The High Court of Kerala in a ruling carried that the income tax refund application u/s 119(2)(b) of the Income Tax Act, 1961 filed after 9 years is not condonable.

The income tax department has furnished the plea against the ruling of the Single Judge. The respondent/writ petitioner, K.C.Antony had approached the writ court impugning an order that was passed via the Principal Commissioner, Income Tax rejecting the application furnished via the respondent u/s 119(2)(b) of the Income Tax Act, 1961 (‘the Act’).

In the cited application filed in 2020, the respondent has asked to invoke the discretionary authority of the Principal Commissioner of Income Tax under Section 119(2)(b) of the Act towards the objective to condone a delay of 3 months that has been occasioned via him in furnishing a return for the AY 2010-2011 that shall have allowed him to claim for tax refund that was lying to his credit with the income tax department.

In the order, the Principal Commissioner has laid on a report furnished via the jurisdictional assessing officer and discovered that the respondent/taxpayer has furnished the application u/s 119(2)(b) of the Act post 9 years.

He indeed discovered that in as much as the objective of filing the late return in 2012 was to avail of the tax refund, even if that three-month delay was condoned, the specified duration via the Central Board of Direct Taxes (C.B.D.T.) Circular No.9/2015 for condoning a delay concerning the application asking to claim of refund being 6 years from the finish of the pertinent assessment year, the application asserted via the respondent/assessee cannot be entertained. The application placed in via the respondent/taxpayer u/s 119(2)(b) of the Act was rejected subsequently.

The single judge opined that the appellants in this had misdirected themselves in regulation keeping that the application of the applicant for condonation of delay was furnished after the duration cited in the board circular directed aforesaid.

Read Also: Easy to Claim & Check Status of Income Tax Refund Online

As per the Judge, the delay the condonation of which was cited u/s 119(2)(b) of the Act, was the delay in furnishing the return, namely, the delay of 3 months in the quick matter and can not be viewed as a reference to the delay of nearly 9 years in preferring the application u/s 119(2)(b) of the Act.

Consequently, by quashing the order the writ petition was permitted, restoring the application, and referring the appellant to regard the case afresh and decide on the aspect as to whether the late 3 months in preferring the return in 2012 can be condoned. The appellants were asked to pay the interest if the refund on being sanctioned was not paid within 6 months from the taxpayer date being discovered qualified for it.

The applicant claimed that the Single Judge was wrong in making an assumption that the Principal Commissioner of Income Tax did not have the authority to reject a belated application furnished u/s 119(2)(b) of the Act.

Recommended: Kerala HC: If an Assessee Fails to Submit a Sales Report for Tax Evasion, Section 74 Must Be Applied

It was cited that the application directed to a case in which a belated return that has been furnished via the taxpayer with a delay of three months, has not been acted on via the department, the preferred application was nearly 8 years after the finish of the assessment year.

It claimed that read with the Board Circular No.9/2015 in which the board has opted to restrict the acknowledgement of these applications, inter alia for the refund merely when they were furnished in 6 years from the finish of the related assessment year, the Principal Commissioner’s measure in rejecting an application u/s 119(2)(b) of the Act that was selected after 8 years could not have been faulted.

While it is the Sri. Anish Jose Antony submission, who is the counsel for the respondent/taxpayer that the impugned ruling of the single judge does not ask for any interruption as the judge has appreciated the legal provisions carrying that the application directed to u/s 119(2)(b) of the Act is the refund application which in turn is a reference to the late-filed income tax return.

As per the bench, the use of the word application u/s 119(2)(b) of the Act is required to be a reference to the application involving the discretionary jurisdiction of the Principal Commissioner, who has been empowered u/s 119(2)(b) of the Act. It is in the term that the word application is being used so that was impugned via the respondent/taxpayer in the writ petition.

The reference with the 9-year duration shows that the word application used in the impugned order was a reference to the filed application u/s 119(2)(b) of the Act and not the belated return that was furnished in 2012.

If that is the matter then the court could not discover fault with the order of the Principal Commissioner which mentions that the Principal Commissioner has not regarded it knowledgeable or suitable to practice the discretion based on the instant matter.

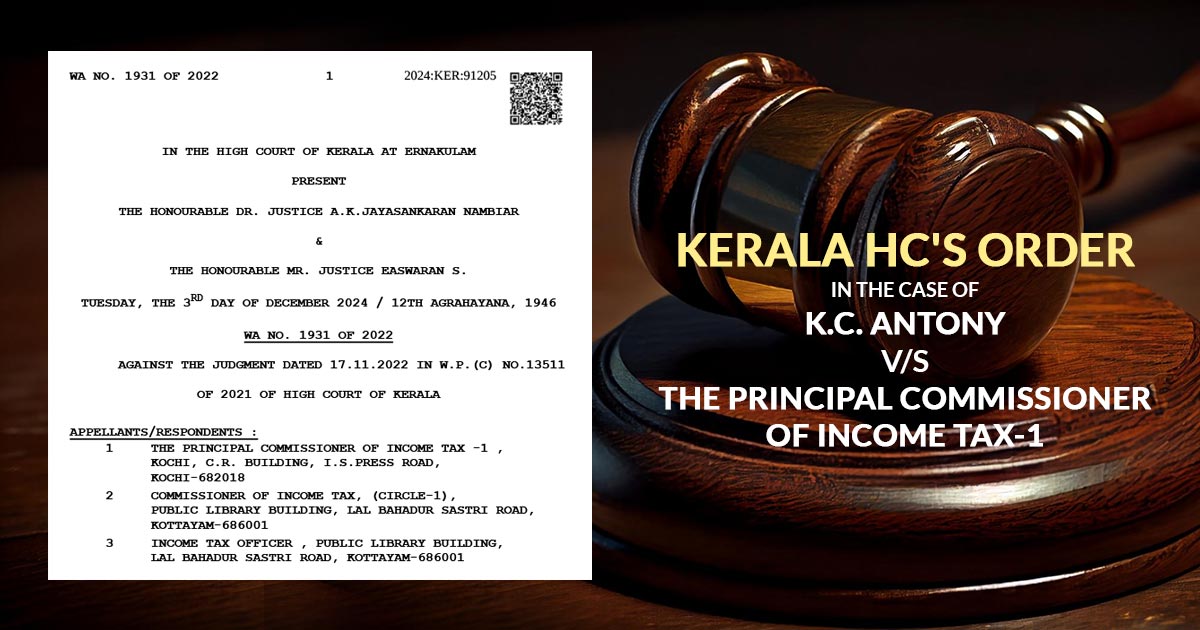

A division bench of Dr. Justice A.K.Jayasankaran Nambiar & The Honourable Mr. Justice Easwaran S carried that “The view taken by the Principal Commissioner cannot be said to be unreasonable when viewed against the statutory framework, where, an assessee seeking condonation of a three month delay that occurred in 2012, had chosen to approach the Principal Commissioner for a condonation of that delay only after eight years.” the bench while permitting the petition set aside the impugned ruling of the Single Judge.

| Case Title | K.C. Antony vs. The Principal Commissioner of Income Tax-1 |

| Citation | WA NO. 1931 OF 2022 |

| Date | 03.12.2024 |

| For the Appellant | Christopher Abraham |

| For the Respondent | Anish Jose Antony |

| Kerala High Court | Read Order |