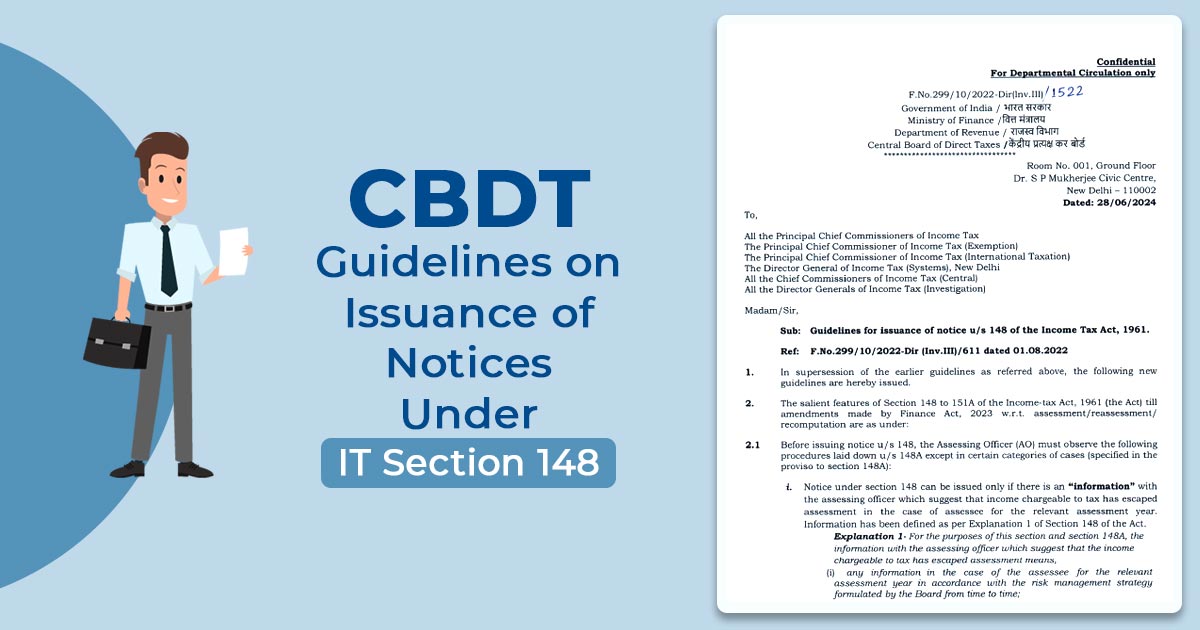

The Central Board of Direct Taxes (CBDT) in a move to ease the process of issuing the notices u/s 148 of the Income Tax Act, 1961, has issued updated guidelines via F.No.299/10/2022-Dir(Inv.III)/1522 on June 26, 2024. Such guidelines are set to draw clarity and consistency in managing the matter concerned with the income that has escaped the assessment.

Taxpayers Implications

These new guidelines help towards a more structured and clear process to manage the matters of income that escapes assessment. A reduction in the random notices can be anticipated by the taxpayers as well as a more predictable timeline for the resolution of their matters. Also, the focus on documentation and proof would seem to lead to stronger and more defensible notices.

Read Also: IT Notice U/S 148 Without Modified Process is Invalid: Telangana HC Quashes Reassessment Notice

With the new norms tax professionals and chartered accountants should familiarize themselves to recommend their clients and ensure compliance. In line with these amendments, it is important to stay updated to prevent the traps and gain benefits of the safeguards introduced by the CBDT.