Cancellation of GST registration is not a hard work as the Indian government GST Portal has provided a simple and easy step-by-step procedure to finally cancel the GST registration of migrated taxpayers through the newly implemented feature. Goods and services tax, which was implemented recently and to be exact on 1st July 2017 with a lot of promises and work in progress tagline, is known to be subsuming all the indirect taxes into one. All the business units are exempted from paying GST which are under the turnover of 20 lakhs annually and all the business units above this exemption limit have to be registered under the GST.

The registration part has been discussed everywhere and has been understood manifold by guides and articles, but now there comes a chance to cancel the registration under GST by the taxpayer itself or by any governing authorities. The cancellation option is for migrated taxpayer only who wants to cancel their registration on GST.

By far we have got the confirmation that the business organisation can cancel their registration by the means of the recently popped up feature on the GSTN portal, but the cancellation feature is limited to only 3 entities who can initiate the cancellation of registration:

- The taxpayer himself

- GST officer

- A legal heir of the taxpayer

The cancellation of the registration can be initiated in some cases like the death of the taxpayer. While the registration can also be done voluntarily but only after one or more years are elapsed starting from the date of GST registration.

Latest Update Under Cancellation of GST Registration

- GST registrations that have been revoked under a new procedure have been introduced. Applicants must file the application by June 30, 2023, after filing all returns with tax payments up to that date. Read Notification

- The Orissa HC has allowed an assessee to file GST returns previous to the cancellation of registration and directed the Government to modify the portal accordingly. read order

- “The CBIC has added the advisory about the new functionality of restoration of cancelled registration under GST via REG-21.” Read More

- “The GSTIN has enabled new features for the taxpayers to easily withdraw the application of GST registration cancellation.”

- The High Court of Gujarat has stopped the cancellation of registration under the GST regime on grounds of vague show cause notice (SCN) without any material particulars. read order

- The Rajasthan High Court issues an order for the petitioner, M/s. Avon Udhyog related to the cancellation of GST registration due to failure to file a reply within time. Read Order

GST Authorities Cancelled 1.63 lakh Registrations

Goods & services tax (GST) authorities have cancelled over 1.63 lakh registrations in October and November of taxpayers who have not filed their GSTR-3B returns for more than six months. The council started serving notices to taxpayers who did not file their GSTR-3B returns for the past six months or more and then cancelled their registration as per the procedure.

Conditions, When a Taxpayer Can Cancel the GST registration?

- Discontinuance or closure of the business

- Taxable person ceases to be liable to pay tax

- Transfer of business on account of amalgamation, merger, de-merger, sale, leased or otherwise

- Change in the constitution of the business leading to a change in PAN

- Registered voluntarily but did not commence any business within the specified time

- A taxable person not liable any longer to be registered under GST act

Who All Cannot File the Cancellation of GST Registration?

- Taxpayers registered as Tax deductors / Tax collectors

- Taxpayers who have been allotted UIN

Steps for Cancellation of GST Registration Online on GST Portal

The GSTN portal is live with the cancellation of GST registration for the migrated taxpayers. All the taxpayers who have not issued any invoice after registration can opt for this service. The individual can fill out form GST REG 16 in case he has filled any tax invoice.

Steps for cancellation of GST registration for the migrated taxpayer:

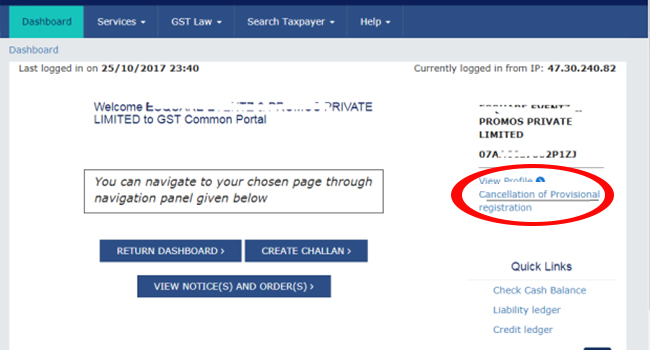

- Login with username and password on the GST portal

- Then click on the tab ‘Cancellation of provisional registration’

