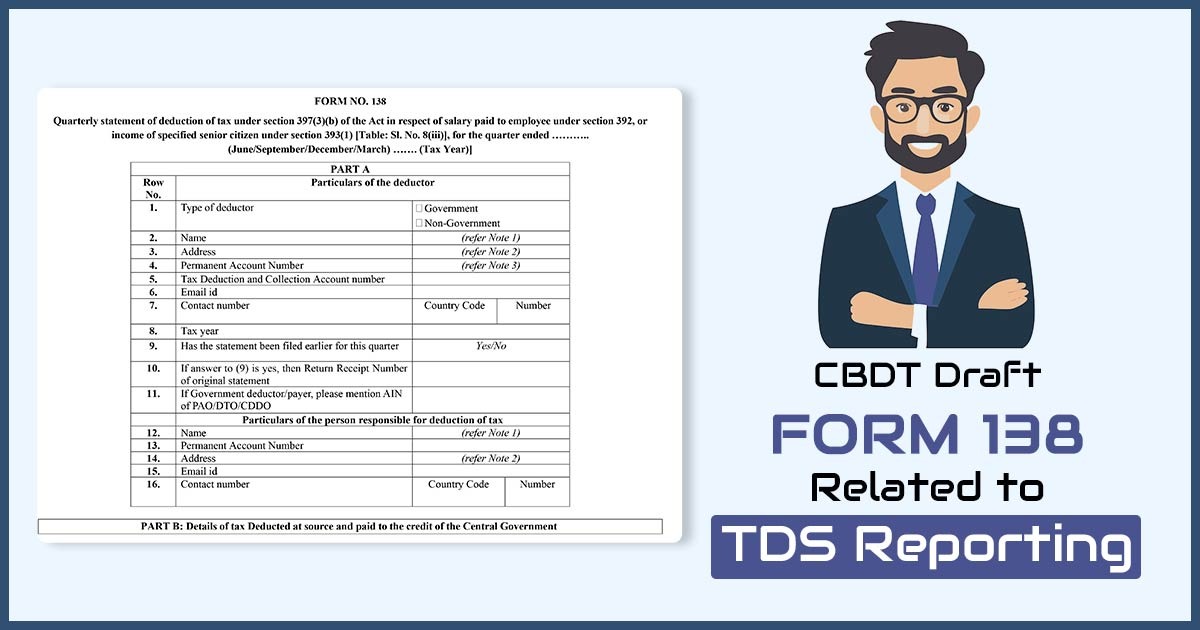

The CBDT has released a new Draft Form No. 138, which provides a clear, organised way for corporations to inform the tax authorities of the taxes they have withheld from earnings during the year. This modification applies to particular sections of the Income Tax Act, aimed at making the tax reporting more specific.

The motive of the proposed form is to enhance transparency, standardisation, and precision in reporting salary payments and specified senior citizen income.

What is the Applicability of the New Draft Form No. 138?

Draft Form No. 138 applies to:

- Employers’ TDS is the deducting on earnings under Section 392

- Payers deducting tax on the payment of selected senior citizens under section 393(1) [Table Sl. No. 8(iii)]

The form must be filed quarterly for the periods ending:

- June

- September

- December

- March

Additional annual information is needed in the March quarter filing.

Framework for Draft Form No. 138

The proposed form is categorised into multiple parts and annexures to confirm detailed reporting.

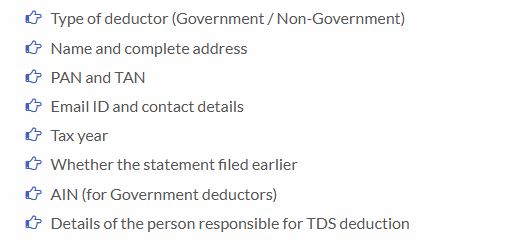

PART A: Details of Tax Deductor

This section includes:

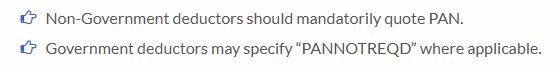

Notably:

PART B – Tax Deposited and Deducted

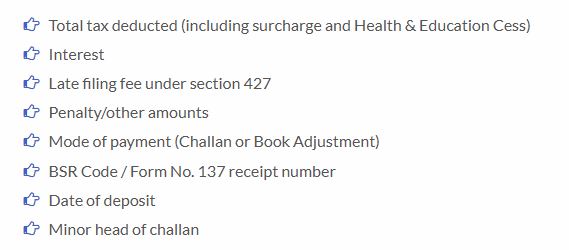

This section needs reporting of:

The government deductors should cite whether payment is via book adjustment, and others should report challan information as mentioned on the TIN 2.0/TRACES portal.

