Contractors are required to file GST at the prevailing rate on the due date for submitting tenders, rather than when the work is allocated. This is outlined in Special Condition No. 49 of the contract agreement, as stated by the Jammu and Kashmir High Court.

According to section 13 of the CGST Act, the applicant submitted the review that the tax filing obligation toward the services emerged at the time of the supply of the work, and therefore, provisions of the contract were in defiance of section 13 of the Act.

It was noted by a bench of Justices Sanjeev Kumar, Justice Puneet Gupta that the review petitioner being a contracting party was obligated under the contractual terms which directed that tax rates as prevailing on the last deadline for receipt of tenders shall be applicable and in the challenge absence to aforesaid provision at any time the claim presented were not sustainable.

There was an 18% GST on the last day for receipt of tender, and a suggestion of the GST counsel for cutting the rate to 12% was carried into effect under a notification post date of receipt of tenders, and was not within the petitioners’ applicability, the court cited.

Despite the GST council’s suggestion, there was an 18% applicable GST rate, till 21 September 2017, it was not reported on which date the bidding submission was completed before.

Court, it does not appear to learn that how the GST incidence or how the change in tax rates concerning the supply of goods and services shall impact the levying of GST is of any assistance to the review applicant.

As per the petitioner, the contract that the review petitioner performed was controlled via SRO-GST-2 whereby the composite supply of works contract was made exigible to GST at the rate of 12%. It is thus unexplained that the differential tax recovery was grounded on 18%.

The court answering submission, GST rates amendment in the above SRO-GST were merely concerned with the particular composite supply of works contracts, which were the works contracts for the construction or installation of cited items such as a historical monument, canal, pipeline conduit, etc

The court, no error was there, no new facts, and no enough reason to reopen or modify the ruling asked to be reviewed.

The Case

For a works contract petitioner, sole proprietor of M/s Kiran Constructions, submitted tenders after the GST Council’s proposal to lessen GST from 18% to 12%, but before the formal notification on 21 September 2017.

1 August 2017 was the tender submissions deadline when GST was still 18% under SRO-GST-11 dated 8 July 2017.

A notice on 6 April 2021 is been obtained from the petitioner for depositing the differential tax amount, computed at the earlier 18% rate, post contract allotting and work started after 12% notification.

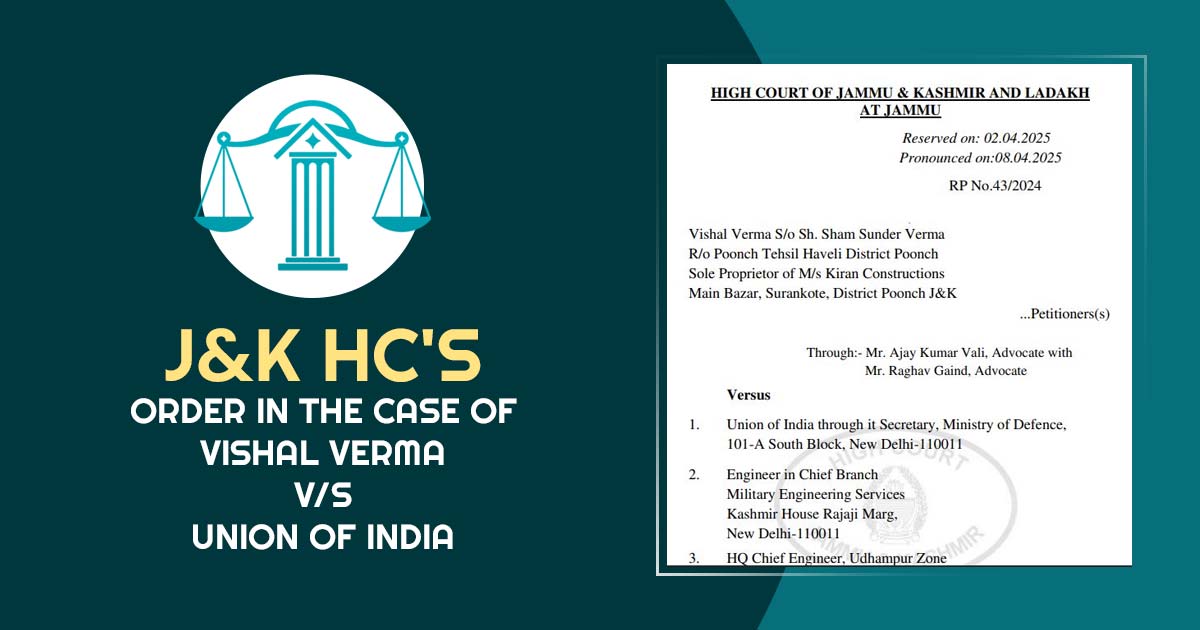

| Case Title | Vishal Verma vs. Union of India |

| Case No. | RP No.43/2024 |

| Counsel For Petitioner | Mr Ajay Kumar Vali, Mr Raghav Gaind |

| Counsel For Respondent | Mr. Vishal Sharma |

| J&K High Court | Read Order |