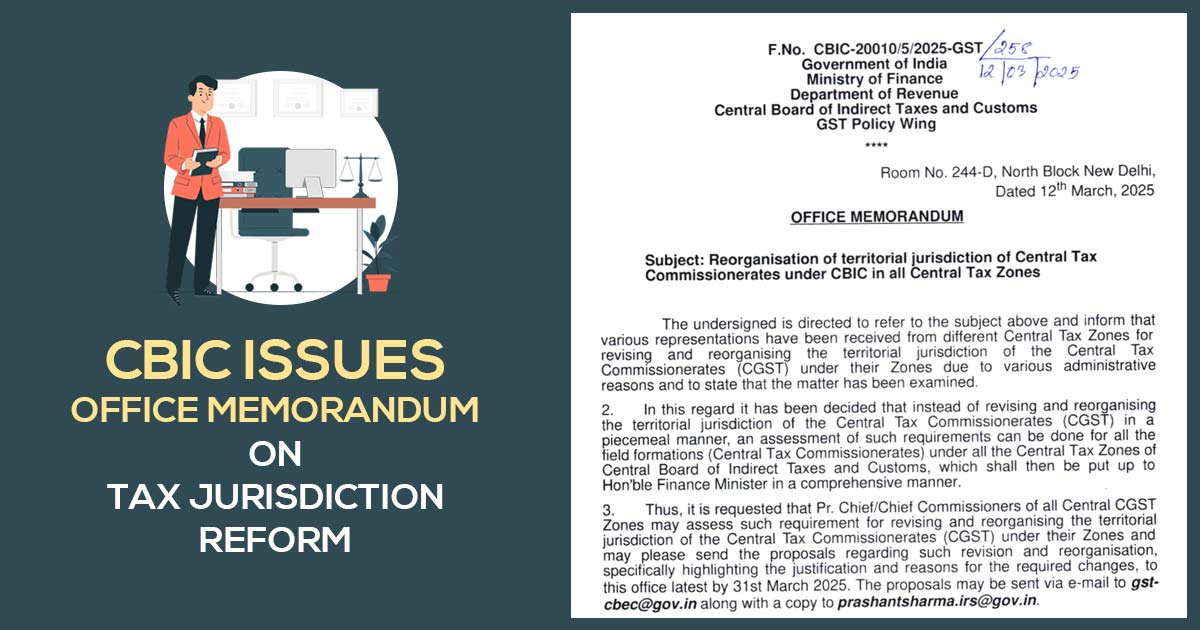

Office Memorandum vide F.No. CBIC-20010/5/2025-GST/258, dated March 12, 2025, has been issued by the CBIC for the reorganisation of the territorial jurisdiction of Central Tax Commissionerates under CBIC in all Central Tax Zones.

Several representations have been obtained from distinct zones for additional reorganization for administrative reasons. A comprehensive assessment will be performed for all formations and presented to the Finance Minister rather than the piecemeal amendments.

It has been requested that chief commissioners of all central CGST zones send the proposals for the revision and reorganization, citing justifications, to gst_cbec@gov.in and prashantsharma.irs@gov.in by March 31, 2025.

The undersigned is asked to direct to the subject mentioned above and notify that distinct representations have been obtained from distinct central tax zones for additional reorganising the territorial jurisdiction of the Central Tax Commissionerates (CGST) under their Zones as of various administrative reasons and to cite that the case has been analyzed.

Concerning the same it has been determined that rather than revising and reorganising the territorial jurisdiction of the Central Tax Commissionerates (CGST) in a piecemeal manner an assessment of these needs could be accomplished for all the formations (Central Tax Commissionerates) under all the Central Tax Zones of Central Board of Indirect Taxes and Customs, which then be put up to the Hon’ble Finance Minister in a comprehensive way.

Therefore, it is asked that Pr. Chief/Chief Commissioners of all central CGST Zones might compute these needs for revising and reorganising the territorial jurisdiction of the Central Tax Commissionerates (CGST) under their Zones and may please send the proposals for these revision and reorganisation citing the justification and reasons for the needed amendment to the same office by 31st March 2025, via e-mail to gst-cbec@gov.in. The proposals may be sent, including a copy to prashantsharma.irs@gov.in.