The Delhi High Court has expressed concerns about the misuse of Section 16 of the CGST Act, 2017. Many traders have been taking advantage of this provision to wrongfully claim input tax credits, which is not permitted. This situation has raised alarms regarding fairness and legality in tax practices.

Through the provisions, the businesses are allowed to get the input tax on the goods and services that are manufactured/ supplied by them in the chain of business transactions. It serves as a business incentive that does not require filing taxes on the inputs, which have been taxed at the source itself earlier.

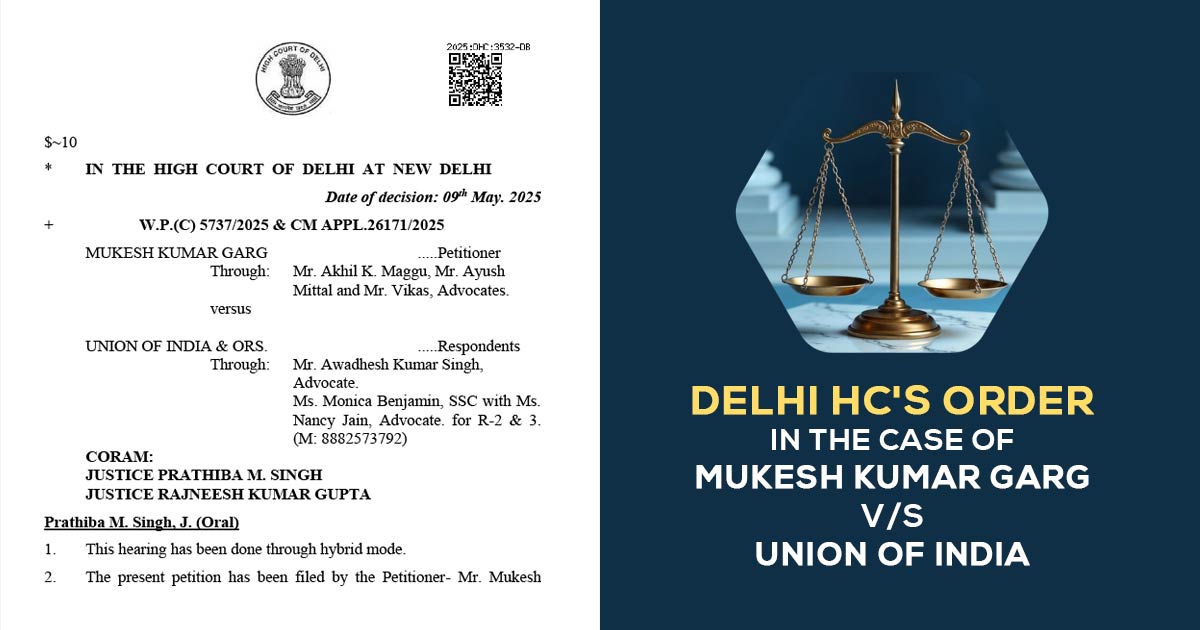

As per the division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta the provision is to streamline the operations of businesses it has been gone through many cases where the same facility under section 16 of the CGST Act has been misused via distinct individuals, firms, entities and companies to avail of ITC despite when the output tax does not depsoted or when the entities or individuals who must deposit the output tax are themselves discovered to be not in existence.

“Such misuse, if permitted to continue, would create an enormous dent in the GST regime itself,” the Judges said.

On an individual’s petition, accused of establishing as many as 28 firms and availing fake ITC of more than ₹115 crores, without any supply of goods or services, the remarks arrived in a writ petition.

The imposed penalties on the applicant have been contested by the applicant, citing that he was not the authorised signatory of the main firm, which had taken the GST Input Tax Credit (ITC) and was operated by his son.

While the department emphasised the collusion of the applicant and said that he was the sole proprietor of one of the firms engaged in the misconduct. As per the department, the levying of the penalty could be asked by the applicant in a plea u/s 107 of the CGST Act, and the case is not similar where the Court needs to entertain the writ petition.

The Court, Article 226 of the Constitution, grants extraordinary writ jurisdiction, which must not be exercised by the Court to support ‘unscrupulous litigants’.

It said that, “the Petitioner and his other family members are alleged to have incorporated or floated various firms and businesses only to avail ITC without there being any supply of goods or services…The allegations against the Petitioner in the impugned order are extremely serious. They reveal the complex maze of transactions, which are alleged to have been carried out between various non-existent firms for the sake of enabling fraudulent availment of the ITC…The Court, in exercise of its writ jurisdiction, cannot adjudicate upon or ascertain the factual aspects.”

The court mentioned that K.D. Sharma v. SAIL, (2008), where the Supreme Court ruled that petitions under Article 226 of the Constitution of India must be entertained exclusively if the person who arrived with clear hands and not in the favour of the persons who present the convoluted facts or misrepresent the factual and correct the record.

Also Read: Delhi HC: Assessee Cannot Plead Lack of Hearing If Show Cause Notice Was Available on GST Portal

Therefore, with the costs of Rs 50,000 to be paid to the Delhi High Court Bar Association within 4 weeks, the court dismissed the petition.

| Case Title | Mukesh Kumar Garg Vs. Union of India |

| Case No. | W.P.(C) 5737/2025 & CM APPL.26171/2025 |

| For The Petitioner | Mr. Akhil K. Maggu, Mr. Ayush Mittal and Mr. Vikas |

| For The Respondents | Mr. Awadhesh Kumar Singh, Ms. Monica Benjamin, Ms. Nancy Jain, |

| Delhi High Court | Read Order |