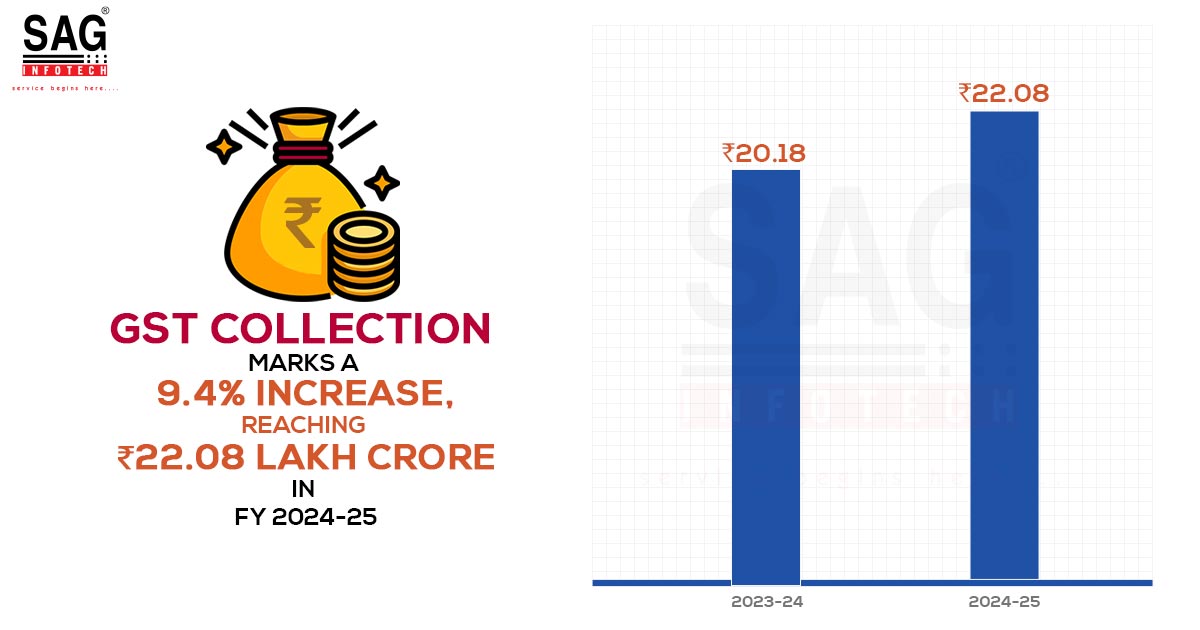

In FY 2024-25, the gross collection of goods and services tax (GST) in India reached an all-time high of ₹22.08 lakh crore, marking a 9.4% year-on-year rise compared to the previous fiscal year, as stated in the official statement.

GST in 2024-25 has recorded its highest ever gross collection of Rs 22.08 lakh crore, showing a y-o-y rise of 9.4%. Rs 1.84 lakh crore is the average monthly collection, the government cited.

As per the data, the gross collections doubled in the last 5 years, compared to Rs 11.37 lakh crore in the 2020-21 financial year. Rs 95000 crore was the monthly average GST collection at that time.

In India, as of 30th April 2025, there are more than 1.51 crore active GST registrations, with more than 1.32 crore as normal taxpayers, 14.86 lakh composition taxpayers, and 3.71 lakh as Tax Deducted at Source (TDS) among other taxable portions.

“In 2020–21, the total collection was ₹11.37 lakh crore, with a monthly average of ₹95,000 crore. The following year, it rose to ₹14.83 lakh crore, and then to ₹18.08 lakh crore in 2022–23. In 2023–24, GST collections reached ₹20.18 lakh crore, showing consistent growth in compliance and economic activity,” the government mentioned in the release.

India, on 1st July 2025, honours the completion of 8 years since the execution of GST.

GST Collection for May 2025

A 16.4% rise to over ₹2.01 lakh crore has been witnessed under the gross GST collections for May 2025, as per the data of the government on 1st June 2025.

From domestic transactions, gross revenues in May 2025 have surged to 13.7% to Rs 1.50 lakh crore, and the GST revenues via imports have surged to 25.2% to Rs 51,266 crore.

The gross central GST revenues have attained Rs 35,434 crore, and Rs 43,902 crore

were the State GST revenues. Rs 1.09 lakh crore was the Integrated GST for May 2025.

Under the updated information, the total GST refunds for May have slipped to 4%.

Get More in the PDF Below