The Allahabad High Court has initiated proceedings to examine the constitutional validity of Section 127 of the Central and State Goods and Services Tax (GST) Act, 2017. The court has issued notices to both the office of the Solicitor General of India and the Advocate General of Uttar Pradesh, requesting their responses to a writ petition challenging the provision.

Section 127 of the GST Act grants “proper officers” the authority to levy penalties when they believe an individual is liable for a penalty, provided the situation isn’t already covered by other specific proceedings under Sections 62, 63, 64, 73, 74, [74A], 129, or 130. Such penalties can only be imposed after providing the affected person a reasonable opportunity to be heard.

The petitioner in this case claims to have only become aware of an order issued against him under Section 127 in 2025, alleging that the orders were neither communicated directly nor uploaded to the official portal.

According to the writ petition, the petitioner had previously faced proceedings under Section 74 concerning transactions with another assessee, which were subsequently dropped. Crucially, on the very same day, a show-cause notice was issued under Section 127 for the identical transactions, leading to the contested penalty order.

The petitioner argues that Section 127 does not empower authorities to reverse their previous stance without the emergence of new facts or circumstances. Furthermore, the petition directly challenges the validity of Section 127 itself.

Read Also: A Guide to Assessment U/S 62 for Non-Filers GST Returns

It contends that the GST Act already contains numerous specific provisions governing the sale and supply of goods and services, making Section 127 inapplicable where such explicit provisions exist. The petitioner asserts that Section 127 confers “unbridled, unchannelized and unregulated powers” upon authorities to impose penalties on taxpayers.

The petition highlights that other sections of the GST Act (62, 63, 64, 73, 74, 129, and 130) provide clear mechanisms for the imposition of tax and penalties. In contrast, it alleges that Section 127 lacks any defined mechanism for exercising its powers. Consequently, both the provision and the penalty order issued against the petitioner under Section 127 are being contested before the High Court.

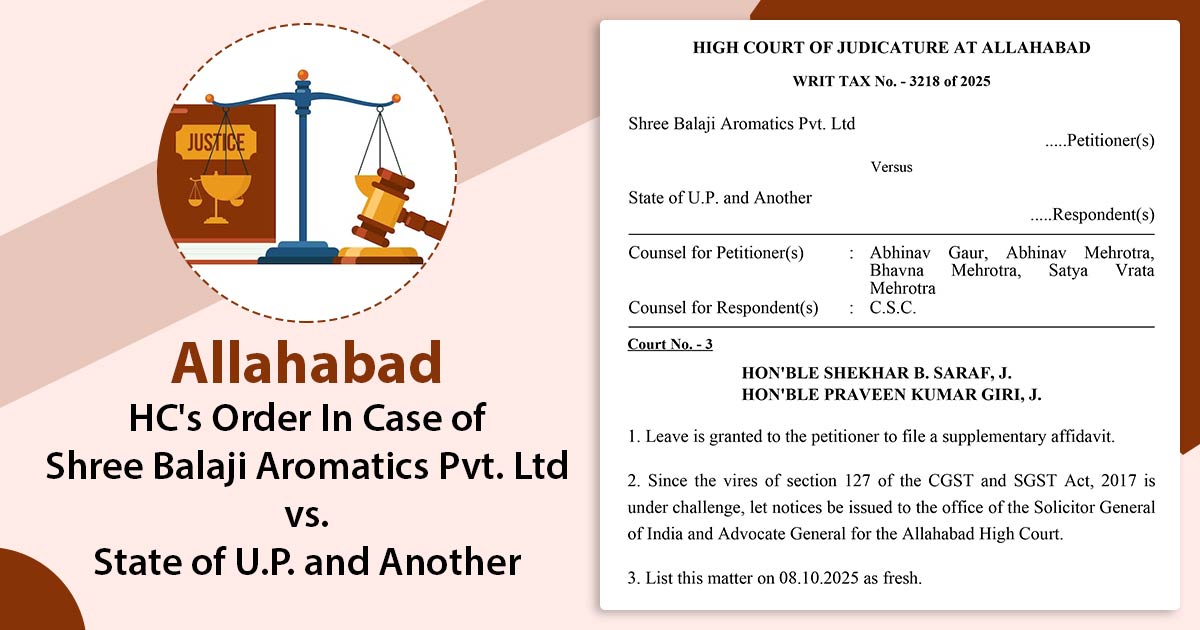

The matter is currently before a division bench comprising Justice Shekhar B. Saraf and Justice Praveen Kumar Giri. The next hearing is scheduled for October 8, 2025.

| Case Title | Shree Balaji Aromatics Pvt. Ltd vs State of U.P. and Another |

| Case No. | WRIT TAX No. – 3218 of 2025 |

| For Petitioner | Abhinav Gaur Abhinav Mehrotra Bhavna Mehrotra Satya Vrata Mehrotra |

| For Respondent | C.S.C |

| Allahabad High Court | Read Order |