According to the Delhi High Court, taxpayers cannot claim they were not allowed to be heard if they fail to check the GST portal for a show cause notice (SCN) and respond to it before an order is passed.

A division bench comprised of Justices Prathiba M. Singh and Rajneesh Kumar Gupta stated thus.

“Since the Petitioner has not been diligent in checking the portal, no reply to the Show Cause Notice has been filed by the Petitioner. Thus the department cannot be blamed.”

Read Also: Delhi HC Sets Aside GST Demand, Directs Dept to Consider Assessee’s Medical Adjournment Request

During a hearing regarding a petition filed by the owner of a company involved in the trading and manufacturing of plastic components, remarks were made about an order that raised a demand of ₹9,21,326. The petitioner argued that this order was issued without providing him an opportunity to be heard or serving a Show Cause Notice (SCN).

In the ‘additional notices and orders’ tab of the GST portal, SCN was furnished in the applicant’s case rather than the notices and orders tab, and hence is not an appropriate mode of service.

Department, before the applicant, a reminder notice was issued, but there was no response. It also said that whenever anything is uploaded on the portal, automated emails and SMSes are also sent.

Thereafter, the Delhi High Court remarked that the department could not be held liable for the failure of the taxpayer to check the portal.

It denied to intervene with the demand, though it allowed the applicant to submit a plea against the impugned order to the Appellate Authority, along with the pre-deposit.

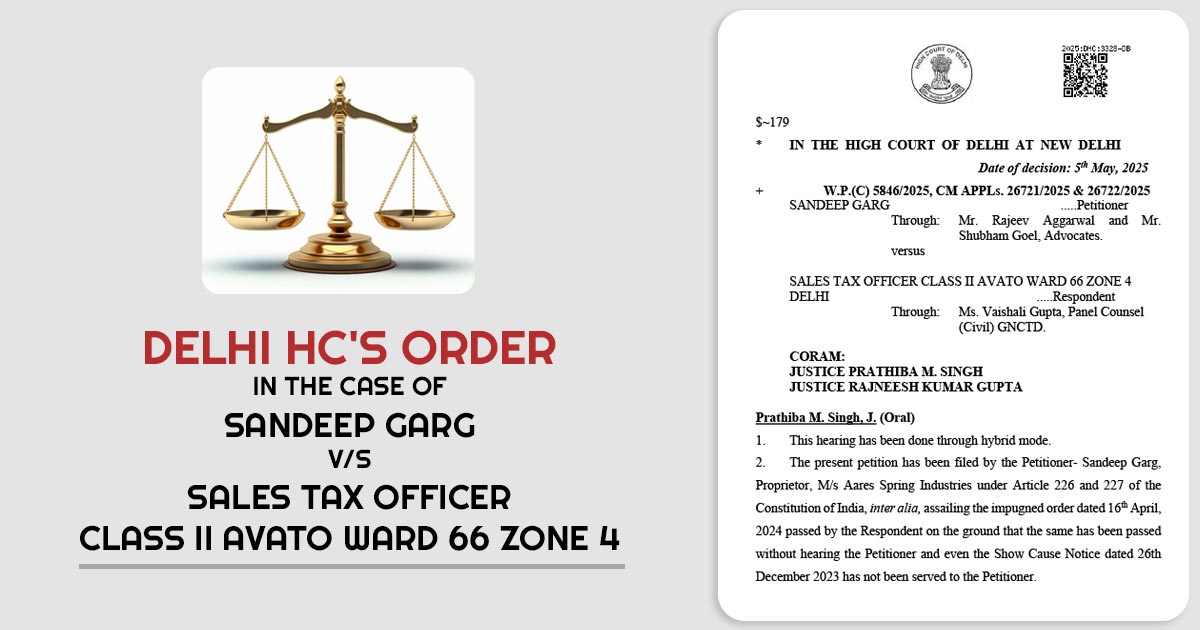

| Case Title | Sandeep Garg vs. Sales Tax Officer Class II Avato Ward 66 Zone 4 |

| Case No.: | W.P.(C) 5846/2025, CM APPLs. 26721/2025 & 26722/2025 |

| For The Petitioner | Mr. Rajeev Aggarwal and Mr. Shubham Goel |

| For The Respondents | Ms. Vaishali Gupta |

| Delhi High Court | Read Order |