Hostels for the working men and women cannot be specified as commercial properties for charging the property tax, water tax, and electricity charges, the Madras High Court ruled.

After observing that the burden of filing those taxes would fall on the inmates of those hostels therefore Justice Krishnan Ramasamy passed the ruling.

The authorities, while charging tax, must view the case through the eyes of the recipient of the service and, rather than from the point of a service provider, the court cited.

The Court concluded, “The nature of activities carried on by the petitioner (the owner of a hostel) is only residential in nature and accordingly, the residential tariff will apply for the purpose of levying the property tax, water tax and water charges for the petitioners’ properties.”

The judgment has been passed by the court on a batch of petitions contesting the conversion of a property tax charged on hostels from a residential tariff to a commercial tariff.

Hostel room service was provided by the applicant to the working men and women. It was claimed that they furnish hostel rooms as sleeping apartments and therefore their hostels should be considered as residential dwelling units.

Opposite to that, the state authorities, along with the municipal corporations and Chennai Metro Water Supply and Sewerage Board, stated that the applicants, being hostel owners, operate a business of leasing out their properties, and therefore, the demand notices for commercial tariff were explained.

Also Read: Karnataka AAR: 12% GST Rate Applies on Hostel Facility Services

The court mentioned that as the rooms of the hostel are merely utilised as residences or sleeping apartments by the inmates and not any commercial activity, the use of the properties shall come within the purview of residential premises.

The court ruled, “It is clear that activities carried on at the petitioners’ hostels are only residential in nature and it is not commercial. Therefore, the 1st issue is hereby answered by holding that the petitioners’ property cannot be considered as commercial property and thus, the commercial tariff will not apply to the petitioners’ properties.”

It mentioned that different yardsticks cannot be applied to tenants of apartments and inmates of hostels.

“If the petitioners’ hostels were treated as a commercial unit, it would be a clear discrimination against the poor. The Legislation was not intended to charge more for the poor and keep the rich in a comfortable position by levying tax at a lower rate of tariff. Even for example, if commercial tariff is applied, a person residing in hostel has to pay double the amount towards property tax and water tax, whereas, the person, living in bungalow/apartment, who can spend higher amount towards rent, will be eligible for payment of property tax, water tax, water charges, etc., at concessional rate, which is applicable for residential unit,” the Court stated.

The Court quashed the demand notices issued before the applicants asked the respondent authorities to treat the property of the applicants as residential units and impose taxes like property tax, water tax, and electricity charges.

The court, benefit of the current ruling shall not apply to the board without the requisite verification.

“The decision arrived at by this Court vide this order is applicable only for the present cases. Even though this order would apply for the hostels, where the inmates are carrying on similar activities, the same has to be verified by the respondent. Therefore, this order cannot be followed in a blindfolded manner by all the hostels, unless and otherwise if they substantiate, before their case before the appropriate Authorities concerned or before any Court of Law, that the inmates are using the rooms only for the purpose of residential activities,” it cited.

Important: Madras HC: Women’s Hostels Are Exempted from GST as They Are Not Being Used for Commercial Purposes

The applicants have been represented by Advocates Aparna Nandakumar, T. Saikrishnan, S Senthil, NK Ponraj, and Kingston Jerold.

The respondent authorities have been represented by Advocates P Prithvi Chopda, D Ferdinand, KN Umapathy, Najeeb Usman Khan, N Velmurugan, V Vijayalakshmi, DR Arunkumar, and C Selvara.

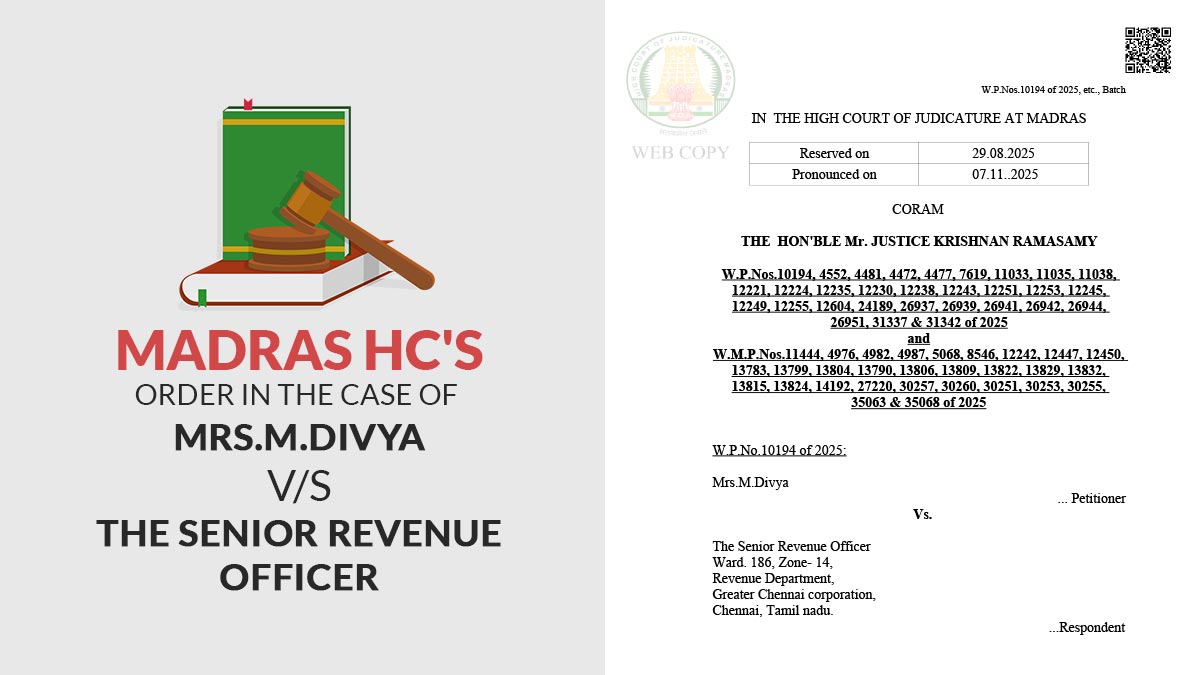

| Case Title | Mrs M.Divya vs. The Senior Revenue Officer |

| Case No. | W.P.No.10194 of 2025 |

| Date | 07th November 2025 |

| Madras High Court | Read Order |