The Telangana High Court has determined that any GST assessment order issued even a single day after the designated limitation period is considered invalid and unenforceable. This ruling underscores the importance of adhering to the statutory timelines established for GST assessments.

The Telangana High Court has determined that any Goods and Services Tax (GST) assessment order issued beyond the legally defined limitation period is considered invalid, even if it is just one day late.

This ruling necessitates the annulment of such orders, along with any associated bank attachment actions that may have been taken as a result.

The applicant, Lakshmi Bhanu Steel Traders, submitted a writ petition contesting the GST assessment order on 01.05.2024, the summary of order in Form GST DRC-07, and the garnishee order issued to the bank of the applicant, on the ground that the order was barred by limitation under the CGST/SGST Act.

The counsel of the applicant claimed that u/s 73 of the CGST Act, the order must have been passed within 3 years from the deadline of filing the annual return for the FY 2018-19, which lapsed on 30.04.2024, but the impugned order was passed dated 01.05.2024, rendering the same limited to time.

The discussion centred around procedural violations, highlighting the lack of a Document Identification Number (DIN), non-compliance with Circular No. 128/47/2019-GST, and the failure to adhere to the Supreme Court’s guidelines established in W.P.(Civil) No. 320 of 2022.

The applicant’s counsel claimed that the failure of the department to comply with the regulatory timeline and procedural needs does not validate the proceedings, warranting the quashing of the order and the pertinent garnishee notice.

The counsel of the government cited that the due date for passing the order was 30.04.2024, and the order was passed dated 01.05.2024, recognising the limitation breach.

Read Also: Telangana HC: Appellate Authority is Legally Empowered to Decide on the Jurisdiction of a GST Order

The order passed on 01.05.2024 was after the statutory time limit, as the limitation period expired on 30.04.2024, the division bench comprising Acting Chief Justice Sujoy Paul and Justice Renuka Yara cited. Therefore, it is not sustainable in law.

The Telangana High Court determined that the GST assessment order issued on May 1, 2024, along with any associated bank attachment, should be annulled due to being issued beyond the established limitation period. As a result, the writ petition was granted, and no costs were ordered.

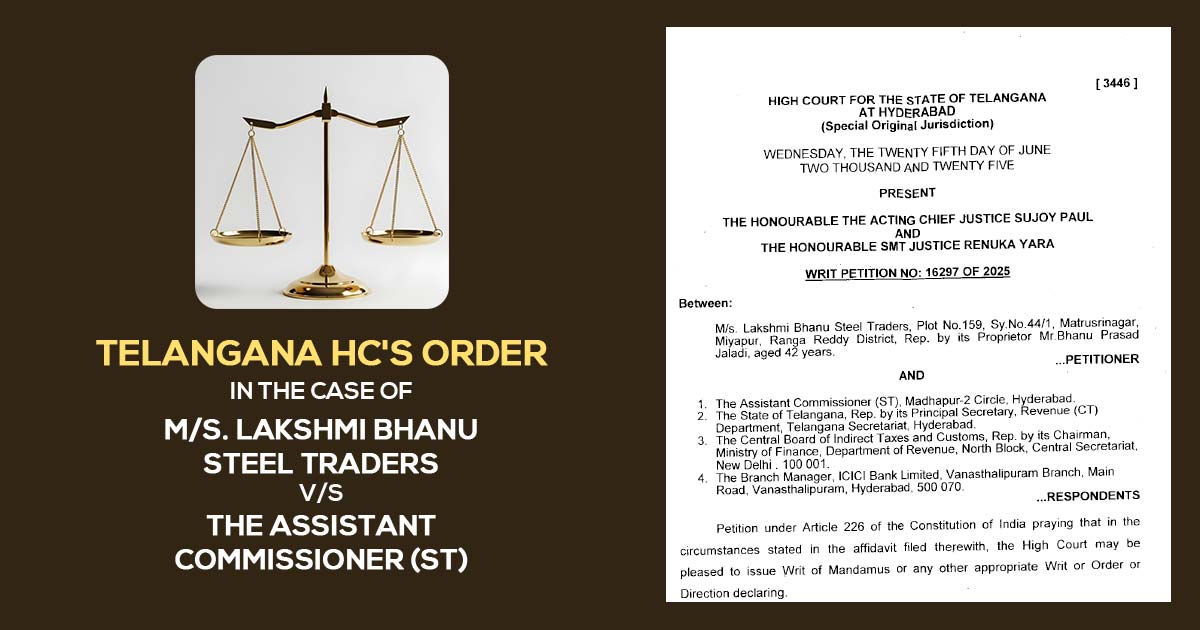

| Case Title | M/s. Lakshmi Bhanu Steel Traders vs. The Assistant Commissioner (ST) |

| Case No. | WRIT PETITION NO: 16297 0F 2025 |

| For Petitioner | Sri Mohammed Rafi |

| Counsel For Respondent | Sri T. Chaitanya Kiran, and Sri Swaroop Oorilla |

| Telangana High Court | Read Order |