The case of Rakesh Saxena vs. PCIT before the ITAT Ahmedabad concerns a dispute over the tax treatment of Voluntary Retirement Scheme (VRS) benefits received by the taxpayer, a former employee of GE Power India Ltd.

The Principal Commissioner of Income Tax (PCIT) has initiated revision proceedings u/s 263 of the Income Tax Act, 1961 contesting the decision of the Assessing Officer’s (AO) to grant an exemption of ₹15,00,000 paid as an annuity to LIC.

It was claimed by PCIT that the same amount was counted under the taxable salary u/s 17(1) of the Act and that the failure of AO to disallow the exemption directed the assessment order to be incorrect and prejudicial to revenue.

It was observed by the Ahmedabad ITAT that similar revision proceedings for other GE Power employees have been kept in the earlier rulings and discovered that the Assessing Officer had not appropriately validated the claims before granting the exemption.

At the time of proceedings the taxpayer losses to appear even after various hearings, and no influential proof was given to oppose the claims of the PCIT. The Tribunal referred to a past Supreme Court judgement that treated annuity payments made by an employer on behalf of employees as part of taxable salary.

Read Also: All Details About 5 Non-taxable Income As Per CBDT Dept

It concluded that the AO did not perform an appropriate inquiry directing a wrong application of tax exemptions. ITAT, based on these findings, dismissed the appeal of the taxpayer, verifying the revision order of PCIT. The same rulings support the principle that employer-paid annuities under VRS schemes are taxable and stress the significance of thorough verification via assessing officers.

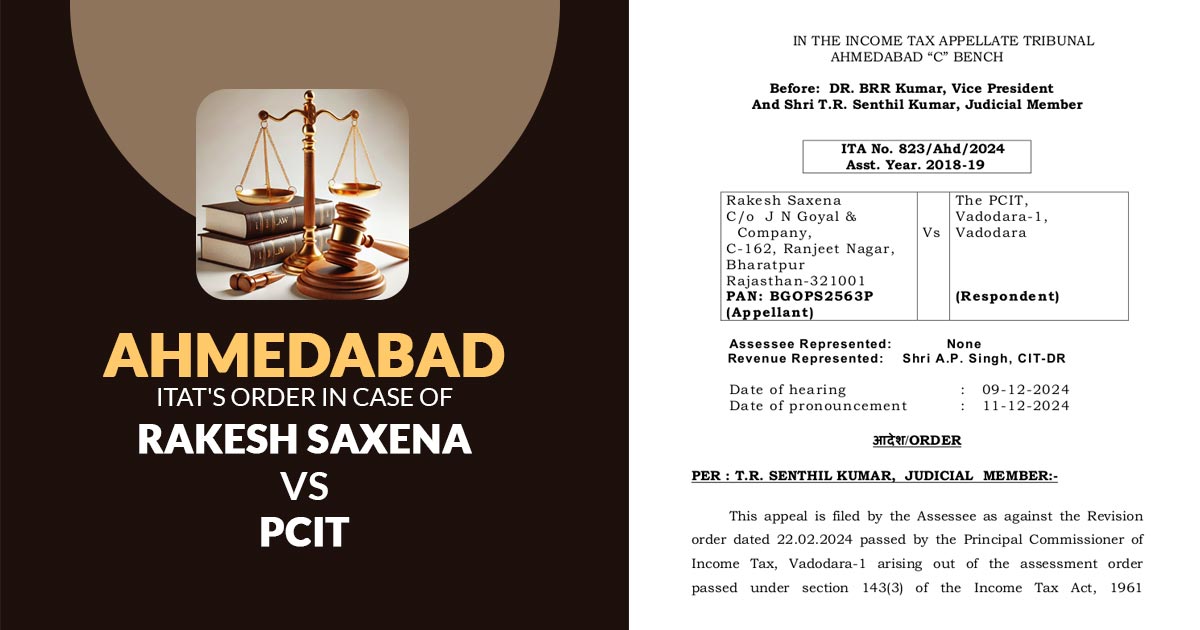

| Case Title | Rakesh Saxena Vs PCIT |

| Citation | ITA No. 823/Ahd/2024 |

| Date | 11.12.2024 |

| Counsel For Appellant | None |

| Counsel For Respondent | Shri A.P. Singh, CI T-DR |

| Ahmedabad ITAT | Read Order |