A major update has been rolled out by the Income Tax Department for its e-filing portal, proposing that taxpayers have enhanced transparency in faceless assessments and appeals. The same decision is anticipated to carry effective clarity and facilitate tracking for millions of taxpayers in the nation.

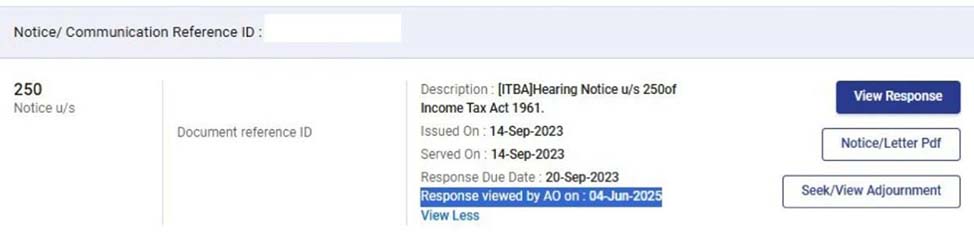

Taxpayer from this update can see when their submissions have been reviewed by the authorities. The portal shows the date on which the assessing officer or Commissioner of Income Tax (Appeals) [CIT(A)] has accessed the submitted response.

Highlights of the New Update

Response viewed by AO on: Date – The same indicator delivers evidence that your documents have been accessed, which ensures certainty of the status of your case and lowers the ambiguity in the faceless assessment process.

For making the faceless regime stronger, the same initiative is a part of the income tax department’s efforts, which makes it transparent and accountable. The taxpayers could have effective visibility into the progress of their tax cases, which enhances trust and efficiency in the system.

The update has been admired by experts, citing that it provides authority to the taxpayers with timely data and supports the government’s dedication to ease the compliance and foster a taxpayer-friendly environment.

The updated portal needs to enhance user experience, lower follow-up queries, and facilitate faceless assessments and appeals.

Taxpayers can now receive clear updates by regularly checking the portal, allowing them to stay informed about their cases without needing repeated follow-ups.