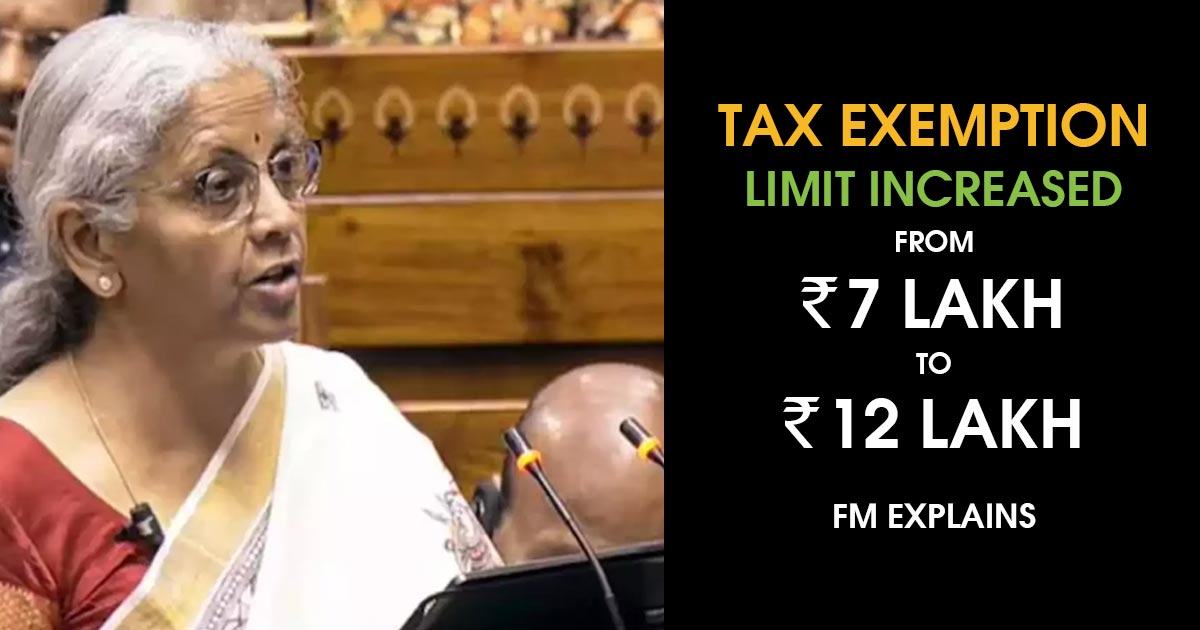

Union Finance Minister Nirmala Sitharaman, to decrease the tax load on people earning Rs 1 lakh per month the government has surged the income tax exemption from ₹7 lakh to ₹12 lakh.

FM also mentioned that the government was reducing the income tax slab rates and broadening the tax brackets to provide relief to taxpayers across all income phases.

The finance minister in a media interaction sought to elaborate on the reason behind raising the exemption of income tax from Rs 7 lakh to Rs 12 lakh and whether the same proceed was pushed via slower than expected growth in income and salaries.

“The government feels that if someone earns Rs1 lakh per month on average, she should not have to pay tax. We are achieving this in two ways: first, by reducing slab rates to create a more uniform, gradually progressive structure; and second, by expanding the tax slabs to provide relief across income groups,” FM Nirmala Sitharaman cited.

She mentioned that the government has wished to furnish additional advantages beyond slab rate reductions by introducing another tax rebate for certain taxpayers, citing that the objective is for the money saved by the taxpayers to flow back into the economy via consumption, savings, or investment.

“We decided that some people should receive extra benefits beyond mere slab rate reductions. Hence, an extra rebate was introduced. Slab rate reductions apply to everyone and the extra rebate for some. The expectation is that the money saved by taxpayers will flow back into the economy through consumption, savings, or investment,” the finance minister mentioned.

She said that the government has proposed extra advantages beyond slab rate reductions by introducing an additional rebate for some taxpayers, unlike the Congress-era tax system.

Read Also: CBDT Chief Seeks Industry Suggestions on the New Income Tax Bill

“If you compare what we have done today with what prevailed in 2014 under the Congress government, the narrative has always been about putting money back into the hands of the people. Compared to the 2014 tax rates under the Congress, someone earning ₹8 lakh now has nearly ₹1 lakh more in their pocket. In 2014, the tax on them was ₹1 lakh; now, it is zero. Moreover, someone earning ₹12 lakh had to pay ₹2 lakh in 2014; now, it is zero. That means ₹2 lakh more in their pockets,” Nirmala Sitharaman cited.

FM mentioned that the government is lessening rates for everyone, which means that an individual making Rs 24 lakh who paid ₹5.6 lahks in taxes in 2014 now pays ₹3 lahks, leaving ₹2.6 lahks more in their pocket.

The finance minister added “Moreover, rates for everyone are being brought down. As a result, someone earning ₹24 lakh, had to pay ₹5.6 lakh in 2014; now they only have to pay ₹3 lakh. That means ₹2.6 lakh more in their pocket. So, it’s not just those earning up to ₹12 lakh who benefit they are not paying any tax at all due to the rebate—but even those earning more will benefit.”

Itr file