The e-invoicing before GST has picked up the speed in its 2nd month with the generation of the bill stating a growth of 17% in November as compared to October. It indicates the 2nd phase for e-invoicing that is to make it important for those whose turnover exceeds Rs 100 cr and more from Jan 1 and the leftover from April 1 concerning B2B transaction

The firms whose turnover is more than Rs 500 cr then it is necessary to use the e-invoicing platform. With respect to 48 million in October, there are near about 56 million invoice reference numbers (IRNs)

Post-Diwali around 3.26 million IRNs has enrolled on Nov 6 which is more than from Oct 1. Daily invoice generation has now increased to 2.5-2.7 million per day correlated to a mean of 1.5 million in a day in October.

“There are almost no complaints. This is because these are large firms with sound tech systems. We are prepared to roll out the next phase from January 1,” an official said. To procure much more clarity in sales reporting, minimizing errors and mismatches, automating data entry work, and enhancing agreement. It assists in removing the tax theft if it is made important for the small as well as medium companies.

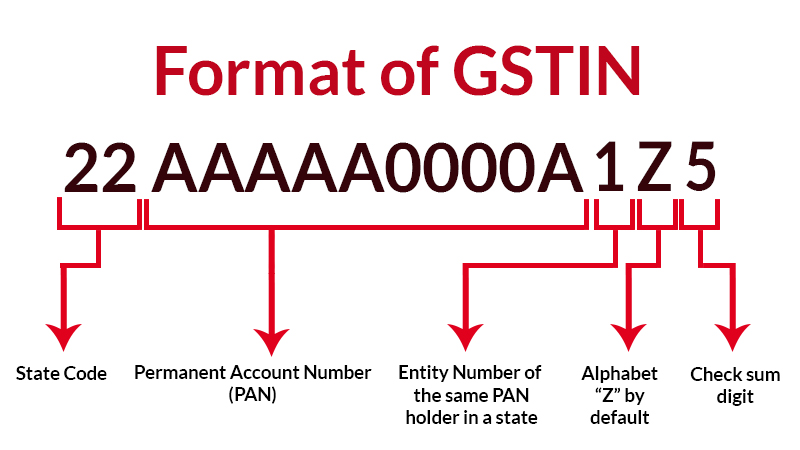

With adjacent to 20,000 GSTINs (GST identification numbers)

From Friday the e-invoice information hs initiated GSTR-1 pr the sales return to form “The e-invoicing system will do away with the need for separate e-way bills,”

The companies whose turnover is more than Rs 500 cr with a small rise seeks to raise the IRN generation. In the middle term, this mechanism will interchange the current e-way bill system