Limited Liability Partnership is a term in the Companies Act that offers the partners to be limited in their personal liability towards any company in case of any liquidation or dissolution of the firm.

Here we will make understand all the relevant and important points under the limited liability partnership, including;

Membership of LLP

Who is Eligible to become a Partner in an LLP?

- Any person who is not disqualified as per the act

- A company considered in the Companies Act 1956 or the Companies Act 2013

- An LLP is considered under the LLP Act 2008

- An LLP is considered a foreign LLP

- A company is considered a foreign company

Who is not Eligible to become a Partner in LLP?

- An individual with a condition might be of unsound mind and has been declared by competent authorities and jurisdiction.

- A minor/ HUF/ Partnership Firm

- An AOP (Association of Persons) or BOI (Body of Individuals)

- An Artificial Judicial Person/ Corporate Sole

- A Co-operative Society registered under any law in the mentioned period

- A body corporate which the Central Government might mention on behalf by notification in the Official Gazette.

Who Can Become a Member of an LLP?

- Any person or a body corporate can become a member of an LLP.

Who is not Capable of becoming a Member of LLP?

The person who cannot become a member of an LLP is

- If he is found to be unsound by the Court of competent jurisdiction and if it is proved;

- If he comes under ‘undischarged insolvent ‘ or

- If his application is shown to be arbitrated as insolvent, but the application is still on hold.

Who is appointed as a Designated Partner in an LLP?

- An LLP stands for the Limited Liability Partnership and is governed according to the rules of the LLP (Limited Liability Partnership) Act, 2008. As the years are passing, the LLP is becoming famous as compared to the ‘Private’ or a ‘Limited Company’ form of business, and this is only possible because the nature of the LLP is easier and the compliance is less.

- Each and every LLP must have at least 2 partners, and both of them must be designated partners who must participate daily in activities and work in support of the partners. After the appointment, the partner or a designated partner can be removed, changed, or appointed.

Who cannot be appointed as a Designated Partner in an LLP?

- A person who has been adjudged insolvent in the last five years.

- A person who has not made clear payments to his creditors in the preceding five years.

- A person convicted by the court for an offence involving moral turpitude, and for which

- The sentence is imprisonment for a minimum of six months

- A person convicted by the court for an offence under section 30

Read Also: Guide to Form LLP 8 Filing with Due Date & Penalty

How can a Designated Partner be Added?

Given below is the procedure by which a designated partner can be added-

1. Apply for the DSC:

The partner must apply for a Digital Signature Certificate (DSC) and for which the documents given below are needed –

- PAN Card of the applicant

- Aadhaar Card of the applicant

- Photo of the applicant

- Email ID of the applicant

- Phone number

2. Apply for DIN:

- After applying for the DSC, the director must apply for the DIN (Director Identification Number) in the DIR-3 Form along with the applicant’s address proof as well as the identity proof.

3. After giving the DIN to the designated partner, the partners of the LLP should call a meeting in which they must pass a resolution so that the designated partner can be added to the partnership contract.

4. A supplementary contract will be drafted, and in that, the new name of the partner will be added.

5. After this, the agreement of the new partner will be taken, that too in writing.

6. After all the above-mentioned documents are prepared and collected then a Form-4 of LLP must be mandatorily filed within the given 30 days after the appointment.

7. After filing the Form-4, the Form-3 must be filed along with the supplementary as well as the original partnership contract within the given 30 days after the appointment.

8. After filing the above-mentioned forms, the designated partner’s name will be added, which can be seen on the MCA (Ministry of Corporate Affairs) site.

