The Income Tax Appellate Tribunal (ITAT) Chennai Bench has held in favor of Laxmi Nanda Kishore, setting aside the Rs.12.14 lakh addition incurred u/s 69 of the Income Tax Act, 1961.

It was discovered by the tribunal that the assessing officer had incorrectly categorized seized gold and silver jewellery as an unexplained investment, overlooking CBDT Instruction No. 1916 (dated 11.05.1994), which permits certain quantities of jewellery to be considered as defined.

Laxmi Nanda Kishore,appellant-assessee a Chartered Accountant and General Manager of Finance & Accounts at Varficus Ventures Pvt. Ltd was exposed to an income tax search dated November 27, 2020.

The authorities in the search have seized 299.7 grams of gold and 3,108 grams of silver jewellery, asserting that the same was an unexplained investment. The AO rejected the explanation of the taxpayer and added Rs 2.14 lakh to the total taxable income u/s 69.

The appellant dissatisfied with this has furnished a plea to the commissioner of income tax (Appeals) [CIT(A)], who permitted the claim partially considering 50% of the jewelry as defined and sustaining Rs.6.07 lakh as an unexplained investment. The appellant aggrieved with the partial relief has approached the ITAT Chennai.

The financial background of the appellant has been analyzed via ITAT and submitted the supporting documents. Kishore has furnished the purchase invoices for 276.945 grams of gold jewellery, which he had acquired between Assessment Years 2015-16 and 2021-22.

It was observed by the tribunal that CBDT Instruction No. 1916 allows 500 grams of jewellery for a married woman, 250 grams for an unmarried woman, and 100 grams for a male family member to be considered as explained without additional proof.

It was discovered by the tribunal that the assessing officer was unable to apply these CBDT norms while computing the seized jewellery.

AO has incorrectly comprised the already shown 276.945 grams of jewellery as additional unexplained assets which inflated the total taxable amount. It was too observed by the Chennai ITAT that the appellant has furnished the true purchases bills and ITRs, which demonstrate that he has enough income to explain the jewellery ownership.

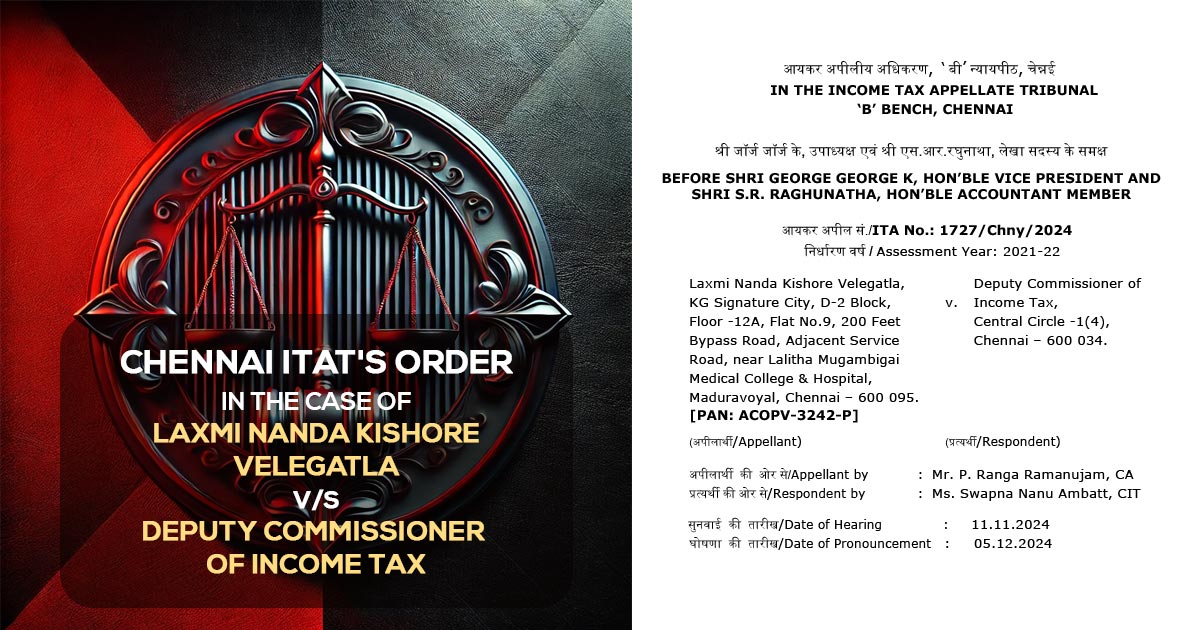

A two-member bench comprising George George K (Vice-President) and S R Raghunatha (AccountantMember) held that the Rs.12.14 lakh addition was unexplained and deleted it in full.

| Case Title | Laxmi Nanda Kishore Velegatla vs Deputy Commissioner of Income Tax |

| Citation | ITA No.: 1727/Chny/2024 |

| Date | 05.12.2024 |

| Appellant by | Mr. P. Ranga Ramanujam |

| Respondent by | Ms. Swapna Nanu Ambatt |

| Chennai ITAT | Read Order |