The penalty under section 270A of the Income Tax Act, 1961, cannot be levied when the underlying addition is based on the estimation of income, the Delhi Bench of the Income Tax Appellate Tribunal ( ITAT ) ruled.

The income of the taxpayer Ram Lakhan for A.Y. 2017-18 has been estimated by the Assessing Officer ( AO ) by assuming he was operating 13 tempos, instead of 10 tempos actually owned by him, and made an addition of ₹1,17,000 on this basis.

U/s 270A, penalty proceedings were initiated after the assessment, and the AO imposed a penalty of Rs 15, 601 which was thereafter validated via the Commissioner of Income Tax (Appeals). The taxpayer, dissatisfied with the order, has appealed to the Tribunal.

As per the taxpayer, the addition was based on estimation, and settled law states that the penalty could not be sustained based on estimates. He relied on judicial precedents along with an earlier order of the Coordinate Bench in his own case dated 15.01.2025, where a penalty levied on similar estimation-based additions had been struck down.

Read Also: No TDS, No Fee: ITAT Mumbai Cancels ₹1.16 Lakh Late Filing Penalty Imposed U/S 234E

The bench of Khettra Mohan Roy and Madhumita Roy said that the penalty order was founded on an estimated addition. Estimation does not hold proof of concealment or misreporting; thus, provisions could not be invoked.

As per the tribunal, the same principle has been kept in the taxpayer’s former matter, and hence it discovered that the penalty order was non-sustainable in statute. Therefore, the penalty of Rs 15,601 has been quashed by the ITAT.

The appeal was permitted by the appellate tribunal held that under section 270A, the penalty could not be imposed where the income additions are made only on estimation without proof of concealment or misreporting.

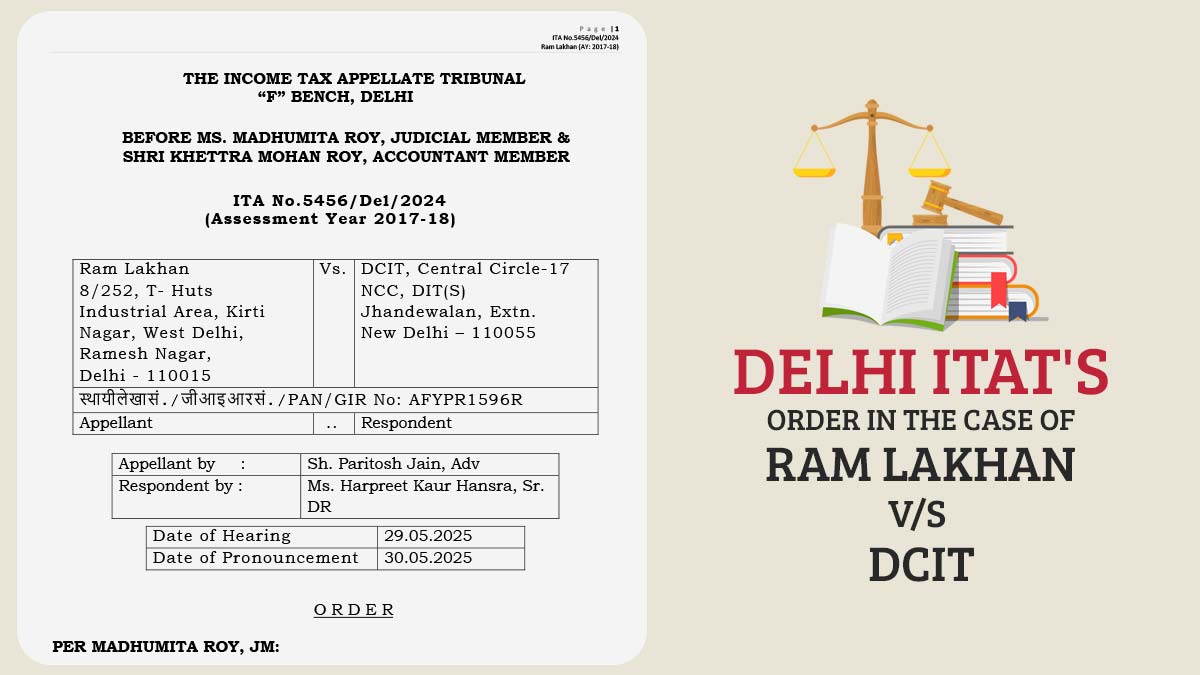

| Case Title | Ram Lakhan vs. DCIT |

| Case No. | ITA No.5456/Del/2024 |

| Assessee by | Sh. Paritosh Jain, Adv |

| Revenue by | Ms. Harpreet Kaur Hansra, Sr. DR |

| Delhi ITAT | Read Order |