The Madras High Court has forgiven a one-day delay in filing the 3B return form and set aside the ITC reversal notice issued via the Goods and Services Tax (GST) department. It was noted by the court that the one-day delay required consideration.

The bench of Justice Krishnan Ramasamy discovered that the applicant’s delay was minimal and caused by the COVID-19 pandemic. The court remarked that the GST Council’s proposal to extend the GSTR-3B filing due date for the Fiscal years 2017-18, 2018-19, 2019-20, and 2020-21, applicable retrospectively from July 1, 2017, sustained the applicant’s case.

The petitioner-assessee Ohm Sakthi Blue Metals, received a notice issued by the respondent on January 25, 2024, for the FY 2019-2020, mandating tax of Rs 3,46,866 including interest, due to a one-day delay in filing GSTR-3B for September 2020.

It was claimed by the applicant that the delay was caused by the COVID-19 pandemic and furnished the objections on February 19, 2024. However, the respondent issued Form GST DRC-01A on March 22, 2024, offering to levy the identical tax amount and direct payment by April 5, 2024, failing which a SCN u/s 73(1) of the GST Act for ITC reversal would be issued.

The dissatisfied applicant filed a writ petition contesting the constitutionality of Section 16(4) of the CGST/TNGST act which is pending consideration. Even after the applicant filed a detailed response on June 29, 2024, the notice was issued by the respondent on July 4, 2024, asking the applicant to appear for the personal hearing. It was directed by the applicant to quash the SCN on May 16, 2024, through this writ petition.

Dr.A.Thiyagarajan Senior Counsel For Mr. D.Senthilkumar, the senior counsel contended that the demand was raised because of a one-day delay caused by the pandemic and that Section 16(4) is procedural, not obligatory.

It was indeed pointed out by the counsel that the 53rd GST Council meeting on June 22, 2024, suggested extending the due date to claim ITC for specific Fiscal years and suggested a retrospective revision to GST Section 16(4).

If the revision were legislated then the applicant shall be qualified to the legal advantage, causing the respondent’s SCN to void. To support this argument the counsel quoted a previous court order.

The counsel of the department carried that the dealy even by one day drops under obligatory provisions of Section 16(4) under GST law, and the applicant cannot avail of ITC beyond the statutory period. Therefore, they pursued the dismissal of the writ petition.

It was concluded by the court that the respondent’s denial to condone the delay and the following ITC reversal u/s 73(1) was unfair and detrimental to the applicant. Therefore the Madras High Court set aside the SCN and permitted the writ petition, with no order towards costs.

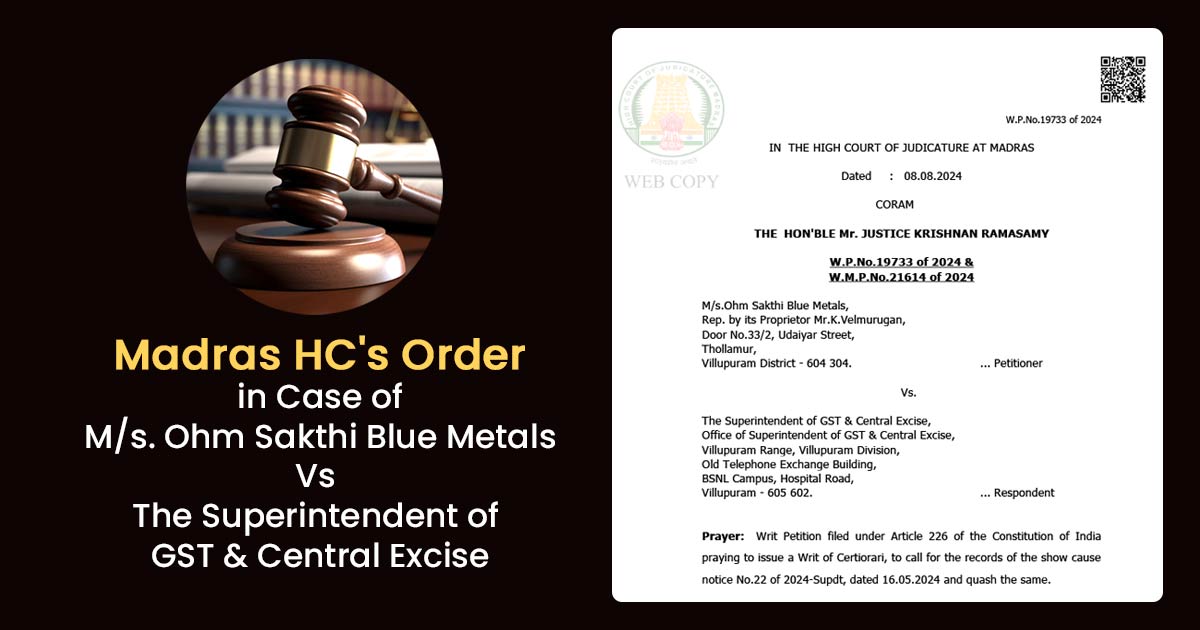

| Case Title | M/s.Ohm Sakthi Blue Metals vs. the Superintendent of GST & Central Excise |

| Citation | W.P.No.19733 of 2024 & W.M.P.No.21614 of 2024 |

| Date | 08.08.2024 |

| For Petitioner | Dr.A.Thiyagarajan, Mr.D.Senthilkumar |

| For Respondent | Mr.Rajendran Raghavan |

| Madras High Court | Read Order |