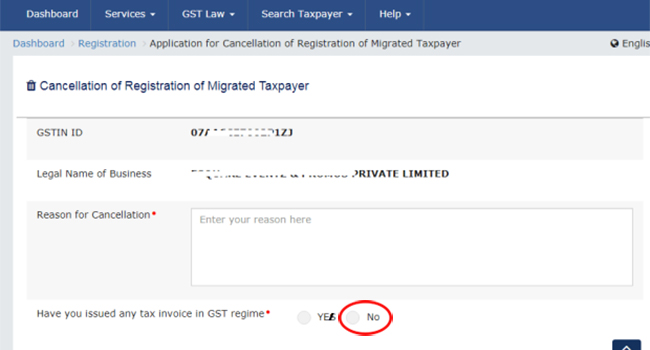

- After which a popup will ask that if a taxpayer has raised any tax invoices in the period of GST

- Select ‘No’

- After the selection, the taxpayer will have to go through verification and have to submit all the form-related details along with the digital signature/EVC

Forms used to cancel GST registration:

GST REG 16: The forms are applicable only when the taxpayer himself applies for the cancellation of registration and there is no consideration for the application other than the taxpayer’s application, which has elapsed one or more years after the GST registration.

GST REG 17: An authorised GST officer can provide the notice of show cause/cancellation to the registered taxpayer and its business entity by using the REG 17 form. The cancellation of registration by the authorised officer can be initiated after issuing the GST REG 17 form to the taxpayer, and he can ask for a show cause as if why the registration should not be cancelled.

GST REG 18: The show cause notice can be replied to by means of the furnished GST REG 18 form under the specified time period stated in the sub-rule (1). The taxpayer or the concerned party must reply to the notice within 7 days of issuance of the notice, giving an explanation of safeguarding the cancellation of registration.

Read Also: Goods and Services Tax (GST) Forms for Registration & Cancellation

GST REG 19: The GST REG 19 form is for the usage of GST officer for issuing a formal order for the cancellation of GST registration. The order for sending the notice must be under 30 days from the date of application or the response date in GST REG 18 form.

GST REG 20: The show cause notice when satisfied by the GST officer can direct for the revoke of any proceedings towards the cancellation of the registration and he should pass the order in the Form GST REG 20.

Application for Revocation of Registration on GST Portal

A person intends to discontinue profession. He has some capital goods on which he has not claimed any input credit at all. He has not sold or transferred the same to any body. Still, it will be deemed to be a supply under Schedule II to the CGST Act. What is the “Transaction Value” on which output tax on deemed supply should be paid (since reduced ‘input tax’ will be zero)?

The useful life of capital goods is 5 years so the transaction value can be calculated by dividing capital goods value by 5, for more detailed analysis kindly consult the GST practitioner

My GST allready cancelled

But

I had surrendered my GST regn during the end of April 2021, but the same was rejected during Oct 2021. I made a representation that my service receipts are much less than the threshold limit and I am an aged person so I do not wish to be registered under GST. I am not claiming any Input Tax Credit either. Again this got rejected, and the Dept did not give any reason as to why they were rejecting my application for cancellation. Should I declare my Service Receipts as Professional Income in my Income Tax Returns for 31.03.2022 as I have been doing in earlier years? Is this the reason why my application for cancellation of GST is getting rejected?

Sir, Please consult this matter with Senior Income tax & Gst Practitioner

I’m an unemployed poor family member. So listening to the people had forced this GST. Before I can not understand. So I want to cancel my GST. My request will be very good for my family if GST is discontinued. Thanks you sir

a Taxpayer Registration cancelled for not filing GSTR 3B for Six months and now closed

But TP filed GSTR 1 for 3 months out of that 6 months and some liability is there and TP pass the credit also so he declare his liability in those 3 months.

So what is the procedure to recover that amount?

First, you have to file all previous returns with late fees & interest, if applicable

I am opening a firm and want to apply for GST. But I am not sure if I might be needing my GST number after 3 years or so. And that time I might want to surrender it. My question is that in that case will I have to close my firm as well or I can continue with my firm and simply surrender my GST?

