The GSTAT has released a comprehensive User Advisory aimed at taxpayers, tax officers, and authorised representatives concerning the recently launched GSTAT e-filing portal.

This advisory highlights essential timelines, necessary conditions, and procedural safeguards for filing second appeals under section 112 of the CGST Act.

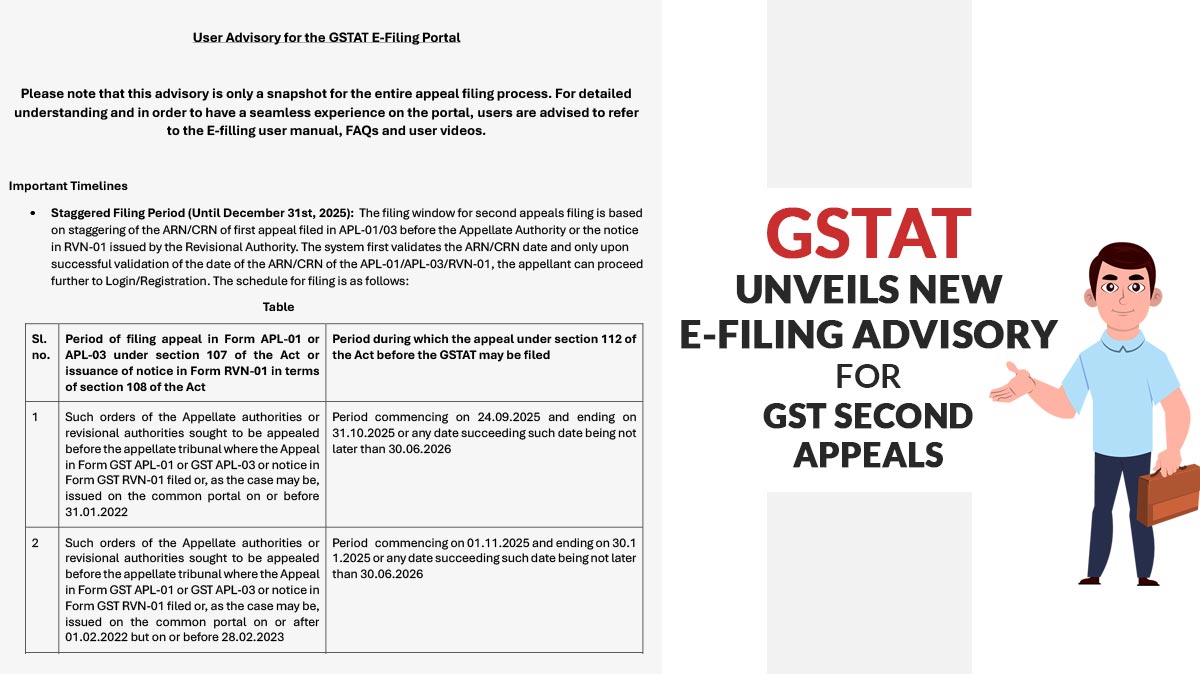

The advisory highlights that the filing process will operate on a staggered schedule, leading up to 31st December 2025. This schedule is determined by the ARN/CRN associated with the first appeal (APL-01/03) or notice (RVN-01).

Specifically, appeals related to orders or notices issued before 31st January 2022 can be submitted between September 24, 2025, and October 31, 2025. Additionally, further filing windows have been available until March 31, 2026.

Read Also: GSTN Enables GST Refund Claims Despite Negative Minor Head Balances

It is important to note that any appeal that is not submitted during its designated period can still be filed later; however, the final deadline for submission is 30 June 2026.

Starting April 1, 2026, appellants are required to submit their APL-04 orders within a statutory timeframe of three months. For instances where the ARN/CRN is not traceable in the GSTN system, the filing period will be available from midnight on December 31, 2025, until June 30, 2026.

To ensure a smooth filing process, GSTAT advises that appellants begin by downloading and completing an offline Excel draft of the filing sheet before logging into the system. It is also important to have all relevant documents prepared in advance.

This includes the impugned order, APL-04, pre-deposit challans, affidavits, and vakalatnamas, all of which should be scanned and saved in PDF format (maximum 20 MB per file).

Read Also: GSTAT to Begin Operations in December to Address 14,000 Pending Cases

The GSTAT advisory prescribes a structured filing workflow:

- Log in or register using GSTIN ID or Back Office ID.

- Sequential completion of order details, case particulars, appellant/respondent details, representative details, and demand details, including pre-deposit.

- Document uploads with a mandatory Vakalatnama if represented.

- Fee payment via Bharatkosh (online/offline), followed by upload of receipts if paid outside the portal.

- Digital Signature Certificate (DSC) or Aadhaar-based e-signature

Once you successfully submit your filing, the system generates a unique filing number and an acknowledgement, which is received on your registered mobile number and via email.

Read Advisory