A batch of Special Leave Petitions filed by the Assistant Commissioner of Central Taxes has been dismissed by the Supreme Court of India, refusing to interfere with the Andhra Pradesh High Court’s decision, which clarified the availability of GST ITC refunds in cases of mismatches in the tax credit ledger.

The applicant, Gemini Edibles and Fats India (Gemini Edibles), in three writ petitions instituted to the Andhra Pradesh High Court. When the Gemini Edibles and Fats India Limited and other manufacturers of edible oils’ ITC refund applications were rejected by the authorities then the processes began.

Notification No.5/2017 has been publicized by the government specifying the list of goods which shall not be qualified to claim the refund under section 54 of the CGST Act; the list was expanded via Notification No. 9/2022-Central Tax (Rate) on 13.07.2022 and possessed various kinds of edible oils and specialty fats apart from coal, lignite and more.

Karan Talwar, representative of Gemini Edibles, argued that neither of the referred notifications has placed an explicit bar, yet the circular publicised such a bar on refund applications furnished post 13.07.2022. Practising Lawyer at Solapur caught for ₹100Cr Fake GST ITC, Shell Companies Formation Read More.

A Division Bench of Justice R. Raghunandan Rao and Justice Maheswara Rao Kuncheam of the AP High Court analysed the legal framework, including section 54 of the CGST Act, and noted that the limitations imposed via Notification No. 9/2022 were prospective, wef 18.07.2022, and could not restrict claims of earlier periods.

It stated that the clarification in Circular No. 181/13/2022-GST, which imposed a restriction on such applications, was not logical and breaches the law, and therefore should be struck down to that scope.

HC asked GST authorities to reconsider and process refund claims on their merits without reference to the disputed circular.

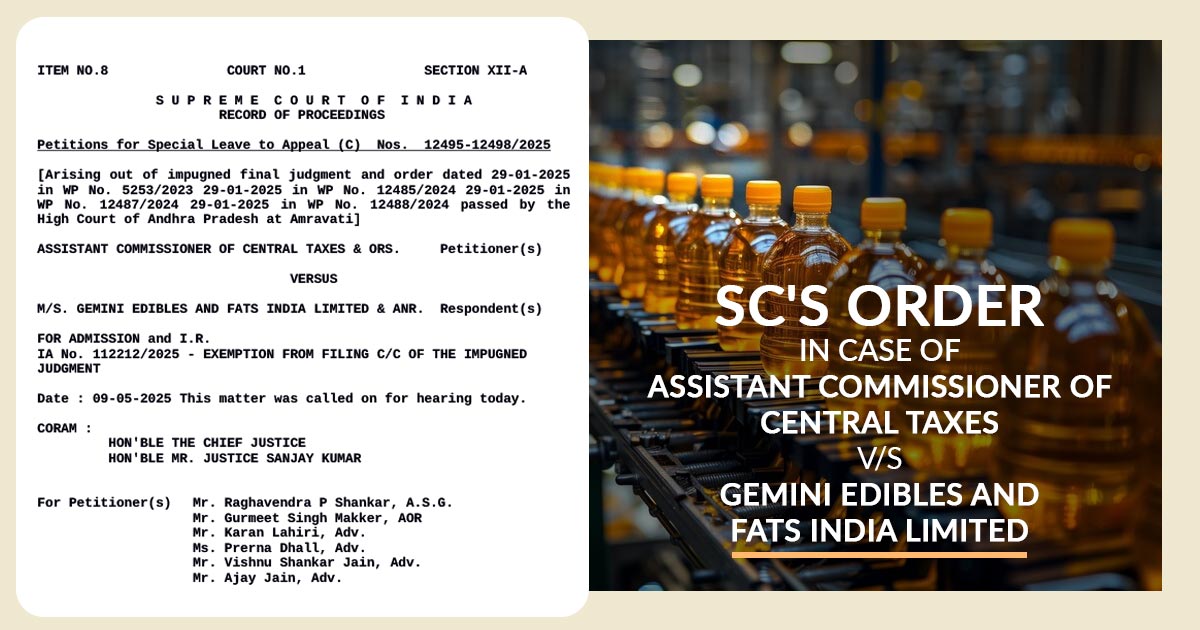

In the present case before the Apex court, a Bench of Chief Justice Sanjiv Khanna and Justice Sanjay Kumar, upon hearing the counsel, said that the Supreme Court shall not intervene with the impugned ruling, and therefore, the special leave petitioners were disposed of, keeping the Andhra Pradesh High Court ruling.

| Case Title | Assistant Commissioner of Central Taxes vs. Gemini Edibles and Fats India Limited |

| Order No. | No. 12495-12498/2025 |

| For Petitioner | Mr. Raghavendra P Shankar, Mr. Gurmeet Singh Makker, Mr. Karan Lahiri, Ms. Prerna Dhall, Mr. Vishnu Shankar Jain, Mr. Ajay Jain, Adv. |

| Supreme Court Order | Read Order |