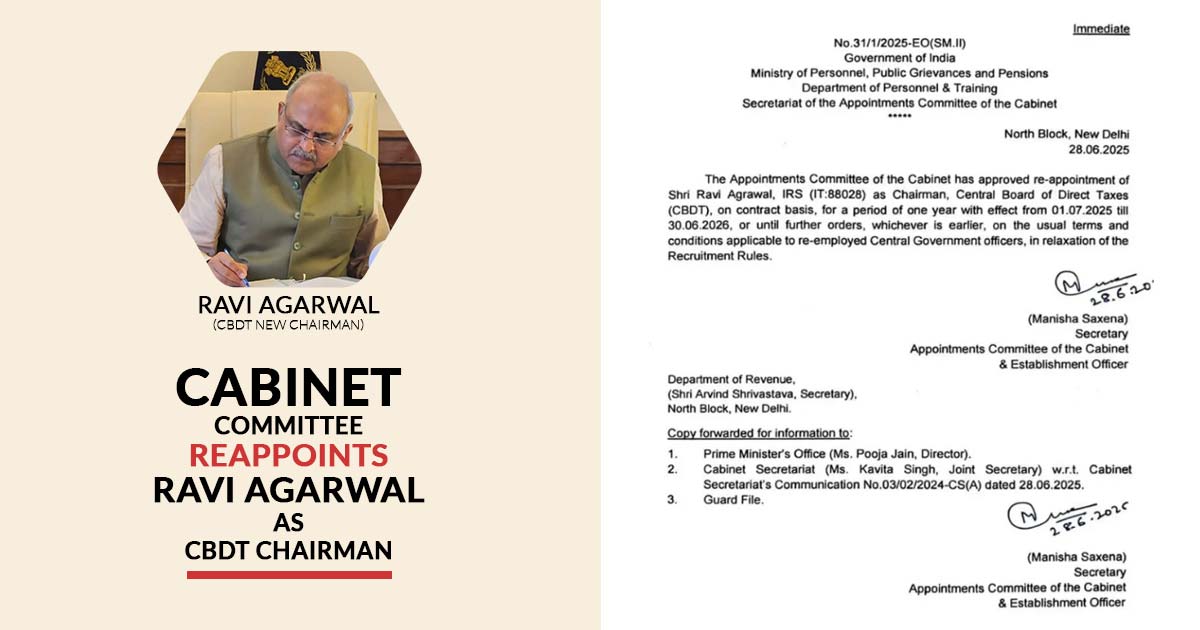

The re-appointment of Shri Ravi Agrawal, IRS (IT:88028), as the Chairman of the Central Board of Direct Taxes (CBDT) has been approved by the Appointments Committee of the Cabinet (ACC). The appointment is on a contractual basis for a period of one year, from July 1, 2025, to June 30, 2026, or until further notice, whichever is earlier.

On June 28, 2025, the Ministry of Personnel, Public Grievances and Pensions, Department of Personnel & Training has communicated the decision via office order No.31/1/2025-EO(SM.II). As per the exempted rules for the re-employed Central Government officers, the reappointment has arrived.

Read Also: CBDT Approves Condonation for Late ITRs U/S 119(2)(b) Till March 2024

Under the reappointment, Shri Agrawal will continue in his leadership role, overseeing the administration of the direct tax laws, tax policy formulation, and taxpayer services in the period when the income tax framework of India is providing the benefit of digital compliance and data analytics for the legislation and transparency.

Manisha Saxena, Secretary, Appointments Committee of the Cabinet & Establishment Officer, signed the order and has been forwarded to the Department of Revenue, Prime Minister’s Office, and the Cabinet Secretariat for essential compliance and record.

The confidence of the government in Shri Agrawal’s persistent leadership in guiding the CBDT via critical policy reforms and improving efficiency in tax administration has been shown in this reappointment.