An advisory on the difference in the value of Table 8A & 8C of the GST Annual Returns FY 2023-24 has been issued by the Goods and Services Tax ( GSTN ).

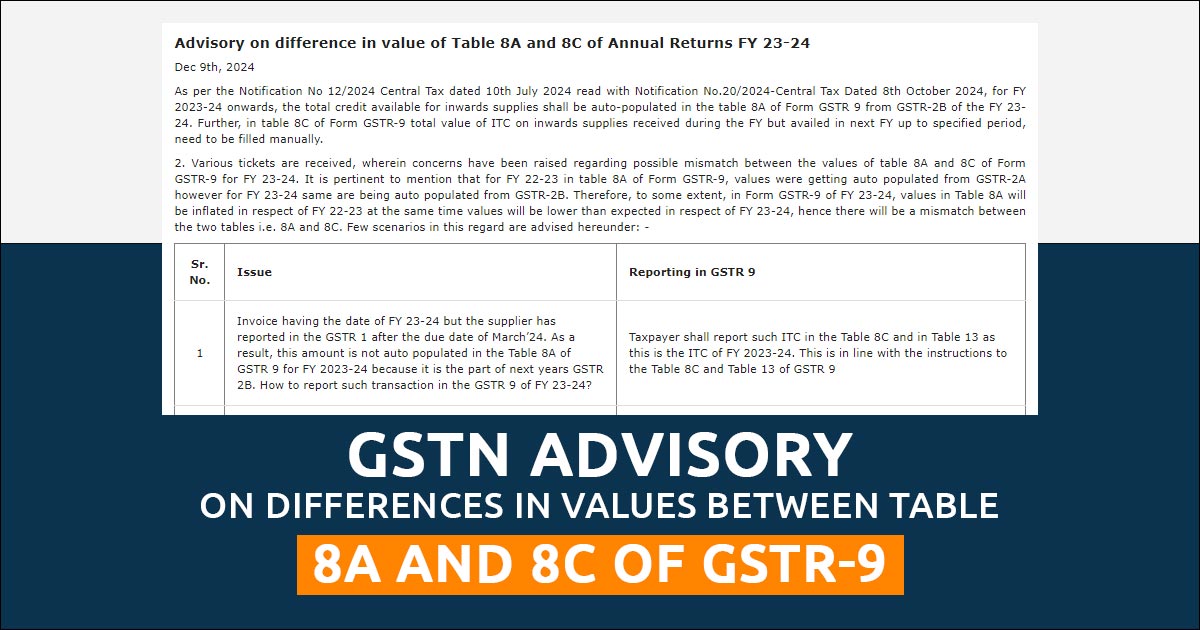

According to the Notification No. 12/2024-Central Tax dated July 10, 2024, and Notification No. 20/2024-Central Tax dated October 8, 2024, the process to report the input tax credit (ITC) in Form GSTR-9 for FY 2023-24 has undergone modifications.

The available total ITC for inward supplies is now auto-populated in Table 8A of Form GSTR-9 using data from GSTR-2B of the same financial year. Table 8C mandates the manual entry of ITC taken in the forthcoming FY for the inward supplies obtained in FY 2023-24 within the set cut-off date.

The concerns for the mismatches between the values in Table 8A and Table 8C have been raised by various assessees.

It is crucial to mark that unlike the former fiscal year (FY 2022-23), in which the values in Table 8A were auto-populated from GSTR-2A for FY 2023-24 then these values emerged from GSTR-2B.

Hence to some extent, in Form GSTR-9 of FY 23-24, values in Table 8A will be increased concerning FY 22-23 while values will be lower than anticipated concerning FY 23-24, therefore there will be a mismatch between the two tables i.e. 8A and 8C. A few scenarios for the same are advised hereunder: –

| Issue | Reporting in GSTR 9 |

|---|---|

| The invoice has the date of FY 23-24 but the supplier has reported in the GSTR 1 after the deadline of March 24. Consequently, this amount is not auto-populated in Table 8A of GSTR 9 for FY 2023-24 as it is part of next year’s GSTR 2B. What is the method to report such transactions in the GSTR 9 of FY 23-24? | The assessee will report these ITCs in Table 8C and Table 13 as this is the ITC of FY 2023-24. This is complied with the instructions in Table 8C and Table 13 of GSTR 9 |

| Invoice of FY 23-24 and ITC has been claimed in FY 23-24. As of the payment not being made to the supplier within 180 days, ITC was reversed in 23-24 under the second proviso to section 16(2) and this ITC is reclaimed in the subsequent Year FY 2024-25, after making the payment to supplier. What is the way to report such transactions in the GSTR 9 of FY 23-24? | It is the ITC of the previous year (2022-23) and was auto-populated in Table 8A of GSTR-9 of FY 22-23. Therefore, the aforementioned value need not be reported in Table 8C and Table 13 of GSTR-9 for FY 23-24. This is within instruction no 2A given for the notified form GSTR 9 which cites that Tables 4,5,6 and Table 7 must have the details of the current FY only |

| The invoice concerning FY 2023-24 but goods were not received in 23-24 thus ITC is claimed in Table 4A5 of GSTR 3B and reversed in Table 4B2 under the guidelines of Circular 170 and these ITC reclaimed in following FY 2024-25 till the prescribed period. What is the method to report these transactions in the GSTR 9 of FY 23-24? | Such reclaimed ITC in Table 8C and Table 13 shall be reported by the taxpayers as this is the ITC of FY 2023-24. |

| The invoice is for FY 22-23 which appears in Table 8A of GSTR 9 of FY 23-24, since the supplier shall have reported it in GSTR 1 after the deadline of filing of GSTR-1 for the tax period of March 23. What is the method to report such transactions in the GSTR 9 of FY 23-24? | It is the ITC of the previous year (2022-23) and was auto-populated in Table 8A of GSTR-9 of FY 22-23. Therefore, the aforementioned value need not be reported in Table 8C and Table 13 of GSTR-9 for FY 23-24. This is within instruction no 2A given for the notified form GSTR 9 which cites that Table 4,5,6 and Table 7 must have the details of the current FY only |

| Where to report the ITC reclaim for an Invoice that belongs to FY 2023-24, and which is claimed, reversed, and reclaimed in the same year? | As stated before by the CBIC press release on 3rd July 2019 in para k, it may be marked that the label in Table 6H cites that data shown in Table 6H is exclusive of Table 6B. Hence the data of these input tax credits is to be shown in one of the rows only. Also as the claim and reclaim are reported in one row hence it must not be reported in the reversal under table 7 of GSTR 9 of FY 23-24. |