You can simply surrender your GST registration & continue with your firm

Sir gst was suspended one month now I filled complete month how can I activated my GST number

Once you filed your pending GST return it will automatically be activated

I have received a notice GST REG-17/31 for obtaining registration by uploading a wrong file of a Rent agreement mistakenly which was not having the signature of the Landlord.

Please consult a GST practitioner

Hi sir,

I canceled my GST voluntarily in April 2020 since my last year’s turnover was less than the exempt limit. How can I re-register, should I start a fresh application or is there an option in the GST dashboard for me?

You should start a fresh application

Hi. Sir Mitakly I have got the GST number as a TDS deductor while I am not liable for the same. And same I have Got another GST number and doing business on that regular GST number for 3 years and filing the regular return. But I want to cancel the GST number as a TDS deductor in which we are not liable to pay tax. Can I file a return? GST as a TDS deductor our CA has applied by mistake and the same department has given approval. And as a Private Limited company, We are not liable. ONLINE CANCELLATION IS NOT SHOWING and we have visited the department they told us when show online then we can go for cancellation. Please guide us.

Sir, in this case, we suggest you contact the GST practitioner

I have a query.

I had done a cancel request on October but I m not able to provide clarification at the time slot.

Now I again try for a cancellation request but I got a msg that your previous cancellation request should reject then only u can go further..

My accountant contacts the office then they informed they did not get any particular GST cancellation request so they not Able to cancel.. I got ARN no also..

May I know what I can do

“Please contact to GST portal”

Hi, My GST registration dtd 15-7-2020, since there are no transactions, I have applied for GST cancellation on 24-11-2020. Before cancellation, I paid all penalties & filed NIL returns. Now my GST status showing “suspended”, as the officer gives notice for seeking clarification – he needs clarification for reason of cancellation. I have mentioned the reason “Others” at the time of cancellation. And the last date given 5-12-2020 by the officer to submit the reply otherwise my application of cancellation will get rejected.

So, my 1st query – How to reply on GST portal, where is the option to reply?

2nd query – If no reply was given on time, then what will be my GST status? will it be “ACTIVE” / “SUSPENDED”

Kindly contact to GST practitioner

We have filed returns up to Feb.’20 but due to Covid 19 and left & non-availability of an accountant we couldn’t file subsequent returns. Businesses have also failed for various reasons including Covid19. The business place was also left in March ’20.

Now, we are trying to file a return for NIL but it attracts a penalty for SGST & CGST for the caped amount without which unable to submit returns.

Please advise what to do?

Also let me know, whether we can apply for registration cancellation as on date without filing all pending returns?

Is any scheme awaited or may arrive to exempt the penalties in lieu of covid-19 or others as was available up to 30th Sept. ’20?

YOUR IMMEDIATE REPLY SHALL BE MUCH APPRECIATED.

Please contact to GST practitioner

The client is doing Business of Jaggery. He has taken the GST number since July 2017. This item is exempt from tax. He has filed all returns till March 2020. April 20 to July 20 all returns are pending. Can he cancel GST registration w.e.f. 31st March 2020 ? or he should file returns till July 2020 & then can he cancel the registration in the middle of the year? Which will be advisable?

Kindly guide. Business is still running.

Great information regarding the cancellation process and find your blog much valuable and useful to my work.

Hi,

I have registered for my cancellation of GST in the month of July, still, it is showing as pending.

If no objections have been raised by the department yet, it is deemed to be accepted and cancelled. you may contact the department for further assistance.

Sir, I am running Common Service Center at my village but during launch of GST in the year 2017 there was rumour that for any kind of Business we require GST so I registered and got GSTIN number but unfortunately in our area there was no CA or Gst practitioner so I could not file ant nil return so I left like but today I registered for cancellation as I talked to one CA he told to pay 2.20 Lacs as late fee levied is it true kindly help Sir

No, there is no such late fee. Please be aware of looters.

