The Madhya Pradesh High Court recently delivered an important ruling concerning the Central Goods and Services Tax (CGST) Act, 2017. The Court determined that any appeal submitted within the designated statutory timeframe should not be considered time-barred.

Additionally, it specified that when calculating the limitation period, the date of the original order should be excluded from consideration. This clarification has significant implications for how appeal timelines are assessed under the CGST framework.

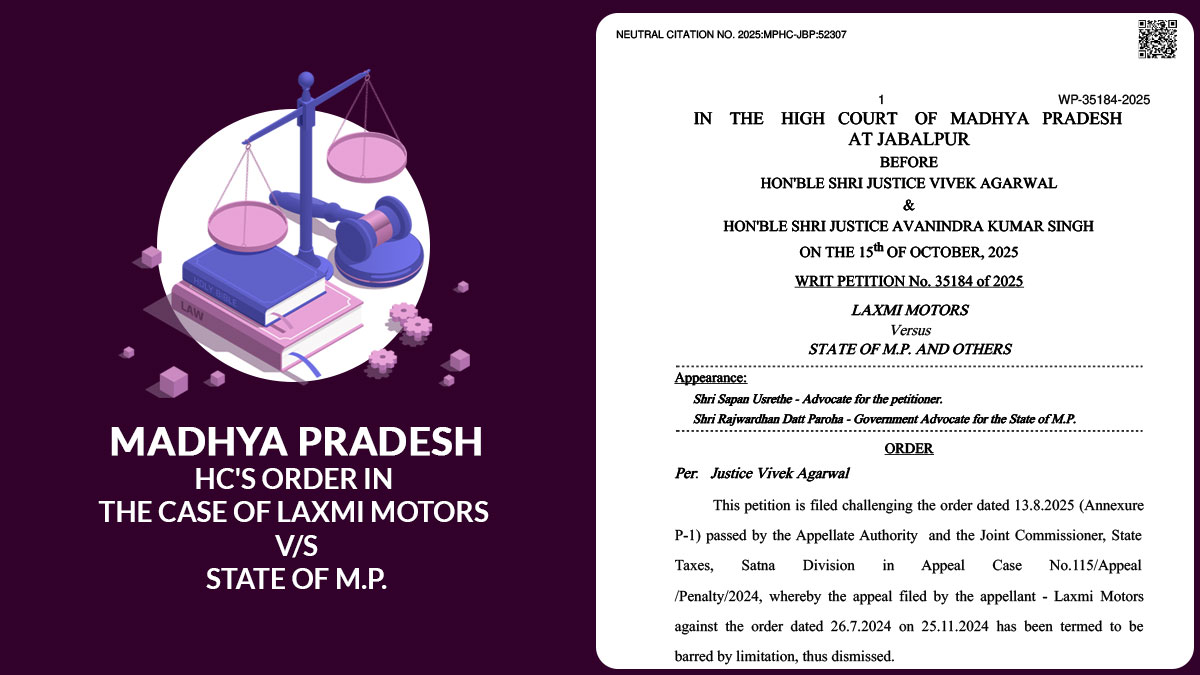

Contesting the order dated August 13, 2025, passed by the appellate authority and the Joint Commissioner, State Taxes, Satna Division, the applicant, Laxmi Motors, has submitted a writ petition. The appeal of the applicant has been dismissed by the appellate authority against an earlier penalty order on 26th July 2024, citing that it was submitted 2 days after the limitation period.

The counsel of the applicant stated that, under Section 9 of the General Clauses Act, 1897, the day on which the order was passed must not be included, and the limitation must commence from the next day, i.e., 28 July 2024.

The petitioner’s counsel argued that Section 107(1) of the CGST Act stipulates a period of three months for filing an appeal, which should be calculated in calendar months rather than days. This interpretation indicates that the appeal deadline was October 27, 2024. Additionally, under Section 107(4), a one-month extension further prolonged the deadline to November 26, 2024. As the appeal was submitted on November 25, 2024, it fell within the allowable limitation period.

The counsel of the State said that the authority had calculated the limitation as 120 days from the order date and discovered that the appeal was limited by 20 days.

U/s 9 of the General Clauses Act, when the word “from” is used to mark the start of a period, the first day is to be excluded, Division Bench including Justice Vivek Agarwal and Justice Avanindra Kumar Singh cited. The limitation period should begin from 27 July 2024 and run by calendar months, the court stated.

The court referenced the rulings of the Apex Court in State of Himachal Pradesh v. Himachal Techno Engineers (2010) 12 SCC 210 and Bibi Salma Khatoon vs. State of Bihar (2001) 7 SCC 197. The Bench, a “month” should be understood as a calendar month, indicating the period ends on the corresponding date in the next month.

The court discovered that the appeal period ended on 26 November 2024. As the appeal was submitted on 25 November 2024, it was considered timely. Thereafter, the court annulled the order dated August 13, 2025, and instructed that the applicant’s appeal be evaluated on its merits.

Rs 25,000 has been charged by the court on the State, asking that the amount not be recovered from the public exchequer but from the officer liable for the mistake. Thereafter, the writ petition was permitted.

| Case Title | Laxmi Motors vs. State of M.P. |

| Case No. | WRIT PETITION No. 35184 of 2025 |

| For Petitioner | Shri Sapan Usrethe |

| For Respondent | Shri Rajwardhan Datt Paroha |

| Madhya Pradesh High Court | Read Order |