Annexure I – TDS Breakup of Deductee-wise

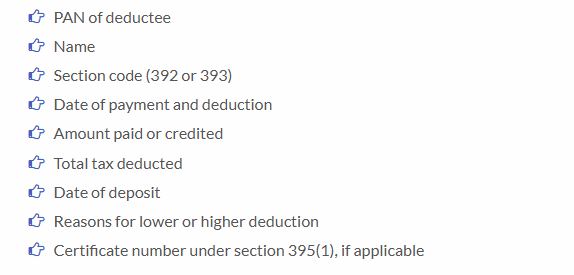

Annexure I includes information on employee/senior citizen-wise, including:

The draft delivers section codes:

Annexure II – Annual Salary Calculation (March Quarter)

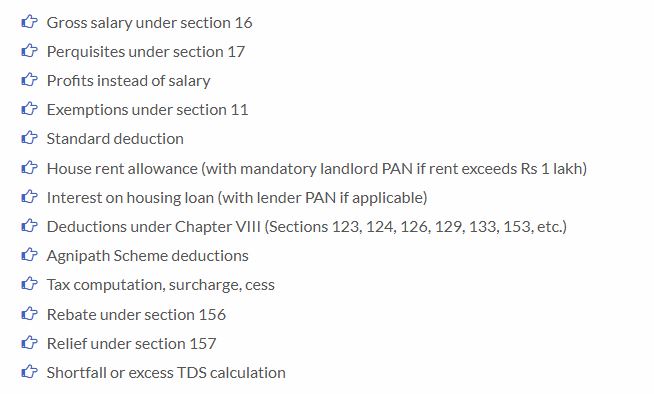

Annexure II, which is to be furnished with the March quarter statement, furnishes a complete annual computation of salary, including:

The annexure integrates payroll computation, deductions, and reconciliation within the TDS reporting procedure.

Annexure III – Senior Citizen Pension & Interest Reporting

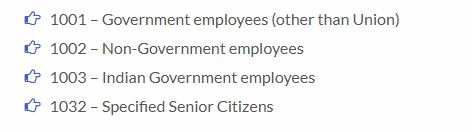

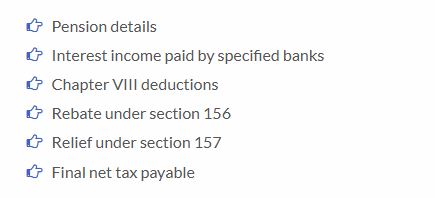

Applicable to selected senior citizens, Annexure III consists of:

The form needs categorisation of senior citizens-

- Code 1, which is below the age of 80 years

- Code 2, which is 80 years or above

Major Key Compliance Implications

Below, we have discussed the key implications of tax compliance for employers and senior citizens:-

Increased Data Reporting

The draft form expands the data needed from deductors, specifically in the March quarter.

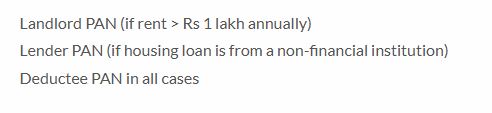

PAN Reporting Mandates

Obligatory quoting of:

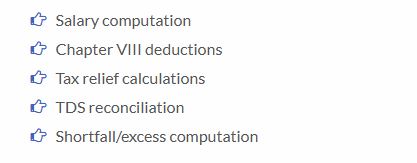

Robust Reconciliation Framework

The form integrates:

The same shows a move toward stringent compliance tracking and system-based validation.

Responsibility of Employers and Banks

Employers should ensure:

Banks filing specified senior citizen income should confirm appropriate reporting of pension and interest income.

Closure: The new draft Form No. 138 shows a complete overhaul of quarterly TDS reporting for salary and the particular senior citizen income. The CBDT, via integrating detailed salary computation, deductions, tax liability, and reconciliation within the statement itself, has the motive to improve compliance precision and reduce reporting discrepancies.

Important: CBDT Releases New Draft Form 130 for Consolidated TDS Certificate U/S 395

If executed in its existing form, then employers, Government deductors, and banks shall be required to upgrade payroll and compliance systems to accommodate the expanded reporting framework.

Stakeholders must review the draft and prepare for procedural adjustments after the form is formally reported.

Complete Draft Form No. 138