Rajasthan bench of Authority of Advance Ruling mentioned that Softy ice cream mix in vanilla flavour is not a dairy product and shall draw an 18% GST.

VRB Consumer Products Pvt Ltd approached the AAR regarding the taxability of vanilla mix in powder form, which will contain 61.2 per cent sugar, 34 per cent milk solids (skimmed milk powder), and 4.8 per cent other ingredients, including flavouring substances and salt.

It was marked by the Authority of Advance Ruling (AAR) that each ingredient has a particular role in making the soft serve smooth and creamy in texture. Also, it is conclusive that not merely the product contents, but the processing undergone in the soft serve machine would have a significant role in furnishing the smooth and creamy texture characteristic of soft serves.

Under the GST law food preparations of additional processing for human consumption draws an 18% tax. Indeed the preparations for the milk powder, sugar, and any other added ingredients, powder for table cream, jellies, ice cream, and similar preparations, draw 18% GST.

Also, it is known that the product in question could not said to be a dairy product, as AAR mentioned.

An 18% GST is applicable on the product ‘Vanilla Mix’– dried softy ice cream mix (low fat) in vanilla flavour.

Tax experts mentioned that the ruling stresses that the major ingredient of the product is sugar, not milk solids, making it a processed food preparation rather than a dairy-based product.

From the product that is to be used in soft serve machines, the classification was been influenced, and its other ingredients such as stabilizers and flavouring agents. The same decision cited the importance of the dominant ingredients and the manufacturing processes in deciding the GST classification.

Tax expert cites that the same ruling stands opposite to the decision of the Apex court in Amrit Foods, where the court classified ‘milk shake mix’ and ‘soft serve mix’ for institutional sales as “dairy produce” under Chapter sub-heading 0404.90.

The divergence between such rulings shows the complexities businesses encounter when categorizing products for GST purposes, emphasizing the significance of ingredient composition and product usage in finding the tax obligation.

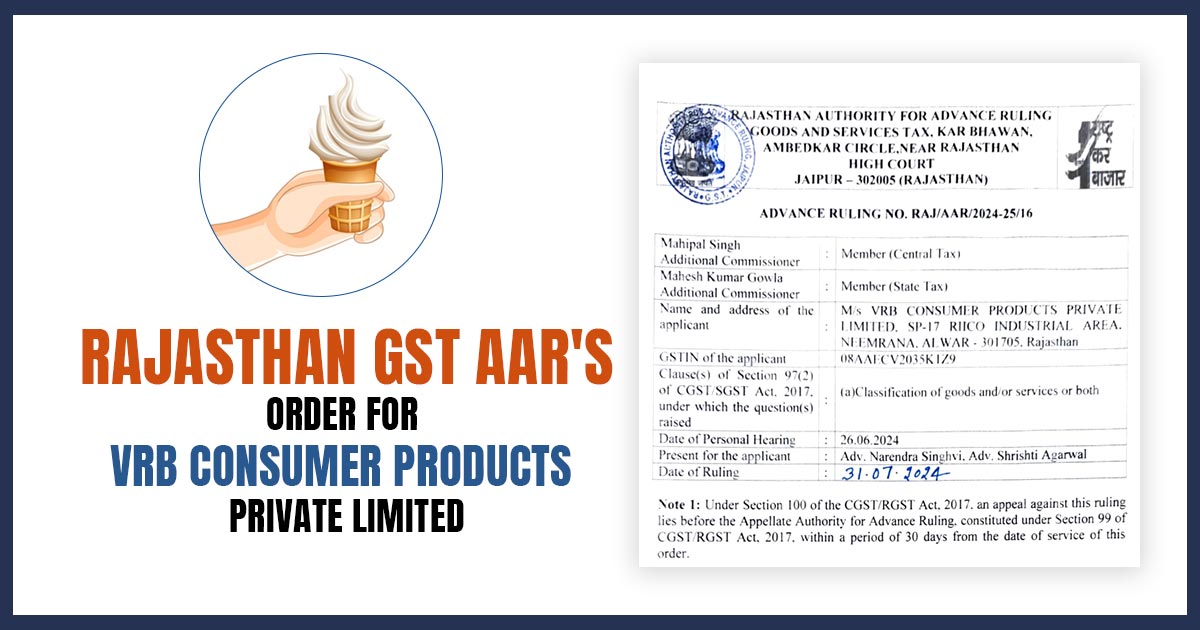

| Applicant Name | VRB Consumer Products Private Limited |

| GSTIN of the applicant | 08AAECV2035K1Z9 |

| Date | 26.06.2024 |

| Applicant | Adv. Narendra Singh Adv. Shrishti Agarwal |

| Rajasthan GST AAR | Read Order |