9. If the Form-3 and Form-4 are not filed within the mentioned 30 days, then an extra fee will be charged.

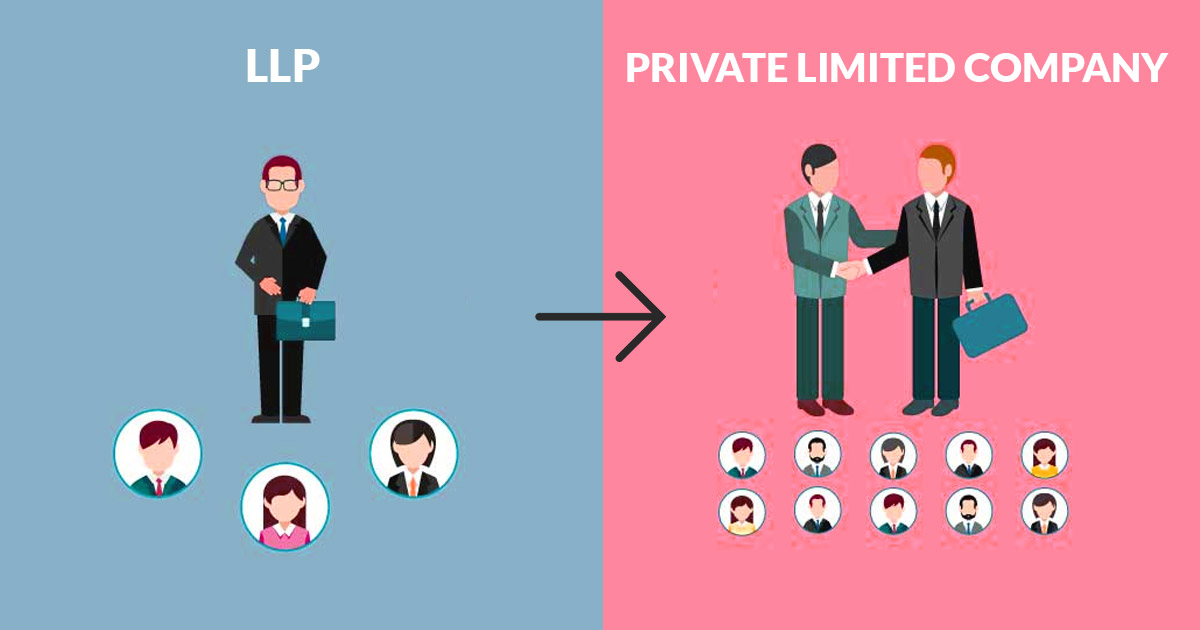

How Can the Limited Liability Partnership Be Converted into a Company?

Introduction

In India, there are many businesses that started as LLP (Limited Liability Partnership) but now want to convert it to a private limited company to taste more growth in the business or might be forgetting the benefit of equity capital. According to the provisions of ‘Section 366 of the Companies Act, 2013’ and ‘Company (Authorised to Register) Rules, 2014’, the LLP businesses have the right to convert into a company.

But there are certain requirements that must be fulfilled for an LLP to convert into a Private Limited Company. For example, there must be a minimum of 2 Designated Partners in LLP, approval from all the partners is mandatory, advertisement in the local and national newspapers must be done, and a NOC (No Objection Certificate) is needed from the ROC in which the registration of LLP is done.

Approval of Name

The approval of the name will be acquired from the Registrar of Companies (ROC) after submitting the application in a format. To apply for this, many items must be selected, which are stated in the ‘RUN FORM’.

Securing DSC and DIN

If the members who are going to be the directors of the company after the conversion do not have the DSC (Digital Signature Certificate) and DIN (Director Identification Number) must have this, and if not, they must obtain them as soon as possible. To get the DIN, one must file an application that is available on the MCA Portal. The DIN application will be processed further, and the central government will approve it through the office of the regional director, the MCA (Ministry of Corporate Affairs). Along with the form, one must also include address proof and identity proof, along with a 1 recent colour passport-size photo. All the above-mentioned documents must be attested by a practising chartered accountant or a practising cost assistant, or a practising company secretary.

Provided that there shall be two or more members for the registration of a company.

Provided further that a company with fewer than seven members shall register as a private company.

Steps to be Followed for Conversion of LLP to Private Limited Company

In Recent amendments, URC-1 have been linked to the SPICe+ Form. This linkage avoids filing of URC-1 separately and streamlines incorporation and conversion.

