GST: GST Act has covered a long journey of 17 years before its implementation in India. Initially, it was suggested in 2010 but then in December 2014 122nd Amendment bill, 2014 was submitted before Lok Sabha for its first discussion and approval. A much-awaited tax reform bill was passed in both houses of Parliament on August 3, 2016.

The following Act of Parliament received the assent of the President on the 12th of April 2017. From thereon, the amendment bill has undergone many changes and finally GST Act was implemented all over India from 1st July 2017 except Jammu & Kashmir.

GST Act has been Categorized as Follows:-

- Central Goods & Services Tax Act, 2017(CGST Act)- Applicable for intrastate transactions

- Integrated Goods & Services Tax Act, 2017(IGST Act)- Applicable for interstate transactions

- Union Territory Goods & Services Tax Act, 2017 (UTGST Act)- Applicable for the intrastate transaction in the union

territories - GST(Compensation to the States)Act- For compensating states for the revenue loss after implementation of

GST.

Similarly, in Jammu & Kashmir GST Act came into force on 8th July 2017 and separate Acts have been formed as the extension in earlier CGST And IGST Acts for J&K.

There were so many indirect tax laws which were removed after GST became applicable. These tax laws were as follows:

| Central Level | State Level |

|---|---|

| Excise Duty | Value Added Tax |

| Service Tax | Entry Tax |

| Central Sales Tax | Purchase Tax |

| Additional Customs Duty | Luxury Tax |

| Special Additional Duty | Taxes on Lottery, etc. |

| Central Surcharges and Cesses | State Cesses and Surcharges |

Implementation of GST has removed cascading effect of the tax on goods and services i.e. tax on tax system has been abolished and a single transparent tax has been introduced. There is a seamless flow of input tax credit from manufacturer to end consumer which has resulted in the price reduction of goods and services. Inflation is likely to come down in near future as GST has benefited many sectors after its roll-out.

It will ensure that the prices of goods and services become feasible and end consumer burden. In GST the cascading effect will be removed and the prices will go down to the ultimate the inflation in prices of goods and services will also decrease.

In GST concept of sale has been abolished. There is only a single-term supply which includes every transaction whether sale, transfer, barter, exchange etc. GST is charged on the supply of goods and services on transaction value. In GST tax paid on purchases can be set off as input tax credit against tax paid on sales i.e. output tax. Supplier only needs to pay differential tax for its goods or services. Earlier VAT credit was not allowed to be set off against Service tax resulting in an increased price of goods and services.

Read Also: Meaning of SGST, IGST, CGST with Proper Guide of Input Tax Credit Adjustment

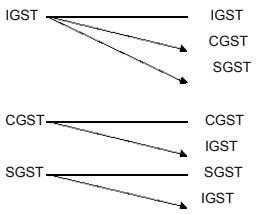

At the same point in time in earlier VAT provisions benefit of interstate sales or purchase of goods was not allowed as CST was charged on such transactions. But in GST cross-utilization of inter and intra-state taxes is possible which is as follows:-

In GST everything has been digitized from registration to cancellation to amendment, return filing, challan creation, tax payment, filing complaints, seeking refunds etc. The economy is moving at a faster pace towards digitization after the GST roll-out. GST rate has also been reduced in digital payments in the recent 27th GST council meeting to promote the digital economy.

In the earlier VAT system, there was no self-assessment procedure. So at the time of the year-end, assesse was liable for the assessment by the department which was a time-consuming job. But in GST there is a self-assessment procedure. So it will help to reduce department interference.

GST has mitigated the problems of earlier indirect taxation system like:

- Different tax laws were in use for different states (like VAT, Purchase Tax, Entertainment Tax, and Professional Tax)

- State-wise return forms

- Tax liability was different according to the state

- Transportation of goods from one state to another state was a time-consuming job. (Lot of time and fuel was consumed as the truck had to stop at various checkpoints before entry in the state)

Current Scenario In GST

- With the return form, simplification tax structure is now simplified

- The entire Indian market has become one market which has reduced the transaction costs of businesses.

- In GST there are lots of tax benefits in case of export (Tax Refund procedures are simple). So it will help to increase exports.

- Tax rates in GST have mainly ranged between 5-28% with the constant reduction in rates in different council meetings which has reduced tax on various goods and services.

- The whole chain of assesse (Wholesalers, retailers etc.) are able to recover GST incurred on input costs as tax credits.

- It can bring more transparency and better compliance.

- Less government interface

- More business entities will come under the tax system thus widening the tax base. This may lead to better and more tax revenue collections.

- Companies which are under unorganized sector will come under the tax regime.

Challenges in GST

After GST was implemented there was a lot of chaos and confusion among people as they were not fully prepared for such a big drastic shift in the taxation system and its compliances. Initially, GST came with different types of return forms for different taxpayers and filing deadlines were also strict. But the GST council and Government have from time to time understood the problems faced by taxpayers and through its council meetings have made major changes in the GST. Compliances have been reduced to the minimum with recent likely changes to happen after the 27th Council meeting are:-

- One monthly return except by composition dealers and the person having Nil return.

- The sales invoices shall be uploaded by the seller continuously during the month and shall be visible to the buyer

- who can avail of input tax credit on such basis

- No need to upload purchase invoices.

- No automatic reversal of input tax credit from a buyer on non-payment of tax by the seller.

- Due process of recovery and reversal by notices and orders

- The content of the return is to be simplified.

Read Also: How to File GST Return Online in India?

Nice write up but could you please bring this entire story into one chart, which explain the thorough version of GST to commen people.

Regards,

CA Hitesh