In a recent ruling, the Uttarakhand High Court expressed serious concerns over the GST department’s action of negatively blocking the input tax credit (ITC) without issuing a prior notice, questioning the legal authority for such coercive measures.

“The working of the Department is startling and shocking. It is not known and incomprehensible as to which provision of law permits the Department to take deterrent and coercive action, even prior to issuance of pre-intimation notice,” stated the Division Bench of Chief Justice G. Narendar and Justice Alok Mahra.

The matter revolves around Rule 86A of the GST Rules, 2017, which empowers tax officers to block ITC if there is evidence that the credit was fraudulently claimed. The petitioner, Kotdwar Steel Limited, a company engaged in the manufacturing of copper ingots and products related to iron and steel, came under scrutiny when the GST authorities issued a DRC-01A.

The notice alleged that the company availed ITC for inward supplies received from a fictitious supplier during the period April 2024 to June 2024, amounting to Rs. 9,27,80,115—without any actual movement of goods.

Read Also: Karnataka HC Rejects ITC Blocking Under GST Rule 86A Due to Lack of Independent Justification

Simultaneously, a negative block equivalent to the same amount was imposed on the assessee’s Electronic Credit Ledger (ECL) via the GSTN portal. The justification cited for this action was: “Supplier Found non-functioning and Credit claimed without receipt of goods/services.”

However, the petitioner contested this move, arguing that Rule 86A does not allow the department to block ITC that is not already available in the Electronic Credit Ledger (ECL). The assessee emphasized that the rule only permits restriction of credit already existing in the taxpayer’s ledger and does not authorize any negative credit balance, i.e., debiting amounts when no credit exists.

The High Court took a firm stance, stating that such actions by the department are “deplorable” and contrary to the foundational goals of the GST regime, which is designed to promote tax compliance rather than dismantle businesses. The bench noted that the intent behind GST laws is to ensure efficient tax administration, not to force business closures or undermine livelihoods.

Taking note of these arguments, the Uttarakhand High Court scheduled the matter for further hearing on April 29, 2025.

“We hope that the Department would bear this in mind. The growth of businesses and sustenance of businesses is vital for employment generation and growth of the Nation. If the Department can bear this in mind and act in consonance with the stated objectives of the Act, it would be rendering yeomen service to the business community. Such actions reflect a mindset, which we do not wish to name here,” stated the bench.

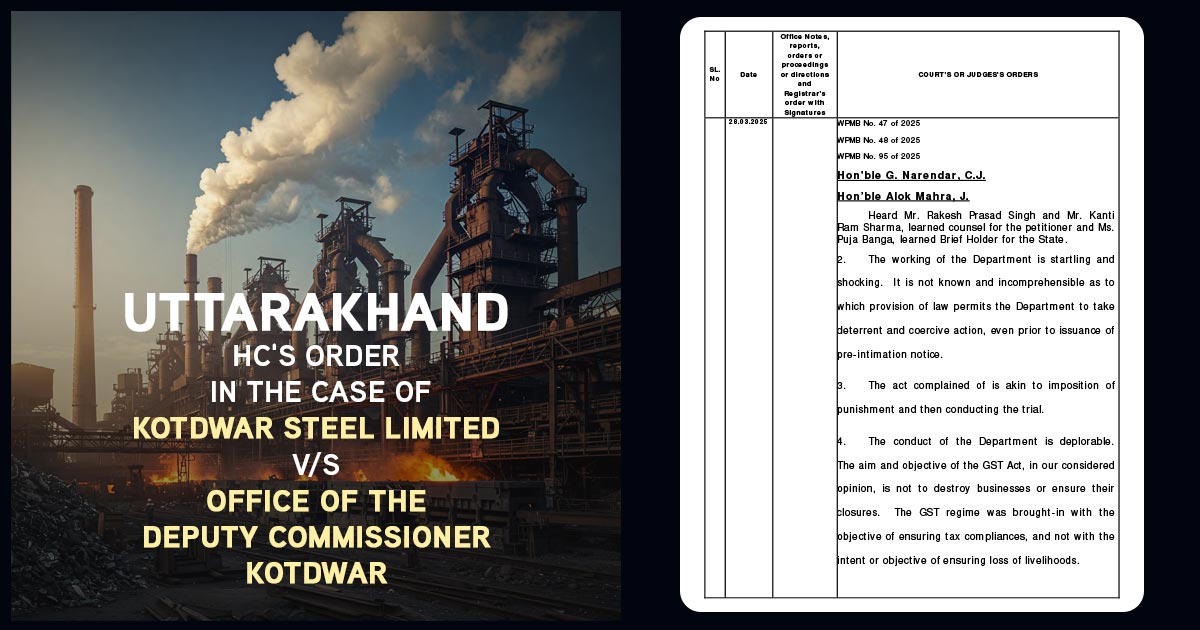

| Case Title | Kotdwar Steel Limited vs. Office of the Deputy Commissioner Kotdwar |

| Citation | WPMB No. 47 of 2025 |

| Date | 28.03.2025 |

| Counsel for the Petitioner | Rakesh Prasad Singh and Kanti Ram Sharma |

| Counsel for the Respondent | Puja Banga |

| Uttarakhand High Court | Read Order |