The 38th GST council meeting has been concluded with several major and minor changes in the GST rates as well as in the annual return filing due dates, penalty and ITC related provisions.

Let us check out the complete amendments done under the finance minister Nirmala Sitharaman in the 38th GST council meeting.

All Updates on 38th GST Council Meeting

- GSTR 9 and GSTR 9C due date extended till 31st January 2020 for the FY 2017-18

- GSTR 1 not filed from July 2017 are not exempted from penalty till 10th January 2020 through GST amnesty scheme

- Only 10% ITC available if invoice not uploaded by the taxpayer on the portal from the earlier 20%

- Due dates for northeastern states extended till 31st December 2019 from November 2019 for GST returns

- Standard Operating Procedure (SOP) released for the benefit of taxman handling GSTR 3B non-compliance cases

- Council rationalised GST rate to eliminate inverted tax structure

- Assets utilised by industrial land developers are GST exempt

- Setting up Grievance Redressal Committees (GRC) at Zonal/State levels

- GST rate increased to 18% from 12% on HSN code 3923/6305 starting from 1st January 2020 (woven and non-woven bags and sacks of polythene or polypropylene strips or same, both or not laminate)

- Exemption from 1st January 2020 on long term lease of industrial or financial infrastructure plot and when Central or State Government holding 20% or more shares in the developer’s capital earlier of 50%

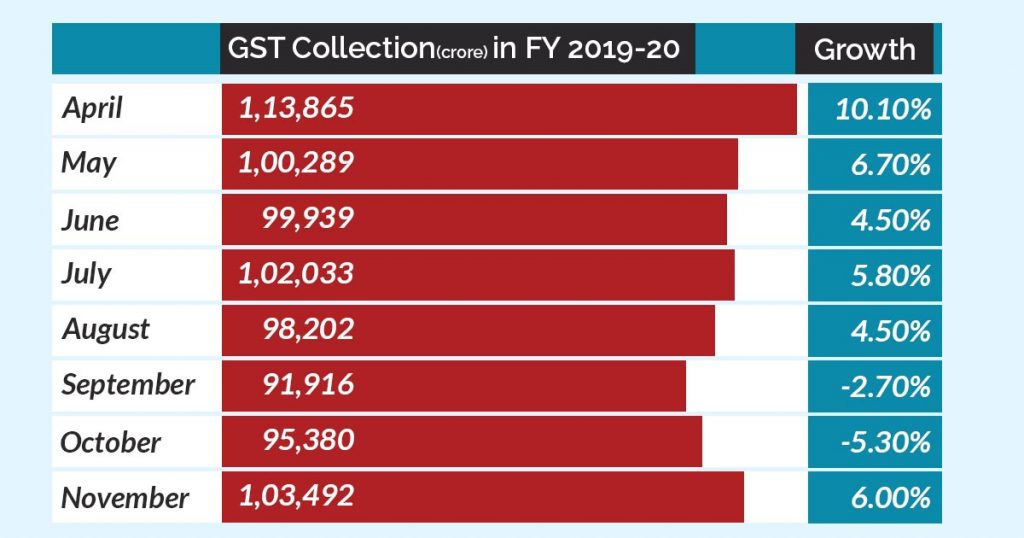

- “The GST Council could decide on measures to shore up the shortfall in tax revenue. Earlier this week, in a meeting with senior tax officials, the Finance Ministry had laid down a monthly GST revenue target of 1.1 lakh crore for the next four months. Out of these four months, one month needs to a have tax collection amounting to 1.24 lakh crore, revenue secretary Ajay Bhushan Pandey had told tax officials. On the back of this development, the GST Council could take steps to ensure better compliance, easier return filing, and curbs to tax evasion.” Source: businesstoday.in

- Union Minister for Finance & Corporate Affairs Nirmala Sitharaman Ji chairing the 38th GST Council meeting in New Delhi. The Meeting is also being attended by MOS for Finance and Corporate Affairs Shri Anurag Thakur Ji besides Finance Ministers of States & UTs and Senior officers from Union Government & States

Read Official Press Release on All Updates – 38th GST Council Meeting

Ahead of the 38th GST council meeting, the Pre Budget Consultation meeting has been started by the union finance minister Nirmala Sitharaman along with state finance ministers and UTs based on the GST discussions. Read Press Release

38th GST Council Meeting Expectations Below:

In the recent update, the industries have given a hint of an increase in GST rates of mobile and fabrics to take the overall GST collections to a certain hike. There may be a discussion about the GST rates of mobile and fabrics

It will be an all-inclusive review that will consider GST rates, GST exemption, compensation cess as well as measures to increase revenue. Besides, suggestions and feedback from state governments solicited by the GST Council secretariat will also be well-thought-of in the GST council meeting

GST Council secretariat wrote a letter to state GST Commissioners, seeking their advice and proposals on measures to increase compliance and improve tax structure. This indicates the rise in the effectiveness of GST rates. The letter reads, “I would request you to provide your suggestions or inputs or proposals as regards measures on compliance as well as rates which would help in augmenting revenue.”

In the same meeting, rate assessment to pitch into an inverted tax system, measures to boost compliance and revenue other than the measures currently under-enforcement, will also be reviewed.

The Government has taken this move in the wack of complaints by states that the government is putting off compensation payments because of the slowdown in revenue. GST collection has increased by 6%

The letter highlighted that reduced GST compensation cess collections have been a worrisome affair in the last few months. Compensation needs have increased and are improbable to be fulfilled from the compensation cess, it added.

On 30th November, Finance Minister Nirmala Sitharaman told that simplification of the GST rate is under consideration, at the ET Awards for Corporate Excellence.

“As regards the rationalization of taxation… too many rates, too many high rates and so on, we are having good conversations with all the states,” FM said. The Government of India (GOI) wants to keep the necessities under the lowest GST rate if GST exempted. “But for the rest of them we are trying to rationalize,” she said.

There are seven slabs for GST rates with more than 1300 goods & 500 services under four GST slabs of 5%, 12%, 18%, and 28 %. Most of the goods & services fall under the GST rate slab

“Possible hikes in the cess to manage the compensation payouts to states and some rate changes in exempted and low rate items could figure as revenue augmentation measures in the next GST Council meeting slated for this month,” stated MS Mani, partner, Deloitte.

The government has taken several measures to increase compliance without increasing the tax rates. These measures include the adaptive integration of technology to catch tax evaders and data analytics to conclude the GST collection and behavior of tax defaulters.

“As such, unless the government is willing to consider taxing education and healthcare, there may not be many items under an exempt schedule that can be brought under GST easily,” expressed Pratik Jain, national indirect taxes leader, PwC. “However, on the compensation cess, the government might be running out of options as states need to be compensated for the revenue shortfall, which is higher than expected,” he added.