It was carried by the Allahabad High Court that the taxpayer could not file for the supply of requisite documents post adjudicating body accepted the appeal placed via them and furnished the notice as per that.

The same would be impermissible, certainly in a case where a statutory appeal was available to the filing party, The bench of Chief Justice Arun Bhansali and Justice Vikas Budhwar said.

Case Background

A Show Cause Notice was furnished before the applicant in which he was notified of the discrepancies in his tax return. The applicant answered citing that the discrepancies specifying were lesser compared to the amount computed in the notice and furnished the requisite documents.

Discovering that the response provided by the applicant was not clear, the notice u/s 73(1) of the Central Goods and Services Tax Act, 2017 was issued to the petitioner. The applicant in his response repeated his previous reasoning concerning the wrong computation of the discrepancies and attached documents of evidence with it. But the authorities on 27.08.2024 passed an order, partly accepting the appeal of the applicant and raising a demand of Rs 7.4 Lakhs to be paid by him.

Dissatisfying he furnished the existing writ petition.

It was claimed by the applicant that the notice was poor in law since it was performed without attaching the needed documents. It was furnished that the SCN must be set aside since the impugned order was passed on a distinct date compared to the cited in the notice.

Opposite to that the respondent’s counsel claimed that once the problem has been discovered via the competent authority and a part of his plea has been accepted then the applicant has the chance of filing a plea against it and a writ petition is not carried.

High Court Order

As per the court, since the applicant did not ask for the requisite documents and furnished the response on the foundation of the documents that were with him, it can not be cited that the non-supply of the documents was the reason enough to set aside the impugned order.

As per the court “The submissions sought to be made by counsel for the petitioner regarding non-supply of documents cannot be countenanced in the circumstances of the present case wherein neither in response to the notice pointing out the discrepancies nor in response to the notice under Section 73(1), the petitioner sought supply of the documents and based on the material available with it, filed the response.”

The court maintained that there was no cause for the same to interrupt in a case where a part of the appeal has been accepted and the applicant has the chance to claim the legal plea.

Consequently, the writ petition was dismissed.

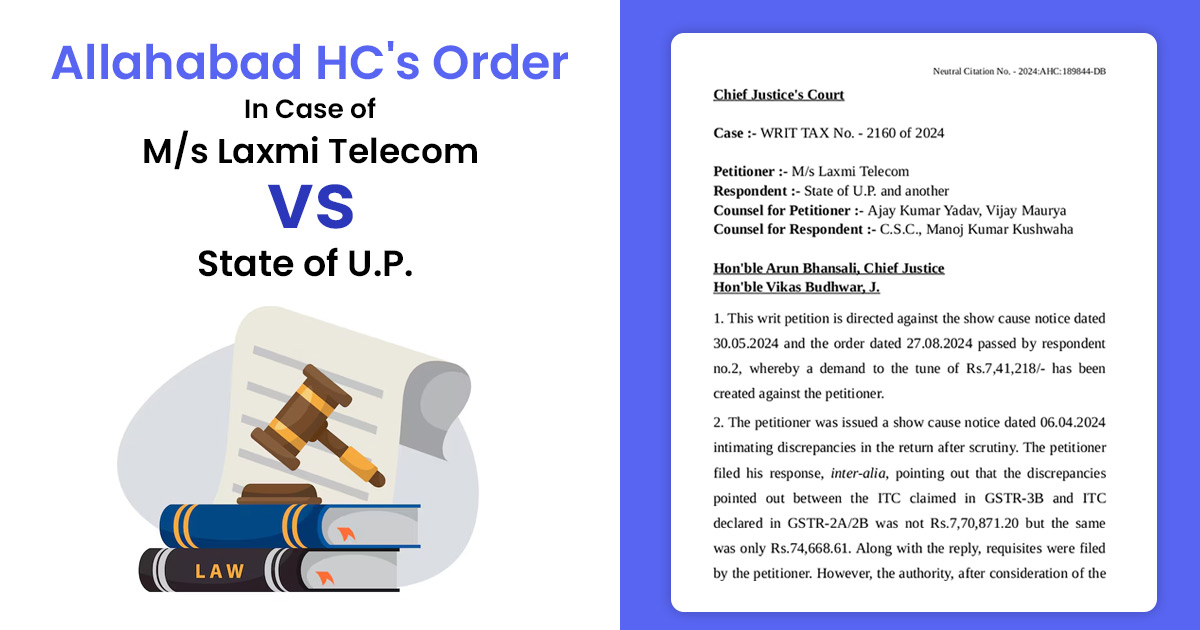

| Case Title | M/s Laxmi Telecom Vs. State of U.P. and Another |

| Citation | WRIT TAX No. – 2160 of 2024 |

| Date | 04.12.2024 |

| Counsel For Petitioner | Ajay Kumar Yadav, Vijay Maurya |

| Counsel For Respondent | C.S.C., Manoj Kumar Kushwaha |

| Allahabad High court | Read Order |