No new grounds can be introduced at the appellate stage without prior tax notice in the show cause proceedings, the Allahabad High Court ruled, while restoring the applicant’s GST registration.

Under two separate GST registrations, the applicant, UPS SCS India, which is in freight forwarding and logistics services, has furnished a writ petition contesting the cancellation of its registration by the assistant commissioner.

On allegations of infringement u/s 25(2) of the UP GST Act, the cancellation is been laid and thereafter in the process of appeal, the appellate authority introduced a new reason asserting that the applicant’s two business verticals cannot be bifurcated as of securing the same HSN/SAC codes.

Read Also: Retrospective GST Registration Cancellation Invalid Without Clear Show Cause Notice

SCN was vague, does not have allegations, and doesn’t furnish a chance for a personal hearing mandated under law, applicant’s counsel claimed. Also, the applicant, the appellate authority, has dismissed the plea instead of addressing such problems on the new grounds that did not come under the original notice.

The counsel of the department counters cancellation, the applicant was furnishing services under the same HSN/SAC code, and does not explain that it has two separate registrations.

Under Rule 22(1) of the GST Rules requirements, SCN (Show Cause Notice) is not able to fulfil the legal needs since it does not fix a date for hearing and does not give charges or evidence against the petitioner, a single-judge bench comprising Justice Piyush Agrawal observed.

It is a breach of principles of natural justice that introduces new backdrops at the appellate stage, without informing the petitioner of such grounds earlier, the court ruled. The cancellation order has been quashed by the court and asked the GST authorities to restore the registration of the petitioner. The writ petition was permitted.

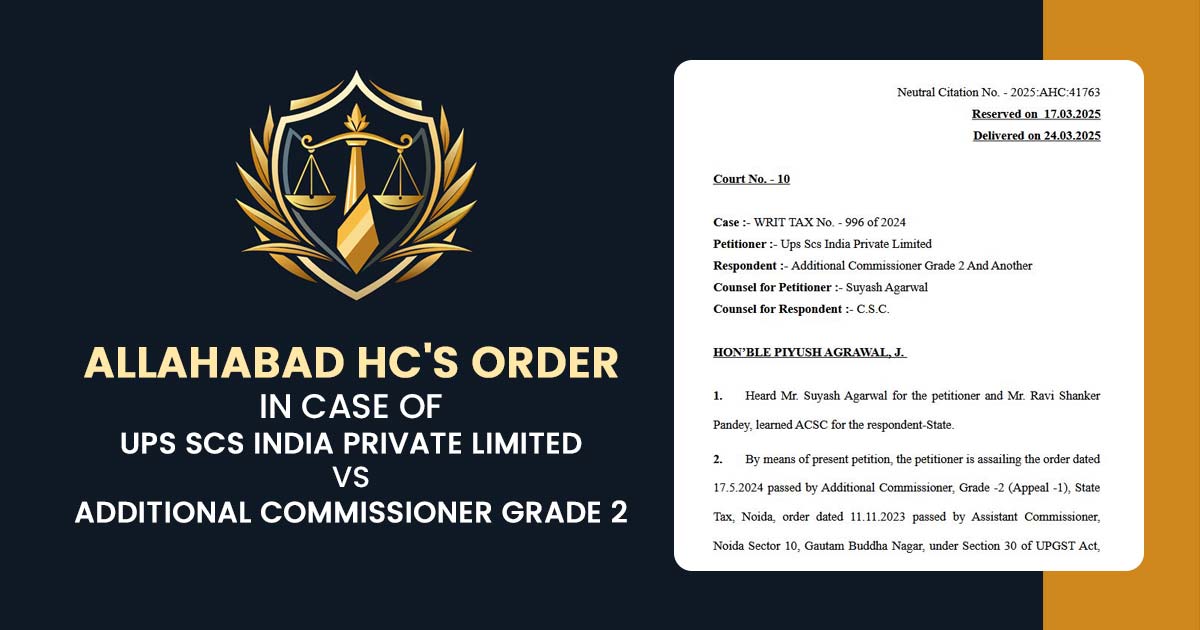

| Case Title | UPS SCS India Private Limited vs. Additional Commissioner Grade 2 |

| Case No. | WRIT TAX No. – 996 of 2024 |

| Counsel For Petitioner | Suyash Agarwal |

| Counsel For Respondent | C.S.C. |

| Allahabad High Court | Read Order |