The Delhi High Court stated that the objective of cancelling GST registration retrospectively must be mentioned in the show cause notice and restored the registration upon clearance of dues.

The bench of Justice Nitin Wasudeo Sambre and Justice Ajay Digpaul has repeated stringent procedural safeguards controlling retrospective cancellation of GST registration, keeping in mind that these drastic measures could not be kept in the absence of recorded reasons and a clear proposal in the SCN.

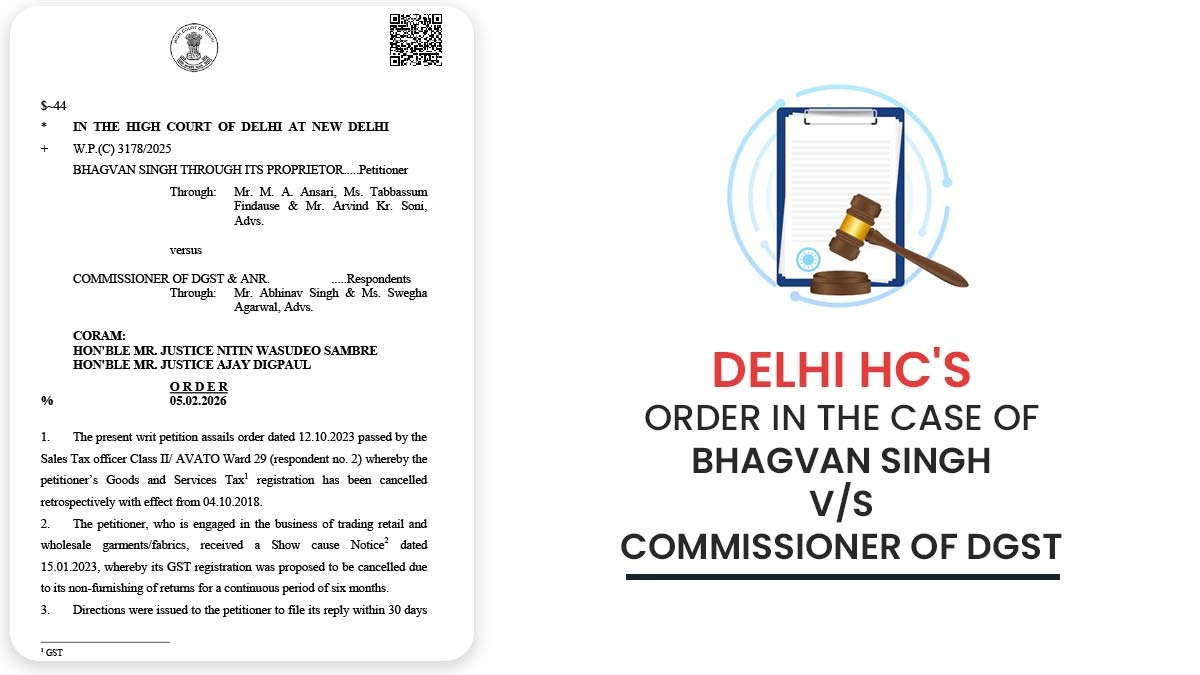

Bhagvan Singh, a sole proprietorship engaged in retail and wholesale trading of garments and fabrics, has filed a writ petition contesting an order on 12 October 2023 passed via the Sales Tax Officer (AVATO, Ward 29), Delhi. The GST registration of the applicant by the impugned order was cancelled retrospectively w.e.f 4 October 2018.

After issuance of SCN on 15th January 2023, the cancellation has emerged alleging non-filing of GST returns for a continuous duration of 6 months. The notice requires the applicant to give a response within 30 days and to appear for a personal hearing on 13 February 2023, and suspends the GST registration immediately.

Thereafter, the department passed the cancellation order, marking that no response had been obtained to the Show Cause Notice (SCN), and proceeded to cancel the registration retrospectively by 5 years.

The matter before the Court was whether the tax authorities effectively explained the cancellation of the GST registration of the applicant retrospectively when the SCN did not reveal any proposal or intent to cancel registration with retrospective effect; and the final order does not have reasons explaining why retrospective cancellation was critical.

The Court considered that Section 29(2) of the CGST Act, 2017, provides authorities with the power to cancel GST registration retrospectively. But the Court mentioned that the same authority is unfettered and needs to be exercised with due application of mind.

Important: Delhi HC: Taxpayer Can’t Shift Burden to CA to Escape GST Penalty for SCN Lapse

Bench, an order of retrospective cancellation should record reasons explaining why the same retrospective effect is needed. It is essential that the show cause notice informs the taxpayer that retrospective cancellation is being considered, allowing the taxpayer to effectively object and respond.

The Court, relying on a consistent line of precedents, including Ramesh Chander v. Assistant Commissioner of GST, Delhi Polymers v. Commissioner, Trade and Taxes, and Riddhi Siddhi Enterprises v. Commissioner of GST, held that failure on either count vitiates the entire proceedings.

The HC concerning procedural infirmities set aside the impugned cancellation order on 12 October 2023; quashed the SCN on 15 January 2023; and asked for the restoration of the applicant’s GST registration. The Court specified that the applicant should clear all due statutory obligations within 30 days from the date of restoration of registration.

The Court safeguarded the revenue’s interest by citing that its order shall not favour the right of the department to initiate proceedings de novo, rigorously in accordance with law, and following due process.

| Case Title | Bhagvan Singh vs.Commissioner of DGST |

| Case No. | W.P.(C) 3178/2025 |

| For Petitioner | Mr M. A. Ansari, Ms Tabbassum Findause, Mr Arvind Kr. Soni |

| For Respondent | Mr Abhinav Singh, Ms Swegha Agarwal |

| Delhi High Court | Read Order |