The Ahmedabad Bench of Income Tax Appellate Tribunal ( ITAT ) supported the Commissioner of Income Tax (Appeals) ‘s judgment to organize Rs. 129.03 lacs, including income from staff loans and miscellaneous income, as business income instead of income from other sources, affirming that this income was related to the business.

Gujarat Urja Vikas Nigam Ltd, the respondent-assessee, revenue appellant had filed a plea against the CIT(A) order on 20.12.2023.

Various reasons have been raised by the revenue appellant for the plea before the tribunal.

First, it argued that the decision of the CIT(A) to treat Rs 129.03 lacs of interest and miscellaneous income as business income, rather than income from additional sources.

Second, it disagreed with the CIT(A)’s removal of an Rs. 6,97,664 addition for interest on capital work-in-progress, claiming the taxpayer didn’t prove that no borrowed funds were used.

It claimed that CIT(A) incorrectly excluded a disallowance u/s 14A from the Book Profit calculation u/s 115JB, which must have been included.

It has been addressed by the tribunal the classification of Rs 119.88 lacs in interest income from staff loans and Rs. 9.15 lacs in miscellaneous income. The CIT(A) has categorized such as business income instead of income from other sources. It was remarked by the tribunal that the High Court of Gujarat formerly ruled on identical issues in the case of Gujarat Urja Vikas Nigam Ltd. vs. DCIT.

In that case, the HC verified that the interest income from the staff loans and advances which the revenue claimed must be categorized as the income from the additional sources, was pertinent to the business activities of the taxpayer.

Read Also: Quick Guide to Business Models with Five Types and Design

The opinion that these interest income has been carried by the HC, being incidental to the main business operations must be regarded as business income instead of the income from the additional sources. It was complied by the tribunal that this precedent and rejected the plea of the revenue.

The Tribunal maintained that the exclusion of Rs 6,97,664 in interest expenses from capitalization on CWIP of Rs. 58,13,869, agreeing with the counsel that adequate interest-free funds were available, as per Gujarat High Court precedent.

The claim of the revenue has been rejected to add section 14A disallowances to book profit u/s 115JB of the act, following the identical HC ruling that these disallowances must not affect book profit computations.

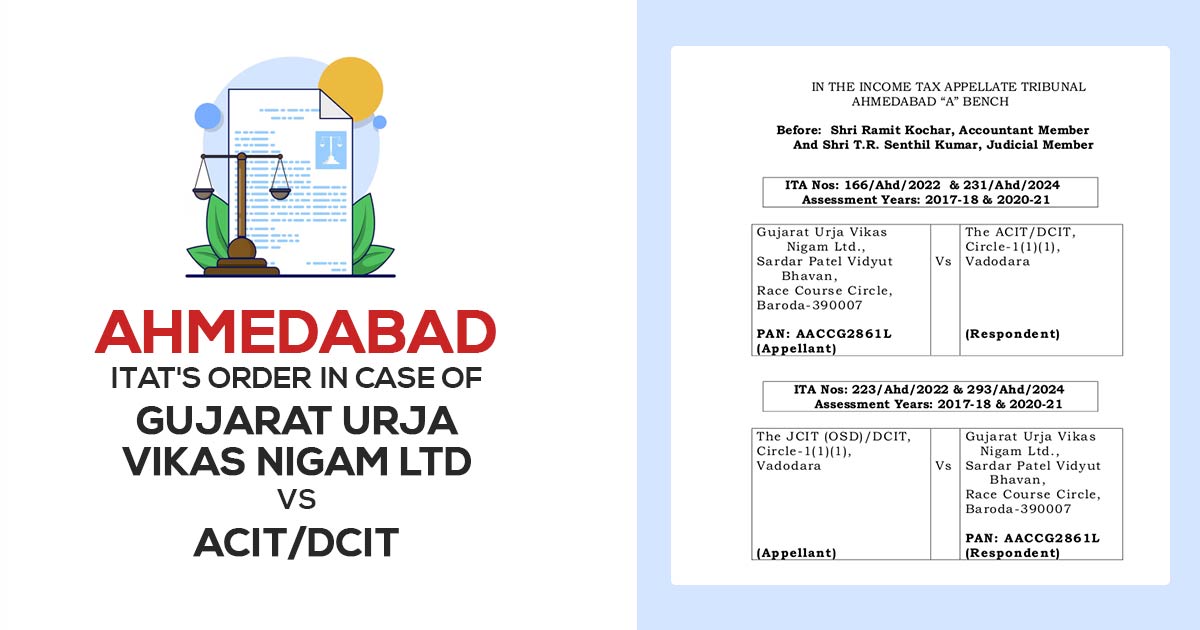

The appeal filed by the revenue has been rejected by the two-member bench including T.R. Senthil Kumar (Judicial Member) and Ramit Kochar (Accountant Member).

| Case Title | Gujarat Urja Vikas Nigam Ltd Vs. The ACIT/DCIT |

| Citation | ITA Nos: 166/Ahd/2022 & 231/Ahd/2024 |

| Date | 08.08.2024 |

| Counsel For Appellant | Shri Manish J. S hah, A.R. |

| Counsel For Respondent | Shri Akhilendra Pratap Yadaw ,CIT-DR & Ms. Bhavnasingh Gupta, Sr. D.R. |

| Ahmedabad ITAT | Read Order |