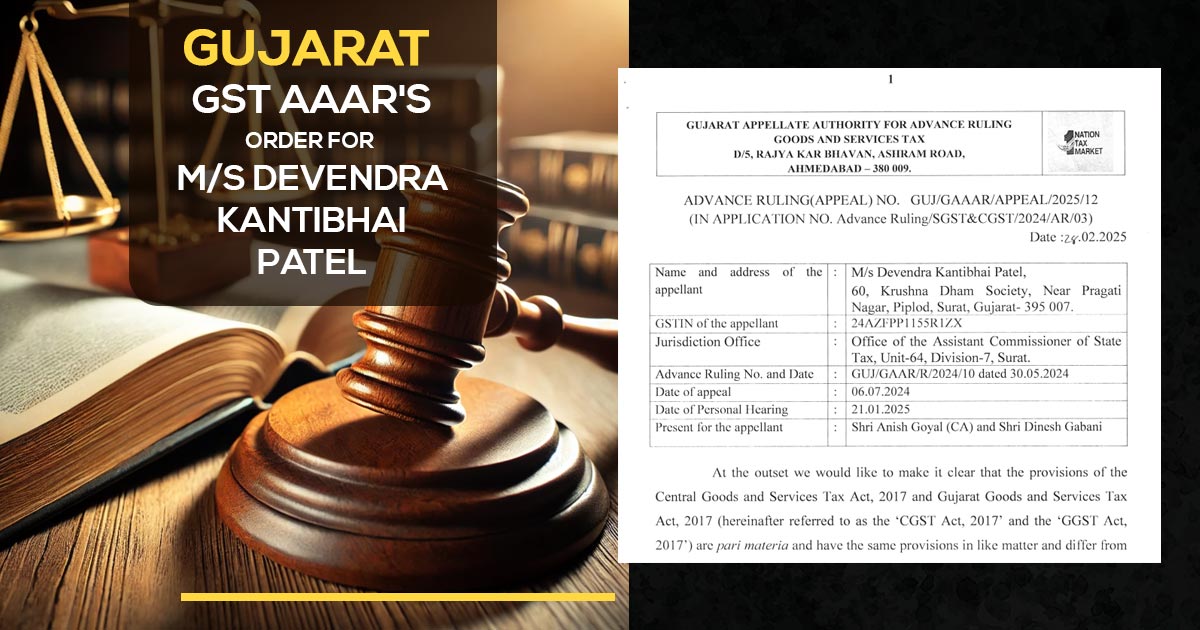

The Gujarat Appellate Authority for Advance Ruling (AAAR) has overturned a prior ruling on Devendra Kantibhai Patel’s GST obligations for consultancy services provided to the Roads and Buildings (R&B) Department of the Gujarat government.

The original Advance Ruling (GAAR) had refused the claim of Patel for exemption under Notification No. 12/2017-CT (R), which exempts pure services of the functions entrusted to Panchayats (Article 243G) and Municipalities (Article 243W) of the Constitution of India.

Read Also: A Complete Guide On Job Work Under GST India

Patel is in a furnishing works contract services (WCS) and engineering consultancy, specifically preparing and providing plans, estimates, and Draft Tender Plans (DTP) for building works, claimed that such services come beneath the operations specified in the 11th and 12th schedules of the Constitution, hence qualified for exemption.

GAAR held against the same, quoting the absence of particular building information furnished by Patel at the time of the initial application. The GAAR provides the reason that without comprehending the nature and purpose of the buildings, it cannot decide if the services are pertinent to the Panchayat or the Municipality functions.

Patel at the time of the plea furnished a list of projects for which the consultancy services were furnished, a significant information missing from the original application. The same new data stirred the AAAR to acknowledge that the ruling of GAAR was incurred without acknowledging significant facts.

It was outlined by AAAR that u/s 101(1) of the CGST Act, 2017, it has the authority to authorize or modify rulings. However provided the new details and the need for its verification, the AAAR considered it precise to remand the case back to the GAAR for a fresh decision.

The AAAR drew parallels with precedents from the Central Excise Act, of 1944, and the Finance Act, of 1994, along with the rulings from other AAARs, to explain remanding the case. The decision outlines the significance of considering all pertinent facts and furnishing the appellant with an adequate chance for a hearing.

| Applicant Name | M/s Devendra Kantibhai Patel |

| GSTIN of the applicant | 24AZFPP1155R17ZX |

| Date | 21.01.2025 |

| Applicant | Shri Anish Goyal (CA) and Shri Dinesh Gabani |

| Gujarat GST AAR | Read Order |