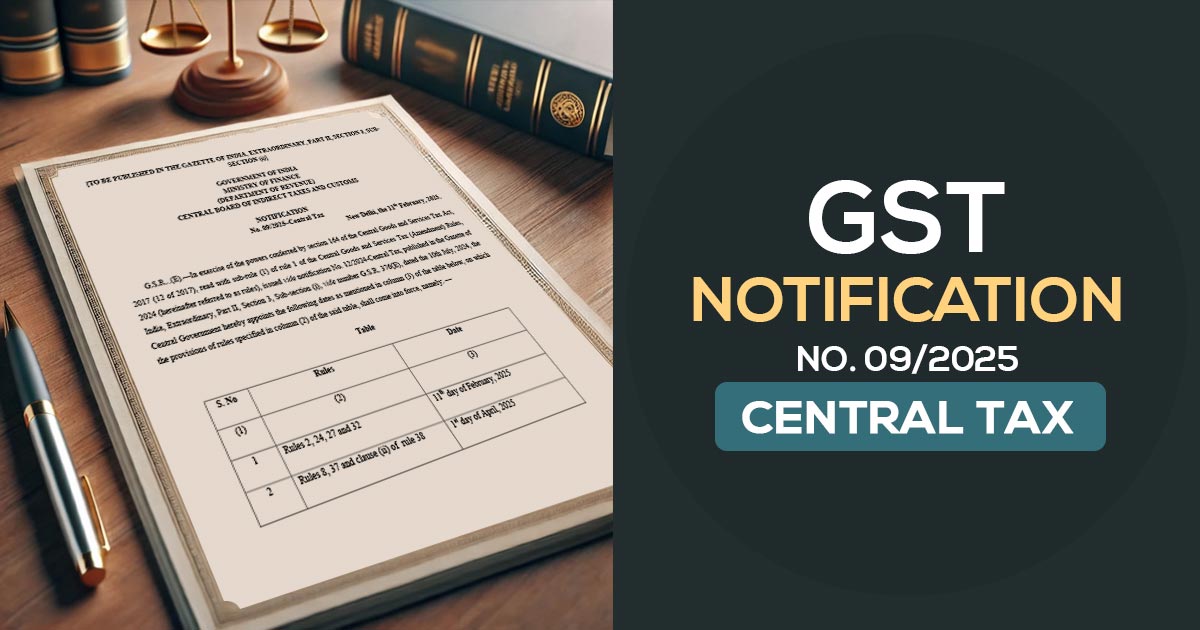

The Ministry of Finance, via the Central Board of Indirect Taxes and Customs ( CBIC ), has issued Central Tax notification No. 09/2025 (G.S.R. 129(E)) on February 11, 2025, under the authority granted by Section 164 of the Central Goods and Services Tax ( CGST ) Act, 2017.

This notification mentions the enforcement dates for specific provisions of the Central Goods and Services Tax (Amendment) Rules, 2024.

The below-mentioned implementation schedule has been set under the notification-

- From February 11, 2025 Rules 2, 24, 27, and 32 will come into force-

- From April 1, 2025 Rules 8, 37, and Clause (ii) of Rule 38 will be legislated.

This notification pursues the earlier issued Notification No. 12/2024-Central Tax, which was published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) on July 10, 2024, under G.S.R. 376(E).

Issued under F. No. CBIC-20006/21/2024-GST, the notification, signed by Raushan Kumar, Under Secretary, is anticipated to impact GST compliance and procedural modifications for businesses and taxpayers.

Notification Extract

G.S.R. 129(E).—In exercise of the powers conferred by section 164 of the Central Goods and Services Tax Act, 2017 (12 of 2017), read with sub-rule (1) of rule 1 of the Central Goods and Services Tax (Amendment) Rules, 2024 (hereinafter referred to as “rules”), issued vide notification No. 12/2024-Central Tax, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R. 376(E), dated the 10th July, 2024, the Central Government hereby appoints the following dates as mentioned in column (3) of the table below, on which the provisions of rules specified in column (2) of the said table shall come into force, namely:

| S. No. | CGST Rules | Date |

|---|---|---|

| 1 | Rules 2, 24, 27, and 32 | 11th February, 2025 |

| 2 | 2 Rules 8, 37, and Clause (ii) of Rule 38 | 1st April, 2025 |