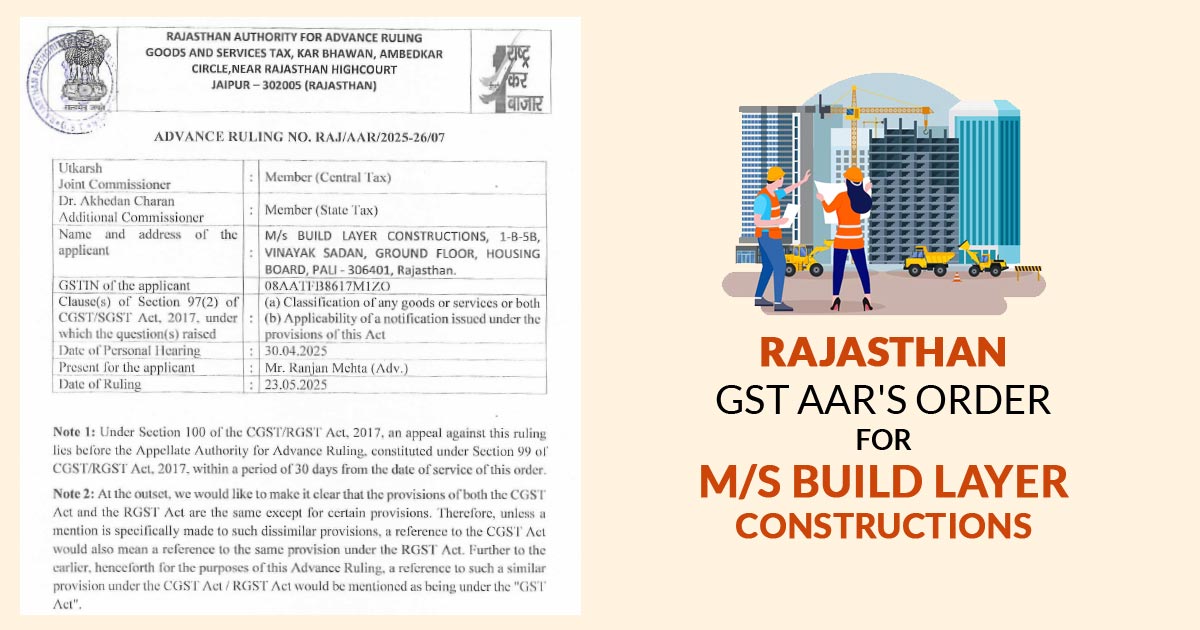

The petitioner is Build Layer Constructions, with address 1b58, Vinayak Sadan, Ground Floor, Housing Board, Pali – 306401, Rajasthan. The petitioner is registered for GST, containing GST registration No. 08AATFB8617M1ZO in the State of Rajasthan. The petitioner has applied for an Advance Ruling.

If the statutory decision of the advance ruling, anyone disagrees, then they are permitted to appeal before the Appellate Authority for Advance Ruling u/s 100 of the CGST/RGST Act, 2017. The same is to be conducted within 30 days of obtaining the order.

Read Also: GST Rate and HSN Code on Construction Services

Both the CGST Act (Central GST) and the RGST Act (Rajasthan GST) have the same meaning. Therefore, unless a clear distinction is made, when we mention the CGST Act, it also encompasses the RGST Act. Hence, through this, both acts combined shall be mentioned as the GST Act.

The Case

M/s Build Layer Constructions (the applicant) is a GST-registered company based in Pali, Rajasthan. They offer labour services to construction projects, and not materials.

A contract with the Rajasthan government has been signed by BCM Builders LLP under the “Affordable Housing Scheme (Pradhan Mantri Awas Yojna)” to build 380 flats, both material and labour included.

Towards the same project, BCM Builders LLP signed another contract with M/s Build Layer Constructions (applicant), for the supply of labour force (only), no material. It signifies that BCM Builders LLP will supply all the construction materials for the project.

The applicant is asking for clarity on the GST treatment of the same arrangement. Particularly, they sought-

- Is the service they are furnishing (pure labour for a government housing project) entitled to any GST exemption?

- What is the accurate classification of their service under GST law?

The applicant answering to this has furnished an Advance Ruling under the GST law (Section 97).

Applicants questions-

Below are the applicant’s raised questions for the advance ruling-

“Question 1: Whether the entry number 10 of the Notification No. 12/2017-Central Tax (Rate) dated 28.06.2017 is applicable on the services of “Pure Labour” provided by the applicant?

Question 2: If the entry number 10 of the Notification No. 12/2017-Central Tax (Rate) dated 28.06.2017 is not applicable, then what will be the classification and IISN for these services of “Pure Labour” provided by the applicant?”

The Ruling

As per the Rajasthan Authority for Advance Ruling (RAAR):

- Answer 1: No, entry number 10 of Notification No. 12/2017-Central Tax (Rate) dated 28.06.2017 does not apply to the services of “Pure Labour” furnished via the applicant.

- Answer 2: Since entry number 10 of the Notification No. 12/2017-Central Tax (Rate) on 28.06.2017 is not applicable, the taxpayer furnished labour service falls under HSN code 9954, drawing a GST rate of 18%.

| Name of Applicant | M/s Build Layer Constructions |

| GSTIN | 08AATFB8617M1ZO |

| Case No. | RAJ/AAR/2025-26/07 |

| Present for Applicant | Mr. Ranjan Mehta (Adv.) |

| Rajasthan AAR | Read Order |