Late Fee is leviable. CA is correct. There is no Loot

મૈ મારો જીએસટી નંબર તા ૦૧।૦૭।૨૦૧૭ ના રોજ કેન્સલ કરાવ્યો,મૈ મારું માઇગ્ેશન કરેલ છે,મારે જીએસટીઆર ૯ ભરવું પડે.મારું સ્ટેટસ ઇનએકિટવ બતાવે છે

જીએસટી કેન્સલ સર્ટિફિકેટ આવ્યા ની તારીખ પછી ફાઇનલ રિટર્ન (gstr ૧૦ ) ભરી દેવું

When GSTR -9 Filling Last date.

Due date is 31st March 2019.

I have issue 20 bill but due to the loss in business, I want to cancel my GST registration but after applying for cancellations do I need to file a NIL return.

Yes, you have to file the return until your registration is cancelled.

Hi,

I need to cancel my GST registration which was registered voluntarily not done any business till date what is the procedure for cancellation is that compulsory to file NIL return.

Login into the portal and in services there is an option for cancellation of registration. Till registration is not canceled you need to file the nil return.

I have applied for cancellation of GST Registration as our turnover remains below the threshold limit of 20 lacs on 11.06.18 but the status of the application is still under process from the department. so what about GST return as from the date of application for cancellation of registration we have not charged and not collected GST amount. if we filed NIL return then it looks that we have not raised any invoice but actually it is not. so what should I do? please suggest

As till the date of cancellation of registration under GST, you will be treated as regd. dealer and you need to collect GST and file the return for the same period.

Once you got cancellation order on GSTIN portal additional notices and orders section. Then file Final Return GSTR-10 within due date which shown in GSTR-10. If it is delayed then you need to pay Late fee Rs. 100 per day max upto Rs.10,000/-.

Your GSTIN will be in suspended status. Your GST return filing period will be automatically closed by GST portal. File the last GST return till the tax period is open. If officer does not issue cancellation certificate then meet the officer and ask for cancellation of GSTIN.

Your GSTIN will be in suspended status. Your GST return filing period will be automatically closed by GST portal. File the last GST return till the tax period is open. If officer does not issue cancellation certificate then meet the officer and ask for cancellation of GSTIN. Once you got cancellation order on GSTIN portal additional notices and orders section. Then file Final Return GSTR-10 within due date which shown in GSTR-10. If it is delayed then you need to pay Late fee Rs. 100 per day max upto Rs.10,000/-.

Hello Sir,

I have registered the GST on 30th January 2018, but I have not made any transaction as of now and did file GST return as well, but interest and late fee keep charging every month.

I have applied cancellation of GST through an online portal.

Please advise, do I need to pay the late fee and interest after applying for cancellation. If I need to pay how can I know that how much amount or maximum penalty I should pay.

Thank you,

Mohammed Aslam

I have a Query about GST Registration Cancellation Actually I have been done Registration But Does not File nil Return and now day by day penalty Levied not we want to cancel Regist. as we want to shut down our business now kindly help us and give a to overcome this issue and please Revert us as soon as possible.

Dear Sir,

I had registered myself for GST in July 2017, but in March 2018. I applied for cancellation of GST No., but in July 6,2018 it is showing the status still “pending for processing”. please note during the entire period I haven’t file any return. please guide what to do?

-Either I file NIL return till date

-or file NIL returns till cancellation application date

-or do nothing and wait for any notice from the department.

Need your advice.

The same problem, I also not filed the return from the date of cancellation, No Clarification from GST Department Yet.

I have done a new registration GST on November 2017 but I have not filed for nil return till the month of June 2018 and I have not done any business can I cancel my GST registration?

Dear Sir,

I was running an export firm and I closed down my business on March 31st. I applied online on 18th of April to cancel my GST number but till date, the number is not cancelled. I have put 2 times in grievance section as well but nothing yet. it shows under process but not cancelled yet and I have to file returns as well regularly though nil but my question is when will it be cancelled?

Hello,

I am planning to start a new e-commerce site, also purchased GST no, if I show inward supply from unregistered GST person,

how to fill that in GST portal? and it is sure that first 5 months there will be no sells,

will I have to pay penalty if I don’t have any outward?

how to show that I don’t have any outward sell for 5 months, its only inwards?

please help me as there will be inward only for next 5 months from an unregistered or registered company or person.

No issues if you have no sale, but you have to file your GST Return Timely.