Here Is a Detailed and Updated Procedure

Gather the partners for the meeting to get the approval of the majority for registering in the LLP u/s 366 of the Companies Act, 2013. To allow more than one partner to take all the mandatory steps and to perform all the papers, documents, contracts, and many more that are necessary to register the LLP as a company.

Apply for name approval through SPICe+ Part- A, select conversion of partnership/ LLP, society into company, The advantage of it is that the business can be named the same as the LLP (subject to availability of name according to the Name Availability guidelines of Companies Act) but the one thing that must be added with the name of the LLP, is the ‘limited’ or the ‘private limited’ words.

Fill details in SPICe+ Part-B and attach all mandatory and optional attachments, and submit the form so that the other linked form can generate.

File linked form such as e-MOA and e-AOA, AGILE PRO-S, URC-1 and INC-9.

Documents Required for Spice+ Form

- Proof of address of registered office/ NOC

- Memorandum and Articles of Association (MoA & AoA).

- Identity and address proof of the proposed director and shareholders

- Declaration by director and subscribers (auto-generated in INC-9)

- DIR-2

- Board resolution authorising conversion

Documents Required for URC-1

- List of all LLP partners

- A list that shows the names of the persons who are the company’s first directors

- LLP agreement

- Statement of assets and liabilities

- Latest Income Tax Return Acknowledgement

- No objection certificate from creditors

- An affidavit must be taken from every person who is appointed as the first director of the company in which it must be written that he is ‘not disqualified to be a director’ as per the sub-section (1) of Section 164 and also that the documents that have been attested with the Registrar for registration of the company have the correct, complete and true information as per the knowledge and belief.

- Advertisement in URC-2 (in English and Vernacular newspaper) – mandatory.

- Declaration by a professional (CA/CS/CMA) confirming compliance.

Cautions While Conversion of LLP into a Private Limited Company for Professionals

There are many ways by which the firm can be converted into a company via itemised sale, slump sale, dissolution thereof and on dissolution, accepting the company as a partner, business taken by the company, etc., as per the choices. The conversion from LLP to the company must be done in an appropriate way, as per the situation and which gives the benefits.

- Obtain an Engagement letter from a subscriber: According to the certification under the SPICE Form, i.e. INC-32 Form, a professional has to declare that he is engaged for the certification purpose so therefore is mandatory to have an engagement letter.

- Verification of original records about the registered office: According to the certification in SPICE Form, i.e. INC-32 form, a professional declares that all the particulars along with attachments have been verified from the original records.

- Ensure all attachments are clear enough to read: According to the certification in SPICE Form, i.e. INC-32 Form, a professional declares that the attachments submitted by him are complete and neat.

- Ensure the registered office of the company is functioning for the business purposes of the company: According to the certification in SPICE form, i.e. INC-32 form, a professional has to declare that the registered office has been visited by him personally. He must also declare that all the original documents have been given after the incorporation. According to section 7(4), the professional must declare that all the copies of the documents/ information are verified from the originally filed documents, which are maintained at the registered office of the company and must give it to the incorporation documents.

- MCA Circular 10/2014: As per this circular, ROC/ RD, if the material fact is not included or the introduction of misleading/incomplete/false information, post giving chances to explain the issue to the government division of MCA, may further proceedings under section 447 or the respective department may take action.

Can a LLP firm enjoying loan from bank converted into Pvt Ltd., without first repaying the loan

Hey, I don’t think there’s the compulsion of a minimum of 7 partners in a firm for it to be covered into a Company. Minimum 2 partners of an LLP can also form a company.

what about URC-2 ?? you haven’t mentioned the advertisement part !!!!!

Hi,

I read your article to convert LLP to private ltd co. & found useful. I have a question that if a property is in name of LLP than how that property will be transferred to Pvt Ltd. co. Whether registration charges need to be paid again for property to transfer from llp to pvt ltd co.

Thanks

Please consult any practicing professional