In its most recent revision, the Goods and Services Tax Network (GSTN) has unveiled a redesigned Notices and Orders Tab on the GST Portal. This overhaul is geared towards optimizing the accessibility of vital information for taxpayers.

The objective of this redesign is to elevate user experience through the implementation of a more intuitive and well-structured interface on the Goods and Services Tax Portal.

By incorporating categorized sections for various types of notices and orders, the update enables users to swiftly pinpoint and address important communications from tax authorities, thus facilitating more efficient interaction.

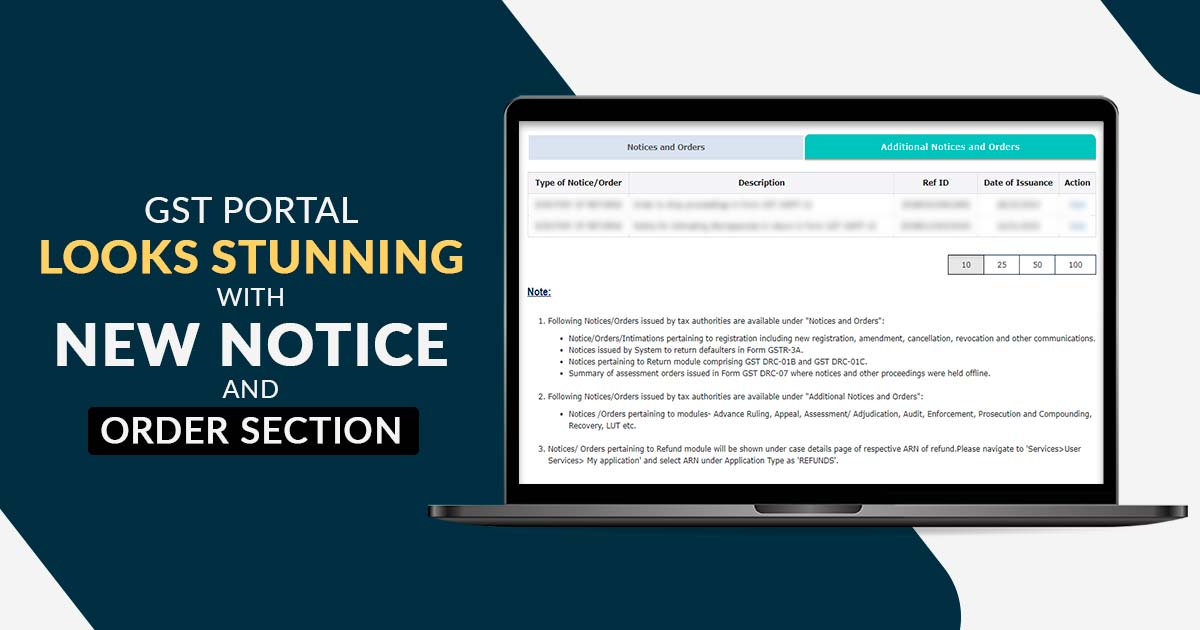

- Following Notices/Orders issued via tax authorities are available under “Notices and Orders”.

Notice/Orders/Intimations related to registration along with the new registration, amendment, cancellation, revocation, and other communication

Notices issued by the System to return defaulters in Form GSTR-3A.

Notices related to the Return module comprising GST DRC-OIB and GST DRC-OIC.

Summary of assessment orders issued in Form GST DRC-07 in which the notices along with the other proceedings were held offline.

- The Following Notices/Orders issued via tax authorities are available under “Additional Notices and Orders”

Notices /Orders about modules- Advance Ruling, Appeal, Assessment/ Adjudication, Audit, Enforcement, Prosecution and Compounding, Recovery, LUT, etc.

Important: A Proper Example of Respond DRC-01 Notice to GST Officer

- Notices/ Orders concerned with the Refund module will be shown under the case information page of the respective ARN of the refund. Please navigate to ‘Services>User

Services> My application’ and select ARN under Application Type as ‘REFUNDS’.

Users can explore the enhanced design by accessing the GST Portal and visiting the “Notices and Orders” tab. The updated layout is designed to streamline the comprehension and response to diverse notices and orders issued by tax authorities. This modification aligns with GSTN’s continuous endeavours to enhance the portal for user convenience and compliance.