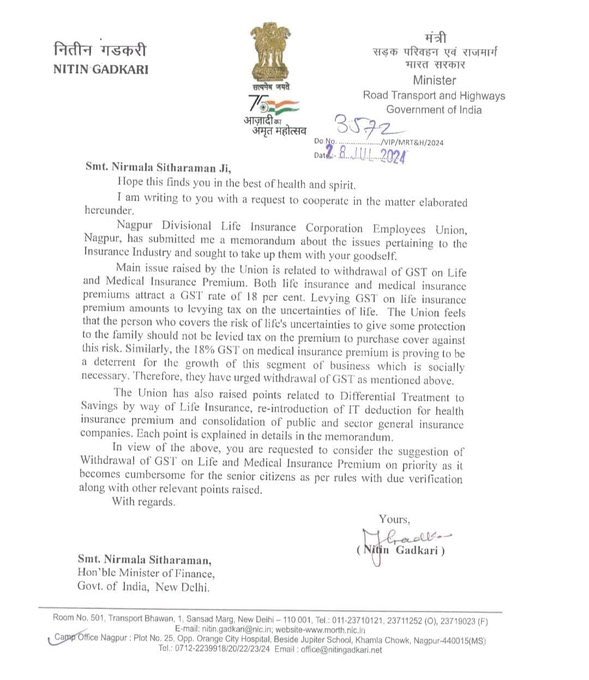

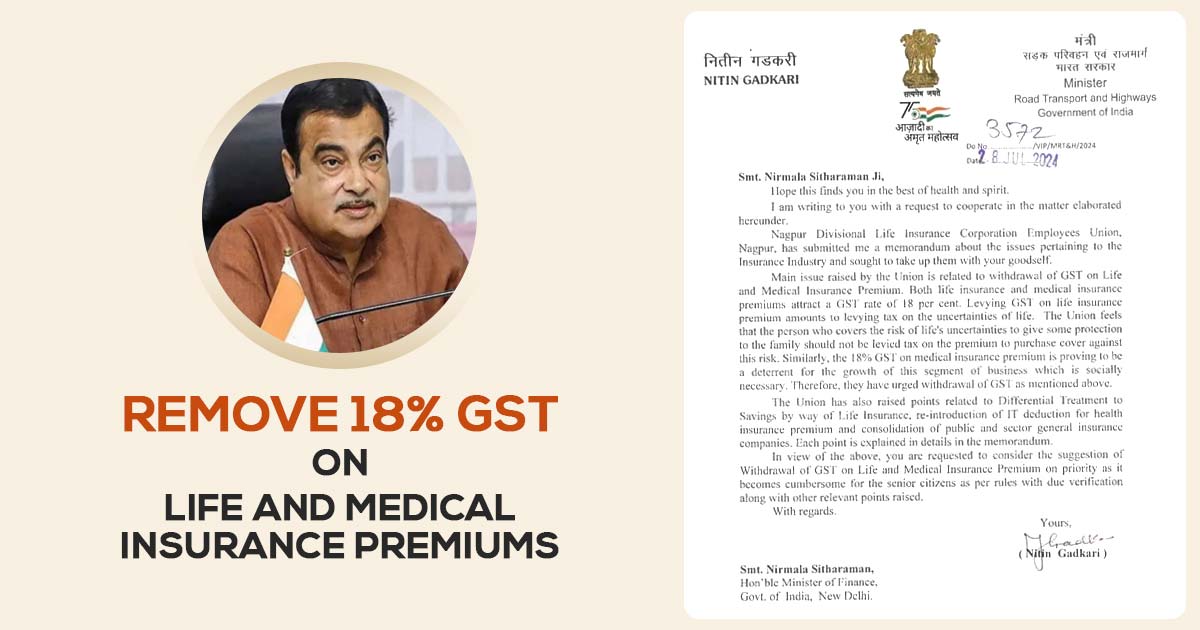

To remove GST on life and medical insurance premiums, Nitin Gadkari, Minister for Road Transport and Highways, has written to Finance Minister Nirmala Sitaraman.

Gadkari said the Nagpur Divisional Life Insurance Corporation Employees Union has given a memorandum to him on the issues of the insurance industry, written in a letter to FM.

Read Also: Insurance Companies Request GST Exemption on Health & Life Insurance Premiums

Union’s major problem was the GST withdrawal on the Life and Medical Insurance Premium.

An 18% GST rate applies to both life and medical insurance premiums. Imposing GST on life insurance premiums amounts to charging tax on life uncertainties, he added in the letter.

As per the Union, the individual who covers the risk of uncertainties of life to provide some safeguard to the family must not be imposed with a tax on the premium to buy the cover against this risk.

Gadkari has pointed out that the imposition of an 18% GST on medical insurance premiums is negatively impacting the growth of this crucial sector.

The Union has brought up issues concerning the unequal treatment of savings via life insurance, reinstating the IT deduction for health insurance premiums, and merging public and sector general insurance firms, according to him.

Therefore please consider the GST removal recommendation on Life and Medical Insurance Premium on priority since it becomes unmanageable for the senior citizens under the rules with due verification along with additional pertinent points raised, stated in the letter.

West Bengal Chief Minister Mamata Banerjee has voiced support for Nitin Gadkari’s call to remove the 18% GST rate on medical insurance premiums and health insurance.