A 10% pre-deposit for the reconsideration of a case where the petitioner was clueless about Goods and Services Tax (GST) proceedings because of the failure of their GST consultant to inform them about the disparity between GSTR 3B and GSTR 2A, as obligated by the Madras High Court in a ruling.

The applicant, Muthu Traders is in trading groceries and allied products, claimed unawareness of GST compliances, and had relied on a consultant for these cases. Because of the failure of a consultant to inform the applicant about the proceedings directing to the impugned order, the applicant was clueless about the situation.

The applicant’s counsel argued that the confirmed tax demand derives from a difference between the applicant’s GSTR 3B returns and the auto-populated GSTR 2A. It claimed the ability of the applicant to elaborate the difference if provided the chance, counsel cited the willingness of the applicant to remit 10% of the disputed tax demand as a prerequisite for remand.

Mr T.N.C. Kaushik, the Additional Government Pleader, regarded the notices sent to respondents 1 & 2, stressing that the impugned order followed an intimation, SCN, and a personal hearing notice.

A Single bench of Justice Senthilkumar Ramamoorthy marked that the tax obligation emerges via the mismatch between the applicant’s GSTR 3B returns and the auto-populated GSTR 2A.

Because the petitioner failed to respond or appear for the personal hearing, the tax demand was confirmed. Even after the same, the court considers it just and important to grant the applicant a chance to challenge the tax demand on its merits.

Therefore, the impugned order was set aside, and the case was remanded for reconsideration. The same remand is within the condition that the applicant remits 10% of the disputed tax demand within 2 weeks and proposes a reply to the show cause notice (SCN) within the identical period.

The high court upon receipt of the applicant’s reply and satisfaction of the remittance condition, directed respondents 1 & 2 to deliver a reasonable opportunity to the applicant, including a personal hearing, and issue a fresh order within 3 months.

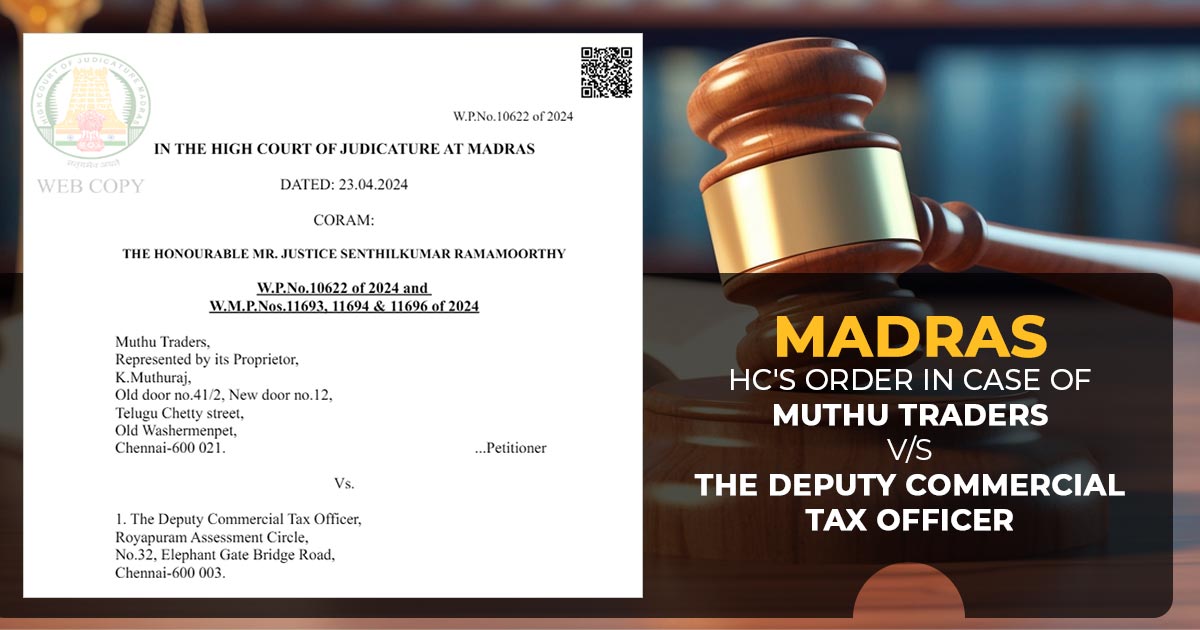

| Case Title | Muthu Traders Vs. The Deputy Commercial Tax Officer |

| Case No.:- | W.P.No.10622 of 2024 and W.M.P.Nos.11693, 11694 & 11696 of 2024 |

| Date | 23.04.2024 |

| For Petitioner | Mr.S.Ramanan |

| For Respondent | Mr.T.N.C.Kaushik |

| Madras High Court | Read Order |