As per the Ahmedabad Bench of the Income Tax Appellate Tribunal (ITAT), it said that Section 271B penalty of the Income Tax Act, 1961 is applicable merely when the accounts are not audited as mandated u/s 44AB not just for the late submission of the audit report.

The taxpayer Vardhabhai Jethabhai Patel, is an individual who is in contractual work and furnished an ITR for the Assessment year (AY) 2012-13, specifying a total income of Rs 3,57,350.

The assessment of the taxpayer has been reopened by the revenue department u/s 147 of the Income Tax Act established on information concerning gross contract receipts of Rs. 1,32,30,498, which surpassed the threshold for audit u/s 44AB of the Income Tax Act, 1961.

U/s 143(3) r.w.s. 147 the reassessment was finalized specifying a total income of Rs 13,23,50,000, with an addition of Rs. 9,65,700 as profit on contract receipts.

U/s 271B of the Income Tax Act, the Assessing Officer (AO) has levied a penalty of Rs 66,152 quoting the failure of the taxpayer to submit the audit report within the said time.

The taxpayer asserted that the accounts were audited dated September 30, 2012, within the said time and the audit report was submitted dated March 26, 2013, including an Income tax return. The delay was based on filing and not on performing the audit.

The Commissioner of Income Tax (Appeals) on appeal carried the penalty elaborating that the audit report was submitted post deadline for the ITR.

It was marked by the single-member bench including Suchitra Kamble (Judicial Member) that the taxpayer had complied with the auditing need u/s 44AB and submitted the audit report including with the ITR.

The tribunal said that as the requirement for auditing the accounts was fulfilled, even if the filing was delayed the penalty u/s 271B of the Income Tax Act was not justifiable. The penalty order was set aside by the tribunal and permitted the plea in the taxpayer’s favour.

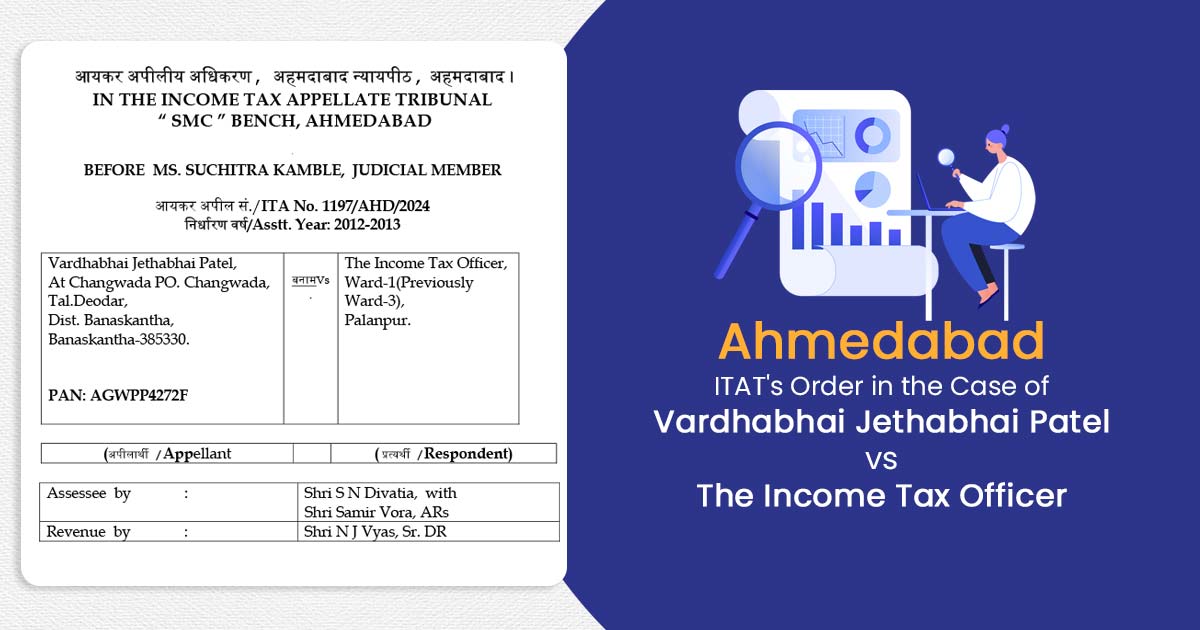

| Case Title | Vardhabhai Jethabhai Patel vs The Income Tax Officer |

| Citation | ITA No. 1197/AHD/2024 |

| Date | 09.12.2024 |

| Assessee by | Shri S N Divatia, Shri Samir Vora |

| Revenue by | Shri N J Vyas |

| Ahmedabad ITAT | Read Order |